Download :- BEL 01-10-2025

Based on comprehensive analysis, Bharat Electronics Limited (BEL) presents a compelling SHORT-TERM BUY opportunity with current market price of ₹406, stop loss at ₹395, and targets of ₹430-450.

Executive Summary

BEL demonstrates strong technical breakout patterns combined with robust fundamental performance, driven by continuous order inflows worth over ₹7,400 crores in FY26 and a healthy order book of ₹74,859 crores. The stock has broken out from its secondary downtrend with bullish technical indicators supporting upward momentum.

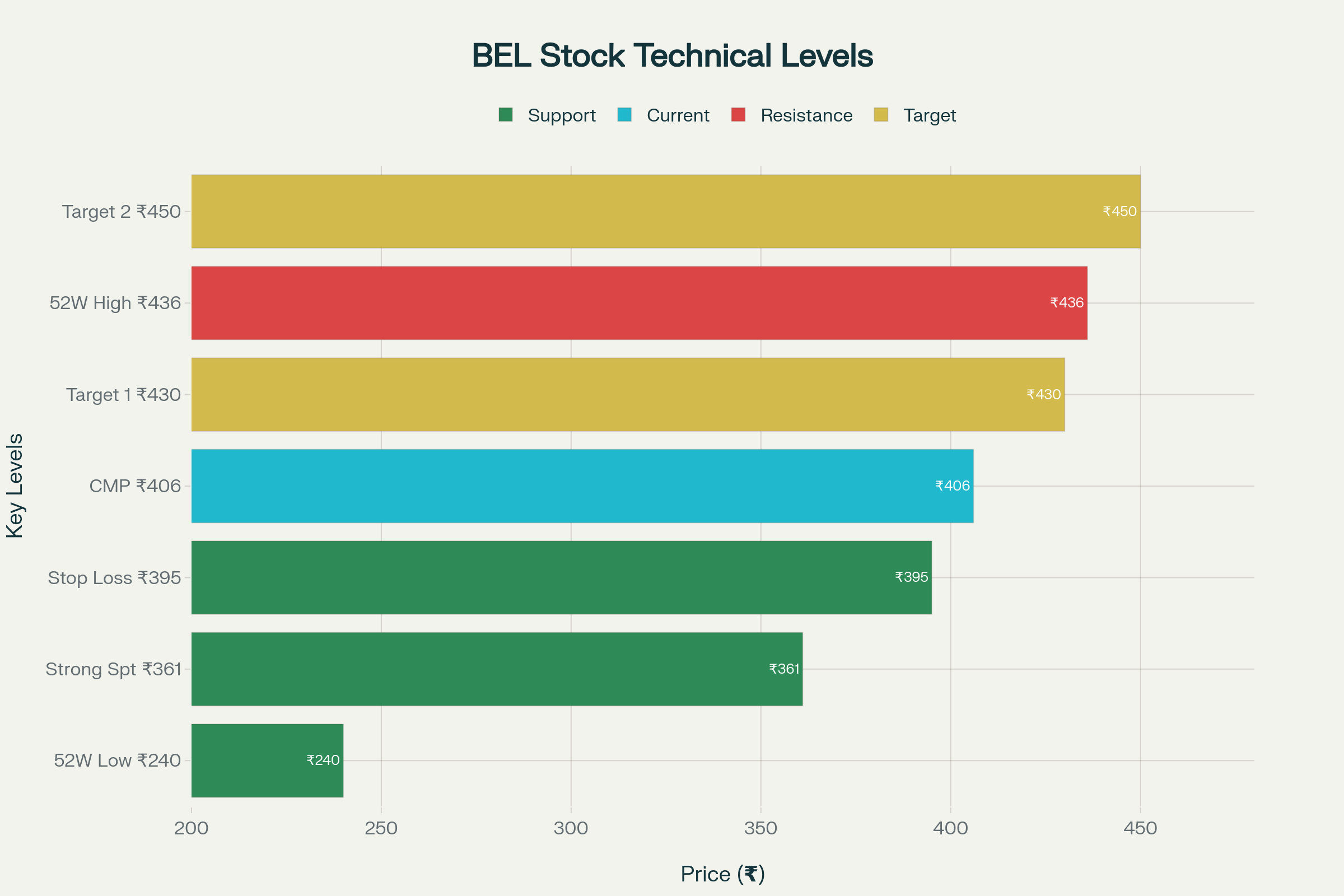

BEL Technical Analysis Chart showing key support/resistance levels and bullish indicators

Technical Analysis – Strong Buy Signals

Key Technical Indicators

The technical setup presents multiple bullish confirmations:

Momentum Indicators:

- RSI (14): 66.02 – In bullish zone above 50, indicating strong buying momentum

- MACD: Positive at 2.58 with bullish crossover above zero line

- Volume: Above average with increased participation during recent breakout

Moving Average Analysis:

- 5-Day EMA: 401.41 (Recent bullish crossover on Sep 25)

- 10-Day EMA: 399.48 (Bullish signal on Sep 29)

- 14-Day EMA: 397.65 (Bullish crossover confirmed)

- All EMAs showing STRONG BUY signals with price trading above key moving averages

Support and Resistance Levels

Support Levels:

- Immediate Support: ₹395 (Recommended stop loss)

- Strong Support: ₹361 (Fibonacci retracement 0.382 level from ATH)

Resistance Targets:

- Target 1: ₹430 (5.9% upside potential)

- Target 2: ₹450 (10.8% upside potential)

- 52-Week High: ₹436 (Previous resistance turned target)

Price Pattern Analysis

BEL has successfully broken out from its secondary downtrend that began from the July 1, 2025 high of ₹436. The breakout was confirmed with:

- Higher than average trading volumes

- Bullish candlestick patterns

- Multiple EMA crossovers providing momentum confirmation

Fundamental Analysis – Solid Foundation

Financial Performance Highlights

Q1 FY26 Results demonstrate strong operational execution:

- Revenue Growth: 5.2% YoY to ₹4,417 crores

- PAT Growth: 24.87% YoY to ₹969 crores

- EBITDA Growth: 32.2% to ₹1,240 crores

- EBITDA Margin Expansion: 600 bps improvement to 28.1%

Key Financial Metrics

Valuation & Returns:

- Market Cap: ₹2,95,278 crores (Large-cap defense stock)

- PE Ratio: 53.68x (Premium but justified by growth prospects)

- ROE: 26.64% (Excellent return on equity)

- ROCE: 33.72% (Strong capital efficiency)

- Debt-to-Equity: 0.00 (Zero debt company)

Order Book Strength – Revenue Visibility

Robust Order Pipeline:

- Current Order Book: ₹74,859 crores as of July 1, 2025

- Recent Order Wins: ₹1,092 crores (Sep 29), ₹712 crores (Sep 16), ₹644 crores (Sep 1)

- FY26 Order Inflow Target: ₹27,000 crores (27% already achieved)

- Order Mix: 93% defense, 7% non-defense and exports

Sector Outlook – Favorable Tailwinds

Defense Budget & Policy Support

Government Commitment:

- Defense Budget FY26: ₹6.81 lakh crores (9.53% increase)

- Capital Outlay: ₹1.80 lakh crores (26.43% of total allocation)

- Make in India: Strong focus on indigenous defense manufacturing

- Export Target: $5 billion defense exports by 2025

Strategic Positioning

BEL benefits from:

- Navratna PSU Status: Access to large defense contracts

- Technology Leadership: Advanced electronics, radar, communication systems

- Indigenization Drive: Government’s ‘Atmanirbhar Bharat’ initiative

- Export Potential: Growing international defense electronics market

Risk Factors & Mitigation

Key Risks

- High Valuation: PE of 53.68x requires sustained growth delivery

- Execution Risk: Large order book needs timely execution

- Competition: Increasing private sector participation in defense

Risk Mitigation

- Diversified Portfolio: Mix of defense and civilian contracts (EVMs, IT infrastructure)

- Strong Balance Sheet: Zero debt with healthy cash flows

- Government Backing: PSU status provides contract stability

Investment Rationale – Why Buy Now?

Catalysts Supporting Upward Move

- Recent Order Momentum: ₹1,092 crores orders announced Sep 29

- Technical Breakout: Confirmed breakout from consolidation phase

- Margin Expansion: 600 bps EBITDA margin improvement

- Defense Budget Allocation: Strong government spending commitment

Short-term Drivers

- Q2 Results: Expected in October 2025 likely to show continued growth

- Order Announcements: Regular order flow announcements provide momentum

- Defense Sector Focus: Budget 2025-26 emphasizes defense modernization

- Technical Setup: Multiple bullish indicators aligned for upward move

Conclusion & Recommendation

BEL presents a compelling SHORT-TERM BUY opportunity based on:

✅ Strong Technical Setup: Bullish breakout with RSI in buy zone, positive MACD, and EMA crossovers

✅ Robust Fundamentals: 24.87% PAT growth, margin expansion, zero debt

✅ Order Book Visibility: ₹74,859 crores order book with continuous inflows

✅ Sector Tailwinds: Increased defense spending and indigenization focus

✅ Risk-Reward: Attractive 6-11% upside potential with defined stop loss

Trade Setup:

- Entry: ₹406 (Current Market Price)

- Stop Loss: ₹395 (2.7% downside risk)

- Target 1: ₹430 (5.9% upside)

- Target 2: ₹450 (10.8% upside)

- Risk-Reward Ratio: 1:2.2 to 1:4 (Favorable)

Time Horizon: 2-4 weeks for target achievement based on technical momentum and upcoming catalysts.

Disclaimer: This analysis is for educational purposes only and not investment advice. Please consult your financial advisor and conduct your own research before making investment decisions. Past performance does not guarantee future results.

Analyst Name: Pradeep Suryavanshi

Bestmate Investment Services Pvt. Ltd.:

A-1-605, Ansal Corporate Park Sec-142, Noida 201305

CIN: U74999UP2016PTC143375

SEBI Registration Number: INH000015996

Website: www.bestmate.in I Email: info@bestmate.in

Disclaimer: Please read the Following very carefully:

“Investments in securities market are subject to market risks. Read all the related documents carefully before investing.”

- Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

- The fees are paid for research Report or Research recommendations and is not refundable or cancellable under any circumstances.

- We do not provide any guaranteed profit or fixed returns or any other services. We charge fixed fees and do not operate on any profit-sharing model.

- Images if any, shared with you are for illustration purposes only.

- We are not responsible for any financial loss or any other loss incurred by the client.

- Please be fully informed about the risk and costs involved in trading and investing. Please consult your investment advisor before trading. Trade only as per your risk appetite and risk profile.

- Trading/investing in stock market is risky due to its volatile nature. Upon accepting our service, you hereby accept that you fully understand the risks involved in trading/investing.

- We advise the viewers to apply own discretion while referring testimonials shared by the client. Past performances and results are no guarantee of future performance.

- All Report or recommendations shared are confidential and for the reference of paid members only. Any unapproved distribution of sensitive data will be considered as a breach of confidentiality and appropriate legal action shall be initiated.

- The Research Report or recommendations must not be used as a singular basis of any investment decision. The views do not consider the risk appetite or the particular circumstances of an individual investor; readers are requested to take professional advice before investing and trading. Our recommendations should not be construed as investment advice.

- In case of any query, please email on Info@bestmate.in be rest assured, our team will get back to you and resolve your query. Please state your registered phone number while mailing us.

- Reports based on technical and derivative analysis center on studying charts of a stock’s price movement, outstanding positions and trading volume, as opposed to focusing on a company’s fundamentals and, as such, may not match with a report on a company’s fundamentals.

Disclosure Document

The particulars given in this Disclosure Document have been prepared in accordance with SEBI(Research Analyst)Regulations,2014.The purpose of the Document is to provide essential information about the Research and recommendation Services in a manner to assist and enable the prospective client/clients in making an informed decision for engaging in Research and recommendation services before investing.For the purpose of this Disclosure Document, Research Analyst is Pradeep Suryavanshi Director, of Bestmate Investment Services Pvt Ltd (hereinafter referred as “Research Analyst”)

Business Activity: Research Analyst is registered with SEBI as Research Analyst with Registration No. INH000015996. The firm got its registration on and is engaged in research and recommendation Services. The focus of Research Analyst is to provide research and recommendations services to the clients. Analyst aligns its interests with those of the client and seeks to provide the best suited services.

Terms and conditions:

The Research report is issued to the registered clients. The Research Report is based on the facts, figures and information that are considered true, correct and reliable. The information is obtained from publicly available media or other sources believed to be reliable. The report is prepared solely for informational purpose and does not constitute an offer document or solicitation to buy or sell or subscribe for securities or other financial instruments for clients.

Disciplinary history:

- No penalties/directions have been issued by SEBI under the SEBI Act or Regulations made there under against the Research Analyst relating to Research Analyst services.

- There are no pending material litigations or legal proceedings, findings of inspections or investigations for which action has been taken or initiated by any regulatory authority against the Research Analyst or its employees.

Details of its associates:- No associates

Disclosures with respect to Research Reports and Research Recommendations Services

- The research analyst or research entity or his associate or his relative MIGH have SOME STOCKS IN HOLDING/PORTFOLIO in the subject company.

- The research analyst or research entity or his associate or his relative do not have financial interest in the subject company.

- The research analyst or its associates or relatives, do not have actual/beneficial ownership of one per cent or more securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance.

- The research analyst or his associate or his relative have any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

- The research analyst or its associates have not received any compensation from the subject company in the past twelve months.

- The research analyst or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months.

- The research analyst or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months.

- The subject company was not a client of Research Analyst or its employee or its associates during twelve months preceding the date of distribution of the research report and recommendation services provided.

- The research analyst or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months.

- The research analyst or its associates have not received any compensation or other benefits from the subject company or third party in connection with the research report.

- The research analyst has not been engaged in market making activity for the subject company.

- The research analyst has not served as an officer, director or employee of the subject company.

- The research analyst did not receive any compensation or other benefits from the companies mentioned in the documents or third party in connection with preparation of the research documents. Accordingly, research Analyst does not have any material conflict of interest at the time of publication of the research documents.