🪔 शुभ दीपावली! नव संवत्सर 2082 की शुभकामनाएं! 🪔🕉️ May Goddess Lakshmi shower her blessings upon your portfolios and may Lord Ganesha remove all obstacles from your path to financial prosperity! As we bid farewell to Samvat 2081 and welcome Samvat 2082, may this new Hindu financial year bring unprecedented growth, wealth, and happiness to all investors! 🙏

As the nation celebrates the festival of lights, Dalal Street prepares for its most sacred and symbolic tradition – the Muhurat Trading session marking the beginning of Samvat 2082. The special one-hour trading window, scheduled from 1:45 PM to 2:45 PM today, represents far more than a mere market session; it embodies India’s unique blend of ancient spiritual wisdom and modern financial aspirations, where the quest for prosperity is sanctified by the blessings of Goddess Lakshmi and Lord Ganesha.

This year’s Muhurat Trading comes at a particularly significant juncture, as markets ended Samvat 2081 on a strong note on Monday, with the Sensex gaining 411 points to close at 84,363.37 and the Nifty adding 133 points to finish at 25,843 – both indices positioning just shy of their all-time highs and setting an optimistic tone for the new Hindu financial year ahead.

Understanding Muhurat Trading: Tradition Meets Finance

The Sacred Significance

Muhurat Trading, literally meaning “trading during an auspicious hour,” is a cherished tradition that dates back to 1957 when the Bombay Stock Exchange initiated this practice. The word “muhurat” refers to a highly auspicious time determined by Hindu astrology when planetary alignments are believed to favor positive outcomes and financial success.

The ceremony is deeply rooted in the belief that investments made during this divine hour receive the blessings of Goddess Lakshmi (deity of wealth and prosperity) and Lord Ganesha (remover of obstacles), ensuring financial well-being throughout the year. Many investors and traders perform special pujas of their trading accounts and offices before participating in this session, blending spiritual faith with financial ambitions.

Historical Context and King Vikramaditya’s Legacy

The Hindu calendar year, known as Vikram Samvat, was established by the legendary King Vikramaditya in 57 BCE. Each Diwali marks the beginning of a new Samvat year, and 2025 ushers in Samvat 2082. For over six decades, Indian exchanges have honored this tradition by conducting a special trading session, making it one of the few stock markets globally where trading occurs on a major national holiday.

Muhurat Trading 2025: Complete Schedule and Timings

Comprehensive Session Breakdown

This year marks a significant departure from tradition as the Muhurat session has been moved from the customary evening slot (typically 6-7 PM) to the afternoon. This strategic shift simplifies operations, reduces post-market system loads, aligns with modern clearing frameworks, and improves accessibility for global investors.

| Session | Start Time | End Time | Duration | Segments Covered | Significance |

|---|---|---|---|---|---|

| Block Deal | 1:15 PM | 1:30 PM | 15 minutes | Equity | Large institutional deals |

| Pre-Open Session | 1:30 PM | 1:45 PM | 15 minutes | All segments | Price discovery mechanism |

| Muhurat Trading | 1:45 PM | 2:45 PM | 60 minutes | Equity, F&O, Currency, Commodity | 🪔 AUSPICIOUS HOUR 🪔 |

| Special Pre-Open (IPO) | 1:30 PM | 2:15 PM | 45 minutes | IPO/Relisted securities | New listings price discovery |

| Call Auction Illiquid | 1:50 PM | 2:35 PM | 45 minutes | Illiquid stocks | Price discovery for illiquid securities |

| Closing Session | 2:55 PM | 3:05 PM | 10 minutes | All segments | Final settlement and closing |

| Trade Modification | 1:45 PM | 3:15 PM | 90 minutes | All segments | Order modifications allowed |

Settlement Obligations

All trades executed during the Muhurat Trading session carry regular settlement obligations, meaning delivery and payment duties for buyers and sellers will be settled exactly as on any normal trading day. This ensures that symbolic purchases translate into genuine investment positions.

Samvat 2081 Retrospective: A Year of Moderate Returns

Benchmark Performance Review

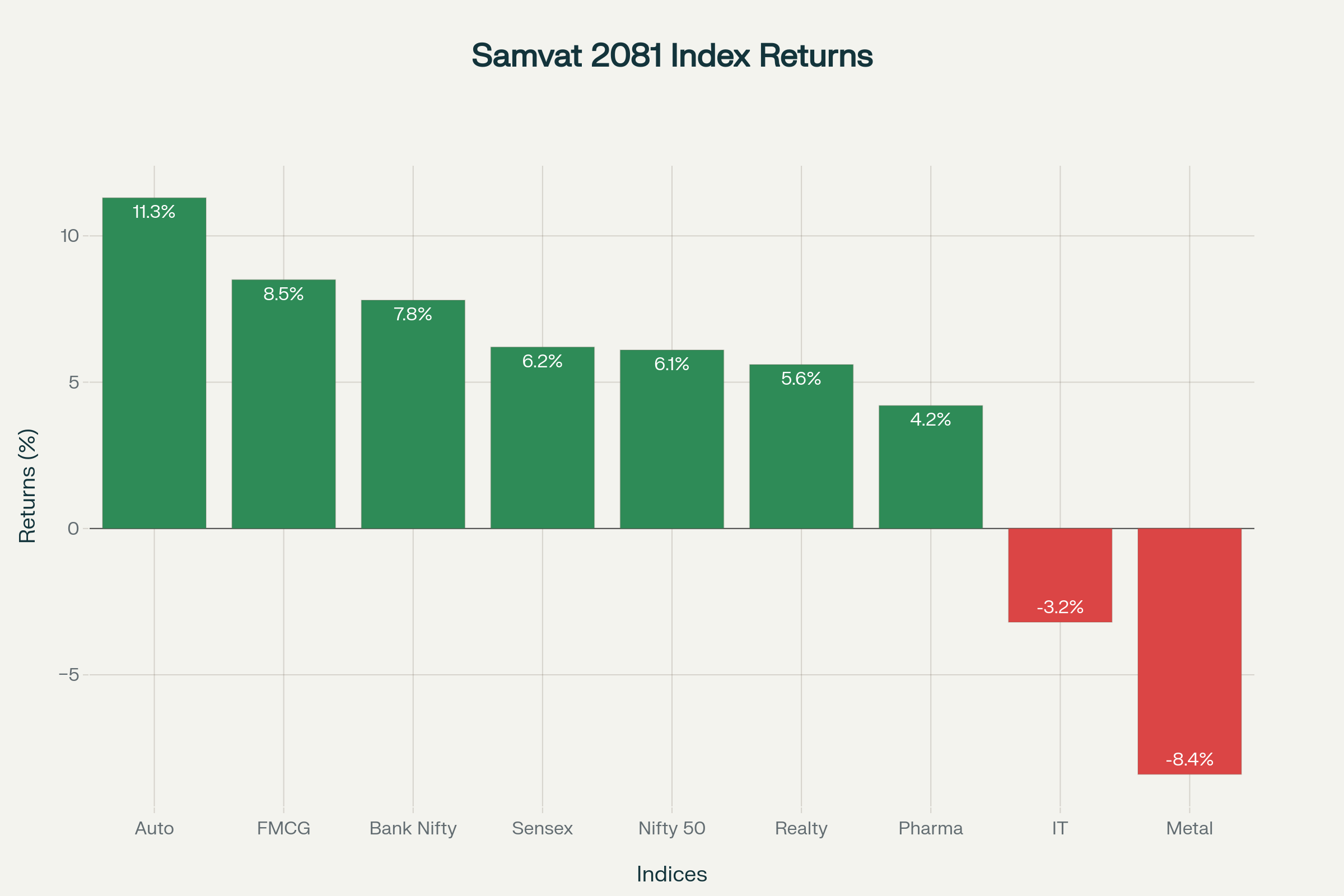

Samvat 2081, which began on Diwali 2024 and concluded on Monday, October 20, 2025, delivered modest but positive returns to investors, with both benchmark indices gaining approximately 6% despite facing multiple headwinds throughout the year including US-China trade tensions, Trump tariff threats, and volatile global markets.

Monday’s Closing Session Highlights

The final regular trading session of Samvat 2081 on Monday witnessed broad-based buying across sectors, with all major indices closing in positive territory, symbolically blessing the transition into the new Hindu financial year.

| Index | Monday Close | Change | Change (%) | Samvat 2081 Return (%) |

|---|---|---|---|---|

| Sensex | 84,363.37 | +411.18 | 0.49 | 6.2 |

| Nifty 50 | 25,843.00 | +133.15 | 0.52 | 6.1 |

| Bank Nifty | 58,035.85 | +322.50 | 0.56 | 7.8 |

| Nifty FMCG | 61,456.80 | +171.35 | 0.28 | 8.5 |

| Nifty Auto | 24,752.60 | +94.30 | 0.38 | 11.3 |

| Nifty IT | 35,298.75 | +156.15 | 0.44 | -3.2 |

| Nifty Metal | 9,856.25 | -86.10 | -0.87 | -8.4 |

Sectoral Winners and Losers

Samvat 2081 witnessed significant sectoral divergence, with the Auto sector emerging as the clear winner with an impressive 11.3% return, driven by robust festive demand, improved chip availability, and strong export growth. The FMCG sector followed with 8.5% gains, benefiting from rural recovery and premiumization trends.

The Banking sector, particularly represented by Bank Nifty’s 7.8% return, demonstrated resilience amid interest rate stability and improving asset quality. However, the IT sector declined 3.2% due to global slowdown concerns and margin pressures, while Metals suffered an 8.4% decline on weak Chinese demand and overcapacity concerns.

Historical Muhurat Trading Performance: A Positive Legacy

Decade of Data Speaks Volumes

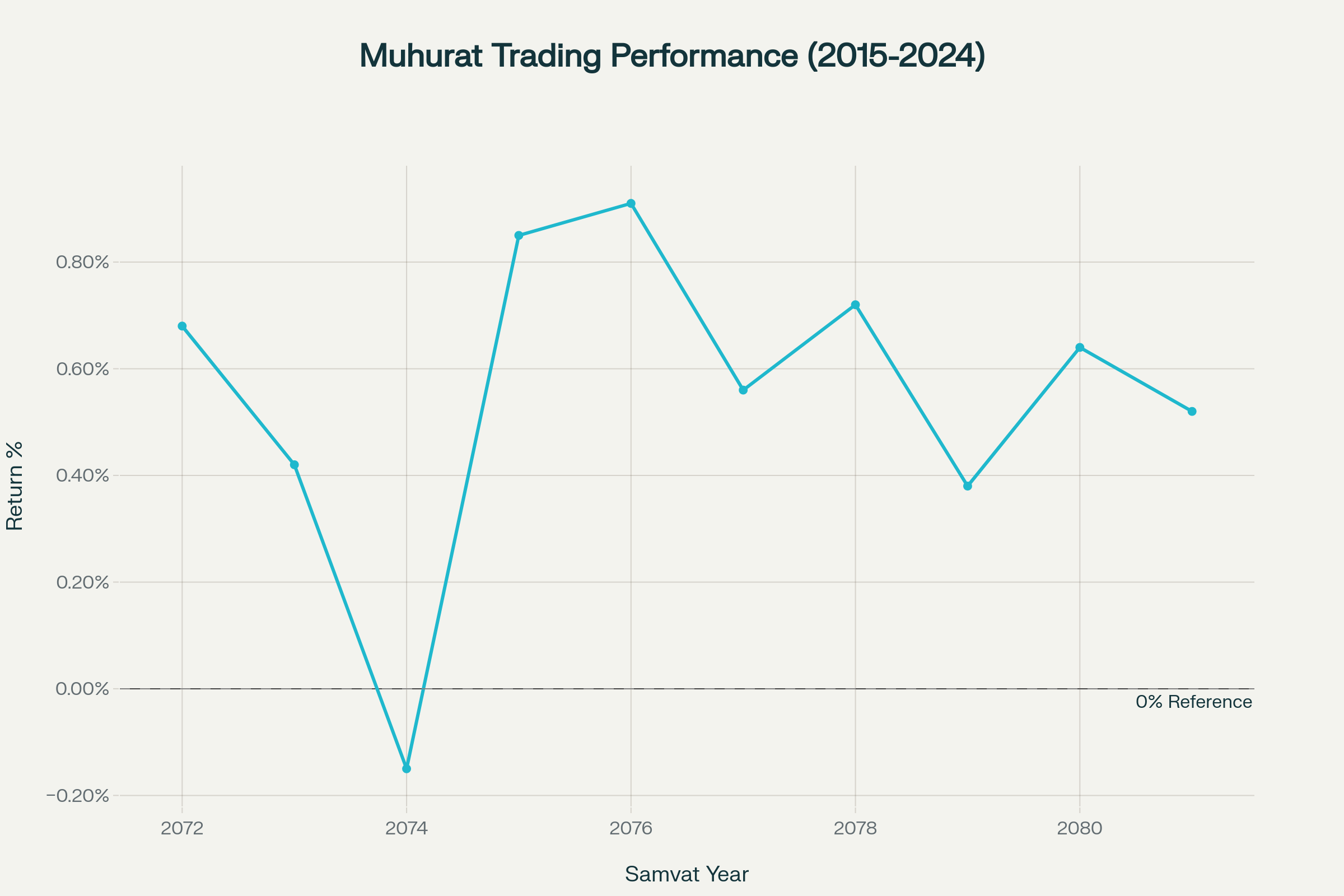

Historical analysis of Muhurat Trading sessions over the past decade reveals an overwhelmingly positive track record, with 9 out of 10 years delivering gains during the special session. This remarkable consistency underscores the powerful combination of festive optimism, symbolic buying, and genuine market strength during this auspicious hour.

The only negative year was Samvat 2074 (2017) when the Muhurat session declined 0.15% amid GST implementation concerns. However, the strongest Muhurat day performances came during Samvat 2076 (2019) with 0.91% gain following Modi’s re-election, and Samvat 2075 (2018) with 0.85% gain during the recovery from the credit crisis.

Full-Year Returns Tell Deeper Story

While Muhurat day returns are largely symbolic, the full Samvat year returns provide more meaningful insights:

-

Best Samvat Year: Samvat 2078 (2021) delivered exceptional 18.5% returns during the post-pandemic recovery boom

-

Second Best: Samvat 2077 (2020) gained 16.3% during the COVID recovery phase

-

Worst Samvat Year: Samvat 2075 (2018) declined 6.2% amid the NBFC credit crisis

-

Average Return: The 10-year average Samvat return stands at approximately 11.2%

Institutional Flow Dynamics: DII Dominance in Samvat 2081

Unprecedented Domestic Support

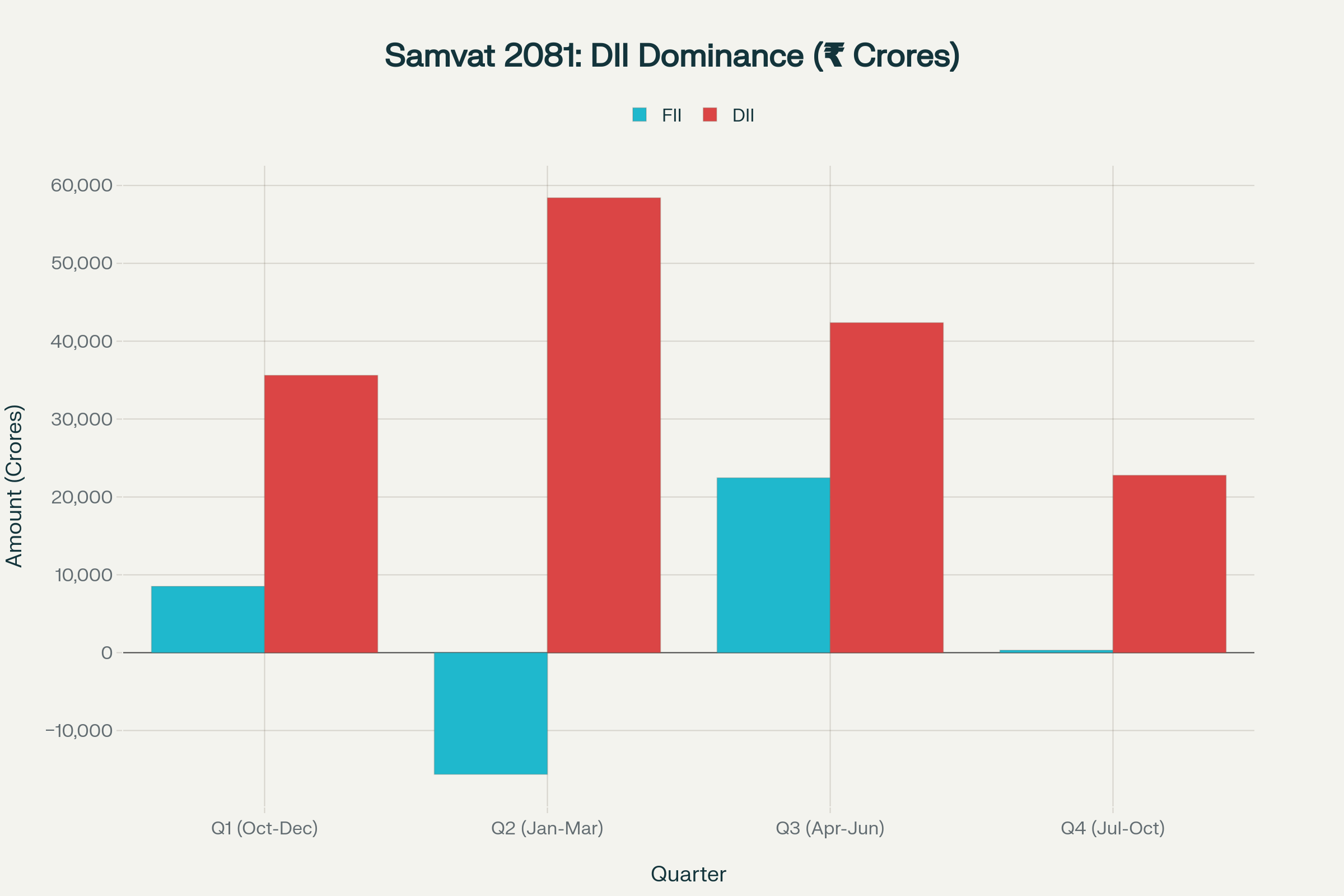

The defining feature of Samvat 2081 was the unwavering support from Domestic Institutional Investors, who recorded cumulative net purchases of ₹1,61,299.54 crore for the entire year, representing one of the strongest years of domestic institutional buying in Indian market history. This massive buying spree reflects the deep conviction of domestic investors in India’s long-term growth trajectory.

Quarterly Flow Breakdown

The institutional flow pattern during Samvat 2081 revealed interesting dynamics:

-

Q1 (Oct-Dec 2024): Both FII and DII were net buyers, with combined inflows of ₹44,140 crore

-

Q2 (Jan-Mar 2025): FII turned sellers with -₹15,630 crore outflows, but DII absorbed this with ₹58,420 crore buying

-

Q3 (Apr-Jun 2025): FII returned strongly with ₹22,450 crore inflows, while DII added ₹42,380 crore

-

Q4 (Jul-Oct 2025): FII flows moderated to ₹314 crore, but DII maintained momentum with ₹22,780 crore

Samvat 2082 Opening Signals

Monday’s session (Samvat 2082’s opening day) witnessed DII net purchases of ₹1,526.62 crore, signaling continued domestic institutional confidence as we enter the new Hindu financial year. FII data for Monday was awaited at press time but expected to be positive given the strong market performance.

Technical Analysis: Muhurat Session Outlook

Nifty 50 Approaching Historic Milestone

The Nifty 50 enters Muhurat Trading tantalizingly close to its all-time high of 26,277.35 achieved in September 2024, currently positioned just 1.7% away. Technical experts suggest that if the index sustains above 25,700 levels during the Muhurat session, a rally toward the 25,950-26,000 zone cannot be ruled out before potential consolidation.

Key Technical Levels for Muhurat Session:

| Index | Monday Close | Expected Open | Support 1 | Support 2 | Resistance 1 | Resistance 2 | Samvat 2082 Target |

|---|---|---|---|---|---|---|---|

| Nifty 50 | 25,843 | 25,920 | 25,800 | 25,700 | 25,950 | 26,000 | 27,000 |

| Bank Nifty | 58,036 | 58,250 | 58,000 | 57,700 | 58,500 | 58,750 | 60,000 |

| Sensex | 84,363 | 84,750 | 84,200 | 83,800 | 85,000 | 85,400 | 88,000 |

Bank Nifty’s All-Time High Territory

Bank Nifty has already achieved its all-time high of 58,222.10 during Monday’s intraday trading and closed just below at 58,035.85, demonstrating exceptional strength in the banking sector. Technical analysts expect the index to maintain its upward trajectory with targets of 58,500-59,000 in the near term and 60,000 for Samvat 2082.

Momentum Indicators

The RSI (Relative Strength Index) stands at 68 on the daily chart for Nifty, approaching overbought territory but not yet there, indicating room for further upside. The MACD (Moving Average Convergence Divergence) remains well above the signal line with expanding histogram bars, confirming sustained bullish momentum.

Global Market Cues: Festive Support from Abroad

Asian Markets Lead with Strength

Asian markets provided robust support on Tuesday morning, with Japan’s Nikkei 225 hitting a record high after Sanae Takaichi became Japan’s first female prime minister. The index gained 0.24%, while South Korea’s KOSPI rose 0.3% and Hong Kong’s Hang Seng surged 1.33%, reflecting improved regional sentiment.

Wall Street’s Mixed Signals

US markets concluded Monday with mixed results as investors awaited major earnings announcements and inflation data. The S&P 500 rose 1.07% and the tech-heavy Nasdaq gained 1.37%, driven by a rally in Apple shares and hopes of resolving the government shutdown. However, the Dow Jones fell 1.12%, reflecting sector-specific weakness.

Commodity and Currency Dynamics

Gold prices paused their record run at $4,340 per ounce as investors booked profits after hitting an all-time high of $4,381 in the previous session. The pause came amid expectations of further US Federal Reserve rate cuts, which typically support gold prices.

The Indian rupee is expected to trade with a slight positive bias around 88.00-88.20 levels against the US dollar, supported by positive domestic market sentiment and steady foreign exchange reserves.

Expert Views and Market Expectations for Samvat 2082

Earnings Growth: The Key Driver

Market experts universally agree that Samvat 2082’s performance will be dictated primarily by corporate earnings growth rather than valuation expansion. VK Vijayakumar, Chief Investment Strategist at Geojit Investments, emphasizes: “The stock market is the slave of earnings, and the long-term trend will be dictated by earnings growth in Samvat 2082”.

The sharp decline in India’s earnings growth to 5% in FY25 from an average of 24% during the previous three years was the major factor behind Samvat 2081’s underperformance. Experts expect earnings growth to revive to 10-15% in FY26, providing a stronger foundation for market returns.

Consensus Return Forecasts:

Major brokerages and research firms have provided their Samvat 2082 return forecasts:

-

Geojit Financial: 10-15% returns expected; bullish on banking and FMCG sectors

-

LKP Securities: 12-18% gains projected; emphasizes domestic flow strength

-

Choice Equity: 15-20% upside possible; optimistic on infrastructure capex cycle

-

Motilal Oswal: 10-14% returns likely; favors IT sector revival and pharma

-

ICICI Direct: 12-16% gains anticipated; positive on IT and banking recovery

-

Master Capital Services: 8-12% returns forecast; cautious on global headwinds

Sectoral Preferences

Consumption-led sectors are expected to perform well following economic reforms and improving rural demand. Banking and financial services remain top picks given their strong momentum and reasonable valuations. Infrastructure and capital goods sectors could benefit from continued government capex and private sector investment revival.

Defensive sectors like pharmaceuticals and FMCG are recommended for portfolio stability, while IT services may see revival if global spending stabilizes and rupee depreciation provides tailwinds.

Top Stock Picks for Samvat 2082: Brokerage Recommendations

Blue-Chip Banking Favorites

HDFC Bank emerges as a consensus pick across brokerages with a target price of ₹2,050, offering 22% upside from current levels of ₹1,680. The bank’s stable deposit franchise, improving margin trajectory, and strong asset quality make it an attractive long-term holding.

ICICI Bank, trading at ₹1,245, carries a target of ₹1,520 (22% upside) from Geojit Financial Services. The bank’s retail-focused business model, consistent profitability, and attractive valuations position it well for the new Samvat year.

State Bank of India (SBI) is Master Capital Services’ top PSU bank pick with an aggressive 23.6% upside target to ₹1,020 from ₹825. The bank’s improving asset quality, strong credit growth, and government backing provide confidence.

NBFC and Financial Services

Bajaj Finance is LKP Securities’ top Muhurat pick with a target of ₹1,260, offering 22.3% upside from ₹1,030. After weeks of consolidation, the stock has broken past its previous swing high, signaling renewed investor optimism. The company’s diversified loan portfolio and strong risk management practices support the bullish case.

Axis Bank, recommended by Angel One with a ₹1,450 target (23.4% upside from ₹1,175), benefits from its improved asset quality metrics, technology leadership, and strong liability franchise.

Technology Sector Selections

Despite Samvat 2081’s IT sector underperformance, brokerages remain constructive on quality names:

TCS, with ICICI Direct’s target of ₹4,500 (12.9% upside from ₹3,985), offers defensive characteristics and stable cash generation. The company’s strong client relationships and digital transformation capabilities provide long-term visibility.

Infosys, carrying Motilal Oswal’s target of ₹2,200 (19.2% upside from ₹1,845), benefits from its strong deal pipeline, margin improvement initiatives, and attractive valuations after recent correction.

Conglomerate and Infrastructure Plays

Reliance Industries remains a core portfolio holding with multiple growth drivers including new energy business, retail expansion, and telecom dominance. Multiple brokerages project ₹3,350 target (17.8% upside from ₹2,845).

Larsen & Toubro, Choice Equity’s top infrastructure pick, carries a ₹4,400 target (20.5% upside from ₹3,650). The company’s strong order book, execution capabilities, and government capex alignment make it attractive for the infrastructure theme.

Consumption and FMCG

ITC, Swastika Investmart’s pick with ₹575 target (18.6% upside from ₹485), offers a compelling combination of FMCG growth, hotel business recovery, and attractive dividend yield. The company’s diversified business model provides stability.

Trading Strategy for Muhurat Session

Volume and Liquidity Considerations

Investors should be mindful that Muhurat Trading typically witnesses lower volumes compared to regular sessions, which can lead to increased price volatility and wider bid-ask spreads. Quick price movements are common within the short one-hour window, making stop-loss discipline particularly important.

Symbolic vs. Strategic Approach

While many market participants treat Muhurat Trading as a ceremonial gesture, making token purchases for auspicious beginning, long-term investors can use this opportunity to initiate positions in quality large-cap or growth-oriented stocks expected to perform well throughout Samvat 2082.

Risk Management Guidelines

-

Avoid aggressive short-term speculation given thin liquidity

-

Maintain strict stop-loss levels on all positions

-

Focus on quality stocks with strong fundamentals

-

Don’t chase momentum; wait for appropriate entry points

-

Consider the symbolic nature while making genuine long-term investments

Sector Focus for Today’s Session

Experts recommend focusing on:

-

Banking and Financial Services: Strong momentum continuation expected

-

FMCG and Consumer Durables: Festive demand theme remains intact

-

Select Large-cap IT: Defensive positioning amid global uncertainties

-

Infrastructure and Capex: Government spending visibility

-

Quality Pharma: Export strength and domestic formulations growth

Market Holidays and Week Ahead

Truncated Trading Week

Markets will remain closed on Wednesday, October 22, for Balipratipada (the day after Diwali), with the Multi Commodity Exchange (MCX) conducting only evening session trading from 5:00 PM onwards. Regular trading will resume on Thursday, October 23, across all segments.

The truncated week limits trading opportunities but increases the significance of the Muhurat session and Thursday’s reopening as key directional indicators for the market.

Earnings Season Intensifies

The coming days will see major corporate results including HUL, Bharti Airtel, Bajaj Finance on Thursday, followed by SBI, Asian Paints, and Dr Reddy’s on Friday. These results will provide crucial insights into corporate performance and set the tone for Samvat 2082’s earnings trajectory.

Auspicious Traditions and Rituals

The Lakshmi-Ganesha Connection

Before the Muhurat session, many traders and investors perform special pujas at their homes and offices, seeking blessings from Goddess Lakshmi for wealth and prosperity, and Lord Ganesha for removal of obstacles in their financial journey. Trading terminals are decorated with flowers and diyas, creating a festive atmosphere on the exchange floors.

The Power of Beginnings

Hindu philosophy places immense importance on beginnings (”Shubh Aarambh”), believing that actions taken during auspicious moments create positive momentum for the entire period ahead. This belief system transforms Muhurat Trading from a mere market session into a sacred ritual that blends faith with finance.

Conclusion: Embracing Samvat 2082 with Optimism

As the clock strikes 1:45 PM today, millions of investors across India will participate in a tradition that seamlessly blends centuries-old spiritual wisdom with modern financial markets. The Muhurat Trading session of Samvat 2082 represents not just an opportunity for symbolic purchases, but a moment to reflect on investment goals, reaffirm financial discipline, and seek divine blessings for the journey ahead.

The fundamentals supporting Samvat 2082 appear stronger than Samvat 2081, with expectations of reviving earnings growth (10-15% vs 5%), stable macroeconomic environment, continued domestic institutional support, and improving global sentiment. While challenges remain in the form of geopolitical tensions, valuation concerns in pockets, and global economic uncertainties, India’s structural growth story remains intact.

The shift in Muhurat timing from evening to afternoon symbolizes the market’s evolution – adapting traditions to modern requirements while preserving their essence. As we transition from the moderate returns of Samvat 2081 to the promising prospects of Samvat 2082, investors would do well to remember that wealth creation is a marathon, not a sprint, and the blessings sought today must be accompanied by disciplined research, risk management, and patience.

Disclaimer: This article is for informational and cultural purposes only and should not be construed as investment advice. Past Muhurat Trading performance is not indicative of future results. The auspicious nature of Muhurat Trading does not guarantee returns; investment decisions should be based on thorough fundamental and technical analysis. Investors should consult with qualified financial advisors before making investment decisions. All trades executed during Muhurat Trading carry regular settlement obligations.

Note: Markets remain closed for regular trading on October 21, 2025 (Diwali Lakshmi Puja) except for the Muhurat session from 1:45 PM to 2:45 PM. Markets will also remain closed on October 22, 2025 (Balipratipada), resuming regular operations on October 23, 2025.

Analyst Name: Pradeep Suryavanshi

Bestmate Investment Services Pvt. Ltd.:

A-1-605, Ansal Corporate Park Sec-142, Noida 201305

CIN: U74999UP2016PTC143375

SEBI Registration Number: INH000015996

Website: www.bestmate.in I Email: info@bestmate.in

Disclaimer: Please read the Following very carefully:

“Investments in securities market are subject to market risks. Read all the related documents carefully before investing.”

- Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

- The fees are paid for research Report or Research recommendations and is not refundable or cancellable under any circumstances.

- We do not provide any guaranteed profit or fixed returns or any other services. We charge fixed fees and do not operate on any profit-sharing model.

- Images if any, shared with you are for illustration purposes only.

- We are not responsible for any financial loss or any other loss incurred by the client.

- Please be fully informed about the risk and costs involved in trading and investing. Please consult your investment advisor before trading. Trade only as per your risk appetite and risk profile.

- Trading/investing in stock market is risky due to its volatile nature. Upon accepting our service, you hereby accept that you fully understand the risks involved in trading/investing.

- We advise the viewers to apply own discretion while referring testimonials shared by the client. Past performances and results are no guarantee of future performance.

- All Report or recommendations shared are confidential and for the reference of paid members only. Any unapproved distribution of sensitive data will be considered as a breach of confidentiality and appropriate legal action shall be initiated.

- The Research Report or recommendations must not be used as a singular basis of any investment decision. The views do not consider the risk appetite or the particular circumstances of an individual investor; readers are requested to take professional advice before investing and trading. Our recommendations should not be construed as investment advice.

- In case of any query, please email on Info@bestmate.in be rest assured, our team will get back to you and resolve your query. Please state your registered phone number while mailing us.

- Reports based on technical and derivative analysis center on studying charts of a stock’s price movement, outstanding positions and trading volume, as opposed to focusing on a company’s fundamentals and, as such, may not match with a report on a company’s fundamentals.

Disclosure Document

The particulars given in this Disclosure Document have been prepared in accordance with SEBI(Research Analyst)Regulations,2014.The purpose of the Document is to provide essential information about the Research and recommendation Services in a manner to assist and enable the prospective client/clients in making an informed decision for engaging in Research and recommendation services before investing.For the purpose of this Disclosure Document, Research Analyst is Pradeep Suryavanshi Director, of Bestmate Investment Services Pvt Ltd (hereinafter referred as “Research Analyst”)

Business Activity: Research Analyst is registered with SEBI as Research Analyst with Registration No. INH000015996. The firm got its registration on and is engaged in research and recommendation Services. The focus of Research Analyst is to provide research and recommendations services to the clients. Analyst aligns its interests with those of the client and seeks to provide the best suited services.

Terms and conditions:

The Research report is issued to the registered clients. The Research Report is based on the facts, figures and information that are considered true, correct and reliable. The information is obtained from publicly available media or other sources believed to be reliable. The report is prepared solely for informational purpose and does not constitute an offer document or solicitation to buy or sell or subscribe for securities or other financial instruments for clients.

Disciplinary history:

- No penalties/directions have been issued by SEBI under the SEBI Act or Regulations made there under against the Research Analyst relating to Research Analyst services.

- There are no pending material litigations or legal proceedings, findings of inspections or investigations for which action has been taken or initiated by any regulatory authority against the Research Analyst or its employees.

Details of its associates:- No associates

Disclosures with respect to Research Reports and Research Recommendations Services

- The research analyst or research entity or his associate or his relative do not have financial interest in the subject company.

- The research analyst or its associates or relatives, do not have actual/beneficial ownership of one per cent or more securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance.

- The research analyst or his associate or his relative do not have any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

- The research analyst or its associates have not received any compensation from the subject company in the past twelve months.

- The research analyst or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months.

- The research analyst or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months.

- The subject company was not a client of Research Analyst or its employee or its associates during twelve months preceding the date of distribution of the research report and recommendation services provided.

- The research analyst or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months.

- The research analyst or its associates have not received any compensation or other benefits from the subject company or third party in connection with the research report.

- The research analyst has not been engaged in market making activity for the subject company.

- The research analyst has not served as an officer, director or employee of the subject company.

- The research analyst did not receive any compensation or other benefits from the companies mentioned in the documents or third party in connection with preparation of the research documents. Accordingly, research Analyst does not have any material conflict of interest at the time of publication of the research documents.