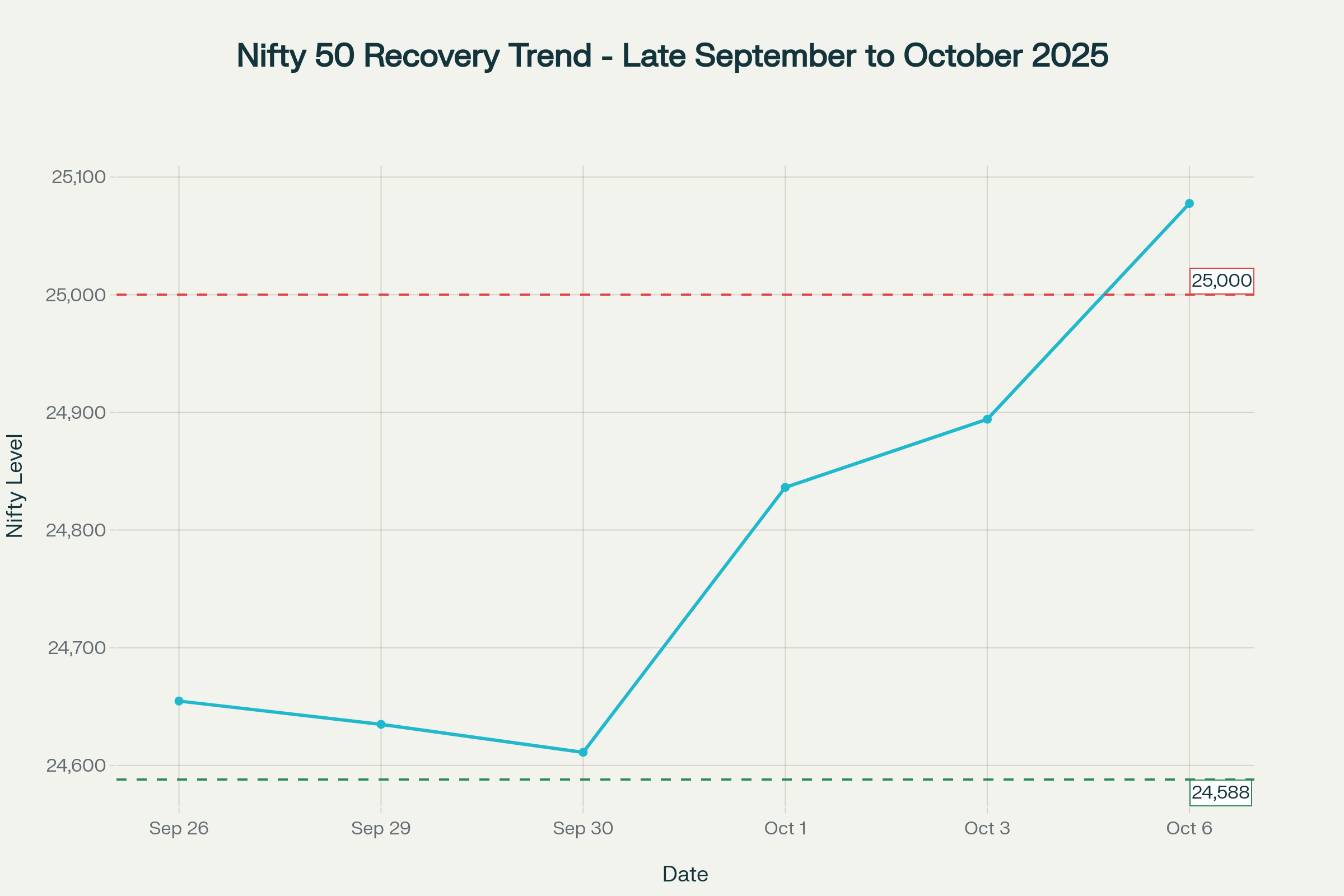

The Indian equity markets are poised for a cautious start on Tuesday as GIFT Nifty signals a flat opening near 25,153 levels, though the underlying momentum remains constructive following three consecutive sessions of gains. Monday’s strong performance, with Nifty 50 reclaiming the psychologically important 25,000 mark, has set the stage for continued optimism, supported by robust domestic institutional buying and improving technical indicators despite persistent foreign institutional selling.

Global Market Landscape and External Influences

US Market Performance and Federal Reserve Outlook

US equity markets delivered mixed signals overnight, with the S&P 500 and Nasdaq Composite achieving new record highs despite the ongoing government shutdown. The S&P 500 advanced 0.36% to 6,740.28, while the Nasdaq surged 0.71% to 22,941.70, driven primarily by artificial intelligence-related deal activity and expectations of Federal Reserve rate cuts. However, the Dow Jones Industrial Average slipped 0.14% to 46,695, ending a six-day winning streak.

The continued government shutdown, now in its seventh day, has paradoxically boosted market sentiment as investors interpret delayed economic data releases as reducing obstacles to the Fed’s dovish monetary policy stance. Markets have fully priced in a 25 basis points rate cut at the October 28-29 Federal Reserve meeting, with December rate reduction odds standing at approximately 94%.

Asian Market Dynamics

Asian markets presented a mixed picture in early Tuesday trading, with Japan’s Nikkei 225 gaining 0.57% to 48,218 after setting new intraday records, while Hong Kong’s Hang Seng Index declined 0.67% to 26,957 amid continued concerns over Chinese economic recovery. Shanghai Composite showed resilience with a 0.52% gain to 3,882.78, supported by ongoing stimulus measures.

Commodity and Currency Movements

Gold prices extended their rally to near-record highs around $3,981 per ounce, driven by safe-haven demand amid US political uncertainty and expectations of lower interest rates. Crude oil prices showed modest gains with WTI crude rising 0.11% to $61.76 per barrel and Brent crude advancing 0.10% to $65.53. The US Dollar Index strengthened 0.11% to 98.21, while the Indian rupee remained relatively stable near 88.72 against the dollar.

Domestic Market Technical Analysis

Nifty 50 Technical Setup

Monday’s session saw Nifty 50 deliver a strong performance, gaining 183.40 points (0.74%) to close at 25,077.65, marking the third consecutive session of gains and successfully reclaiming the crucial 25,000 psychological level. The index formed a long bullish candle on daily charts, signaling strengthening momentum and growing trader confidence.

Technical indicators suggest the current uptrend has room for further extension. The index has completed a 50% retracement of the recent decline from 25,448 to 24,588, with the retracement level placed at 25,020. The RSI has improved significantly to 55, advancing steadily from the neutral zone and indicating sustained buying interest.

Key Technical Levels for October 7:

-

Immediate Resistance: 25,100-25,150 (61.8% retracement level)

-

Key Resistance: 25,200-25,250 (previous swing highs cluster)

-

Next Targets: 25,330-25,400 (trendline resistance)

-

Immediate Support: 25,000-25,018 (psychological and retracement levels)

-

Key Support: 24,900-24,880 (confluence of EMAs and Fibonacci levels)

Bank Nifty Outperformance

Bank Nifty demonstrated remarkable strength, surging 516 points (0.93%) to 56,105, outperforming the benchmark index for the fifth consecutive session. The banking index has surpassed its previous swing high of 55,835, confirming a breakout above the Ichimoku Cloud with RSI reaching 63.42.

Private banking stocks led the rally, with major contributors including Kotak Mahindra Bank, Axis Bank, and HDFC Bank, benefiting from strong quarterly business updates and attractive valuations. The sector’s technical setup suggests potential for further upside toward 57,000 levels, with strong support established at the 56,000 zone.

Institutional Flow Analysis

Foreign vs Domestic Investment Patterns

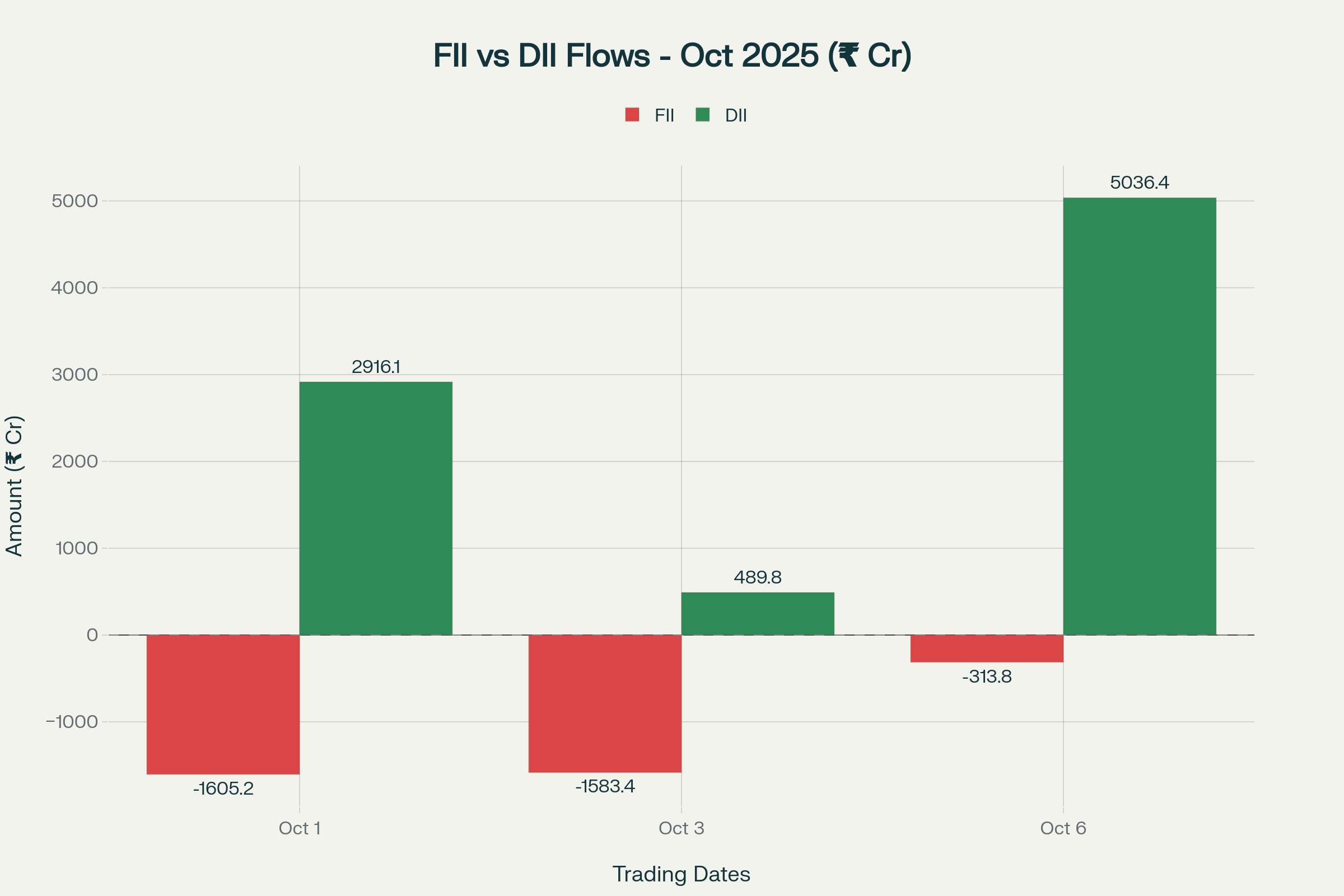

The October trading sessions have revealed a clear divergence in institutional investor behavior, with Foreign Institutional Investors (FIIs) maintaining their selling stance while Domestic Institutional Investors (DIIs) have provided robust support to the markets.

On October 6, FIIs remained net sellers for the 10th consecutive session, offloading ₹313.77 crore worth of equities. However, this represents a significant moderation from the heavy selling seen in early October, when daily outflows exceeded ₹1,500 crore. Month-to-date, FIIs have pulled out ₹3,502.34 crore from Indian equities.

Conversely, DIIs have emerged as the primary market stabilizers, with net purchases of ₹5,036.39 crore on Monday alone, marking their 29th consecutive session as net buyers. Their cumulative buying in October has reached ₹8,442.29 crore, effectively offsetting FII outflows and providing a net positive flow of ₹4,939.95 crore to the markets.

Derivative Market Insights

Options Data and Market Sentiment

The derivatives market provides encouraging signals for continued bullish momentum. The Nifty Put-Call Ratio (PCR) jumped significantly to 1.33 from 1.17 in the previous session, indicating increased bullish sentiment among options traders. A PCR above 1.0 typically suggests that traders are selling more Put options than Call options, reflecting confidence in market stability or upside potential.

Key Options Levels for October 7 Expiry:

-

Maximum Call Open Interest: 25,200 strike (135 lakh contracts) – acting as immediate resistance

-

Maximum Put Open Interest: 25,000 strike (171 lakh contracts) – providing strong support

-

Significant Call Writing: 25,200, 25,300, and 25,250 strikes showing fresh writing

-

Maximum Put Writing: 25,000 strike with addition of 135 lakh contracts

India VIX and Volatility Outlook

The India VIX, the market’s fear gauge, rose modestly by 1.32% to 10.19 but remained well below key moving averages, indicating continued support for bullish sentiment. The relatively low VIX levels suggest that market participants expect limited volatility in the near term, supportive of trending moves rather than sharp reversals.

Sectoral Performance and Rotation

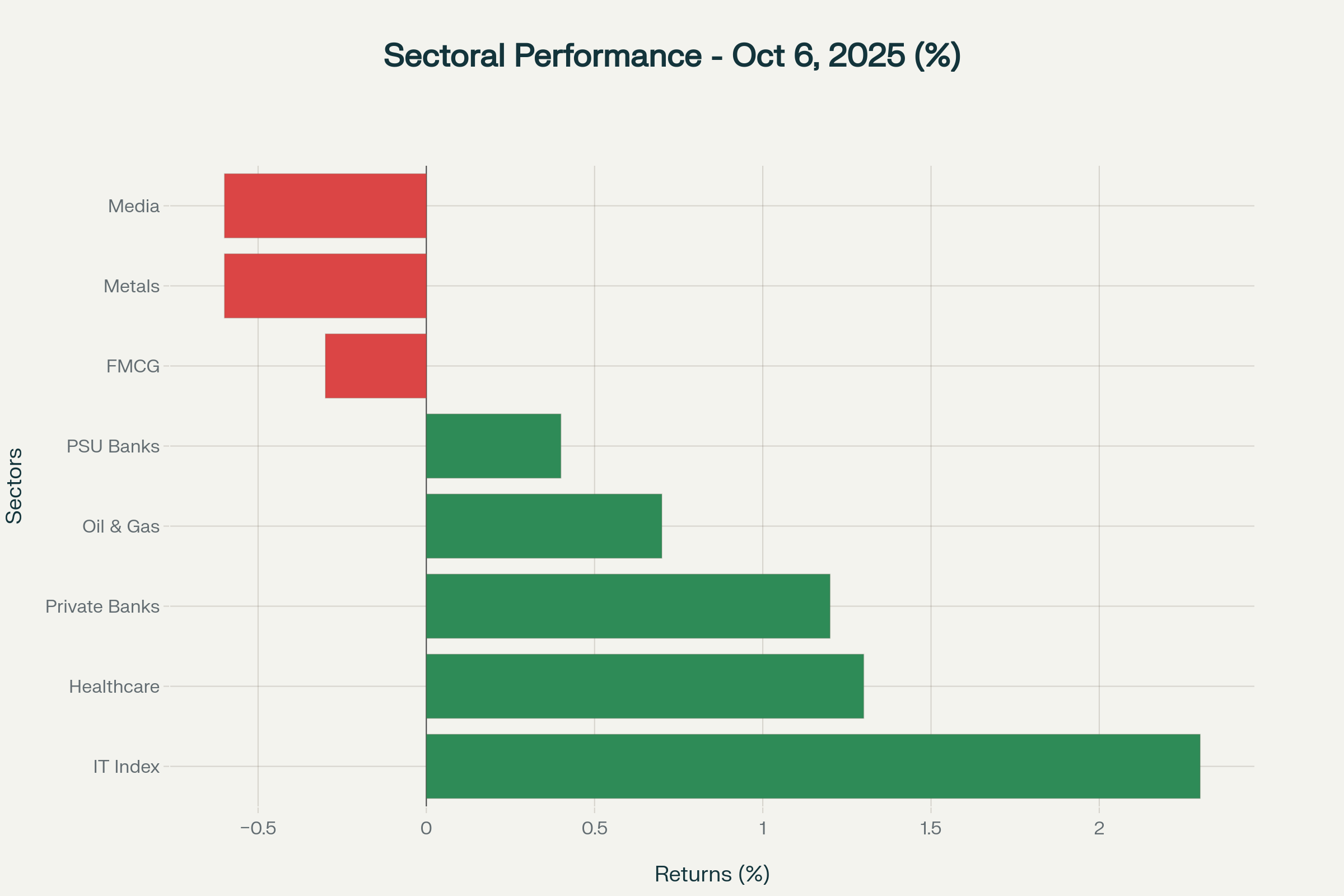

IT Sector Leading Recovery

The Information Technology sector emerged as Monday’s standout performer, with the Nifty IT index surging 2.3% and extending its three-session recovery to 3.2%. This rebound comes after earlier weakness tied to US labor market concerns and represents a significant shift in sentiment ahead of the upcoming quarterly earnings season.

Key IT gainers included TCS, Tech Mahindra, and mid-cap names like Coforge and Wipro, which outperformed larger peers. The sector’s recovery is attributed to expectations of stable IT spending and potential benefits from the weaker rupee.

Healthcare and Banking Momentum

Healthcare stocks continued their strong run, with the sector gaining 1.3% led by Max Healthcare, Apollo Hospitals, and Fortis Healthcare. The rally was supported by the government’s revision of Central Government Health Scheme (CGHS) rates, which is expected to improve realization for hospital operators.

The private banking sector gained 1.2%, with strong quarterly business updates from major lenders driving investor interest. Banks reported robust loan growth and improving asset quality metrics, supporting the sector’s outperformance.

Pressure on Traditional Sectors

Metal stocks faced headwinds with the sector declining 0.6%, led by Tata Steel’s 1.9% drop amid concerns over demand and commodity price volatility. Similarly, FMCG and media sectors showed modest declines, reflecting selective profit-taking after recent rallies.

Economic Data and Corporate Developments

Quarterly Business Updates

Several major corporations reported encouraging quarterly business updates that supported market sentiment:

Bank of India reported strong year-over-year growth metrics with global business expanding 11.8% to ₹15.61 lakh crore, global deposits rising 10.08%, and gross advances jumping 14% to ₹7.08 lakh crore.

Metropolis Healthcare delivered robust Q2 performance with consolidated revenue surging 23% year-over-year, driven by acquisitions and organic growth. The company maintained its debt-free status with a net cash surplus of ₹55 crore.

Policy and Regulatory Environment

The Reserve Bank of India’s recent monetary policy stance continues to support market sentiment, with the central bank maintaining the repo rate at 5.5% while adopting a neutral tone toward future policy moves. This balanced approach has provided confidence to both domestic and international investors about policy predictability.

Market Outlook and Trading Strategy

Near-term Technical Projections

The technical setup suggests that Nifty 50 is well-positioned for continued upside momentum, provided it maintains above the 25,000 support zone. A decisive close above 25,150 would signal extension of the current rally toward 25,400 levels, representing the trendline resistance connecting major highs from June and September 2025.

Bank Nifty appears even more constructive, with the potential to test 57,000 levels in the near term. The banking index’s strong fundamentals, supported by healthy credit growth and improving margins, provide a solid foundation for continued outperformance.

Risk Factors and Considerations

Despite the positive technical setup, several factors warrant caution. The persistent FII selling, while moderating, continues to create supply pressure that could limit upside momentum. Additionally, global uncertainties including the US government shutdown and geopolitical tensions in the Middle East could impact sentiment.

The elevated valuation metrics across several sectors, particularly in the broader market indices, suggest that any negative surprises could trigger sharp corrections. Investors should remain selective and focus on sectors with strong fundamental support.

Sector Allocation Strategy

Current market dynamics favor a barbell approach with exposure to both defensive sectors like IT and Healthcare, which offer stability and growth visibility, and cyclical sectors like Banking and Select Industrials that can benefit from domestic economic momentum.

The ongoing earnings season will be crucial in validating current valuations and providing direction for the next phase of market movement. Companies reporting strong Q2 results and providing positive guidance are likely to outperform, while those missing expectations may face significant pressure.

Conclusion and Day Trading Outlook

Tuesday’s trading session is expected to begin on a cautious note with GIFT Nifty indicating a flat opening near 25,153 levels. However, the underlying technical momentum remains constructive, supported by improving breadth indicators and sustained domestic institutional buying.

Key levels to monitor include immediate resistance at 25,100-25,150 and support at 25,000-25,018. A breakout above resistance could trigger fresh buying toward 25,250-25,300 levels, while a breach of support may lead to consolidation in the 24,900-25,100 range.

The session’s trajectory will likely be influenced by global cues, corporate earnings updates, and institutional flow patterns. With volatility remaining subdued as indicated by the low India VIX, trending moves are more likely than sharp reversals, favoring momentum-based strategies over contrarian positions.

Traders should remain alert to any developments regarding the US government shutdown resolution and Federal Reserve commentary, which could provide fresh directional cues for both global and domestic markets. The focus should remain on stock-specific opportunities in sectors showing strong fundamental and technical momentum while maintaining appropriate risk management protocols.

Disclaimer: This analysis is for informational purposes only and should not be construed as investment advice. Investors should conduct their own research and consult with financial advisors before making investment decisions. Past performance is not indicative of future results.

Analyst Name: Pradeep Suryavanshi

Bestmate Investment Services Pvt. Ltd.:

A-1-605, Ansal Corporate Park Sec-142, Noida 201305

CIN: U74999UP2016PTC143375

SEBI Registration Number: INH000015996

Website: www.bestmate.in I Email: info@bestmate.in

Download Full report :- nifty 7-10-2025

Disclaimer: Please read the Following very carefully:

“Investments in securities market are subject to market risks. Read all the related documents carefully before investing.”

- Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

- The fees are paid for research Report or Research recommendations and is not refundable or cancellable under any circumstances.

- We do not provide any guaranteed profit or fixed returns or any other services. We charge fixed fees and do not operate on any profit-sharing model.

- Images if any, shared with you are for illustration purposes only.

- We are not responsible for any financial loss or any other loss incurred by the client.

- Please be fully informed about the risk and costs involved in trading and investing. Please consult your investment advisor before trading. Trade only as per your risk appetite and risk profile.

- Trading/investing in stock market is risky due to its volatile nature. Upon accepting our service, you hereby accept that you fully understand the risks involved in trading/investing.

- We advise the viewers to apply own discretion while referring testimonials shared by the client. Past performances and results are no guarantee of future performance.

- All Report or recommendations shared are confidential and for the reference of paid members only. Any unapproved distribution of sensitive data will be considered as a breach of confidentiality and appropriate legal action shall be initiated.

- The Research Report or recommendations must not be used as a singular basis of any investment decision. The views do not consider the risk appetite or the particular circumstances of an individual investor; readers are requested to take professional advice before investing and trading. Our recommendations should not be construed as investment advice.

- In case of any query, please email on Info@bestmate.in be rest assured, our team will get back to you and resolve your query. Please state your registered phone number while mailing us.

- Reports based on technical and derivative analysis center on studying charts of a stock’s price movement, outstanding positions and trading volume, as opposed to focusing on a company’s fundamentals and, as such, may not match with a report on a company’s fundamentals.

Disclosure Document

The particulars given in this Disclosure Document have been prepared in accordance with SEBI(Research Analyst)Regulations,2014.The purpose of the Document is to provide essential information about the Research and recommendation Services in a manner to assist and enable the prospective client/clients in making an informed decision for engaging in Research and recommendation services before investing.For the purpose of this Disclosure Document, Research Analyst is Pradeep Suryavanshi Director, of Bestmate Investment Services Pvt Ltd (hereinafter referred as “Research Analyst”)

Business Activity: Research Analyst is registered with SEBI as Research Analyst with Registration No. INH000015996. The firm got its registration on and is engaged in research and recommendation Services. The focus of Research Analyst is to provide research and recommendations services to the clients. Analyst aligns its interests with those of the client and seeks to provide the best suited services.

Terms and conditions:

The Research report is issued to the registered clients. The Research Report is based on the facts, figures and information that are considered true, correct and reliable. The information is obtained from publicly available media or other sources believed to be reliable. The report is prepared solely for informational purpose and does not constitute an offer document or solicitation to buy or sell or subscribe for securities or other financial instruments for clients.

Disciplinary history:

- No penalties/directions have been issued by SEBI under the SEBI Act or Regulations made there under against the Research Analyst relating to Research Analyst services.

- There are no pending material litigations or legal proceedings, findings of inspections or investigations for which action has been taken or initiated by any regulatory authority against the Research Analyst or its employees.

Details of its associates:- No associates

Disclosures with respect to Research Reports and Research Recommendations Services

- The research analyst or research entity or his associate or his relative do not have financial interest in the subject company.

- The research analyst or its associates or relatives, do not have actual/beneficial ownership of one per cent or more securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance.

- The research analyst or his associate or his relative do not have any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

- The research analyst or its associates have not received any compensation from the subject company in the past twelve months.

- The research analyst or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months.

- The research analyst or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months.

- The subject company was not a client of Research Analyst or its employee or its associates during twelve months preceding the date of distribution of the research report and recommendation services provided.

- The research analyst or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months.

- The research analyst or its associates have not received any compensation or other benefits from the subject company or third party in connection with the research report.

- The research analyst has not been engaged in market making activity for the subject company.

- The research analyst has not served as an officer, director or employee of the subject company.

- The research analyst did not receive any compensation or other benefits from the companies mentioned in the documents or third party in connection with preparation of the research documents. Accordingly, research Analyst does not have any material conflict of interest at the time of publication of the research documents.