Tuesday Trading Day – Monthly Options Expiry + Fed Rate Decision: Markets Navigate Critical Session with Multiple Catalysts

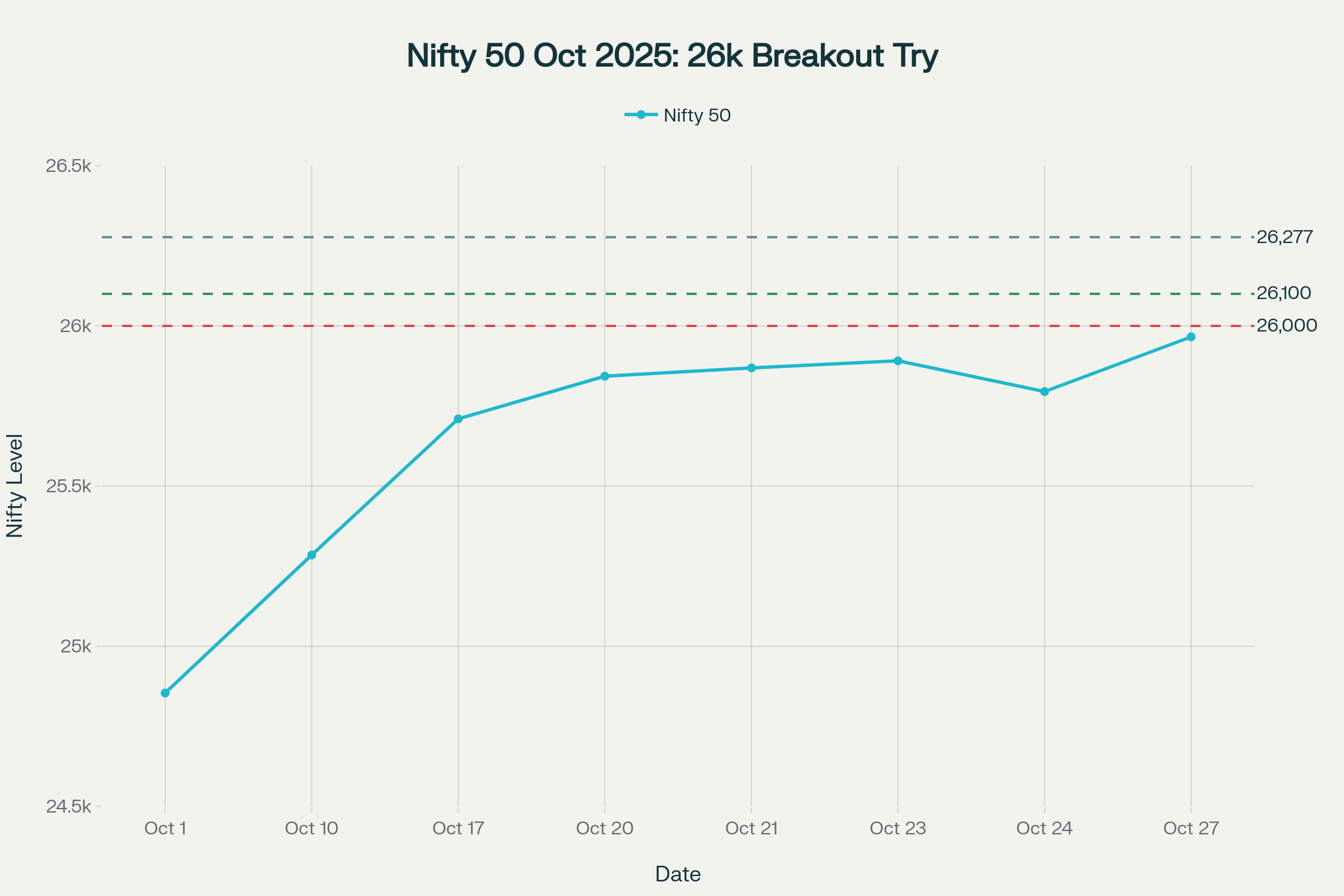

The Indian equity markets are poised for a cautiously positive start to Tuesday’s critical trading session, with GIFT Nifty indicating a marginal 0.06% gain at 26,050 levels, as traders prepare for the confluence of three major market-moving events: monthly options expiry, the commencement of the Federal Reserve’s two-day FOMC meeting, and a slew of major Q2FY26 earnings announcements. After Monday’s impressive rally that saw the Nifty 50 surge 170.90 points (0.66%) to close at 25,966.05 – just 34 points shy of the psychologically crucial 26,000 mark – bulls are positioned for what could be a historic breakout attempt.

Monday’s session marked a significant technical development as the Nifty touched an intraday high of 26,005.95 during the weekly options expiry, breaching the 26,000 level for the first time since September 2024, though it failed to sustain above this resistance. The Sensex rallied 566.96 points (0.67%) to 84,778.84, while Bank Nifty demonstrated exceptional strength with a 496-point (0.86%) surge to 58,196, underscoring the broad-based bullish momentum.

Monday’s Session Review: Bulls Storm 26,000 Barrier

Weekly Expiry Brings Volatility and Gains

Monday’s weekly options expiry session witnessed strong buying interest right from the opening bell, with the market opening marginally positive and consistently marching higher throughout the day. The Nifty formed a bullish candle pattern with a higher high and higher low, indicating sustained buying pressure and positive momentum heading into the critical monthly expiry.

Nifty 50 rallies 1,112 points (4.47%) in October, closing just 34 points below crucial 26,000 level

Nifty 50 rallies 1,112 points (4.47%) in October, closing just 34 points below crucial 26,000 levelThe technical significance of Monday’s price action cannot be understated. By touching 26,005.95 during intraday trade, the Nifty confirmed that bulls have the strength to challenge the 26,000 psychological barrier. However, the fact that not a single 5-minute candle managed to close above 26,000 suggests this level remains a formidable resistance that requires decisive breakout confirmation.

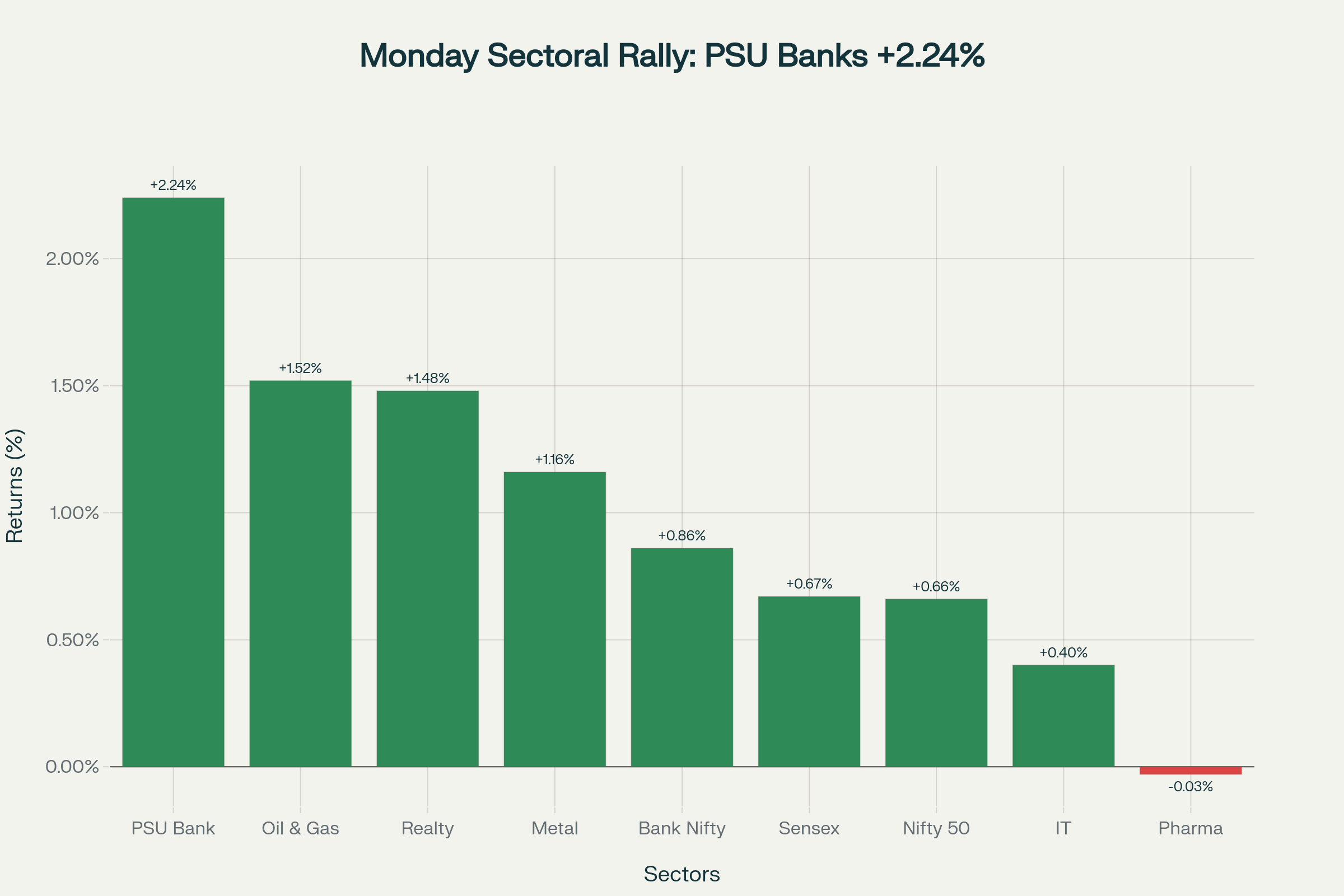

Sectoral Strength: PSU Banks Lead the Charge

Monday’s rally was characterized by exceptional sectoral participation, with the Nifty PSU Bank index emerging as the standout performer with a spectacular 2.24% surge. This outperformance was driven by strong quarterly earnings from State Bank of India and heightened FII interest in well-capitalized public sector banks trading at attractive valuations.

Broad-based rally on Monday with PSU Banks outperforming on strong earnings and FII interest

Broad-based rally on Monday with PSU Banks outperforming on strong earnings and FII interestOther cyclical sectors joined the rally, with Oil & Gas gaining 1.52%, Realty advancing 1.48%, and Metals rising 1.16%, reflecting growing confidence in the domestic economic recovery and infrastructure spending. Bank Nifty’s 0.86% gain, driven by leaders like State Bank of India (+2.02%), Kotak Mahindra Bank (+1.65%), and HDFC Bank (+0.52%), confirmed the financial sector’s continued strength.

Stock-Specific Action Reflects Sectoral Trends

Individual stock performance mirrored the sectoral leadership, with SBI Life Insurance Company topping the gainers’ list with a 3.44% surge, followed by Grasim Industries (+2.91%), Bharti Airtel (+2.50%), Reliance Industries (+2.24%), and State Bank of India (+2.02%). The strength in Reliance came from the company’s announcement of a strategic AI venture partnership with Meta, boosting investor confidence.

On the downside, pharmaceutical stocks faced profit-booking with Dr Reddy’s Laboratories declining 2.45%, Cipla falling 1.85%, and Sun Pharma dropping 1.68%. Defensive consumption names like Nestle (-1.28%), Asian Paints (-0.95%), and Britannia (-0.82%) also witnessed selling pressure as investors rotated into cyclical plays.

Institutional Flow Dynamics: Near-Neutral FII, Robust DII

FII Positioning Shows Mixed Signals

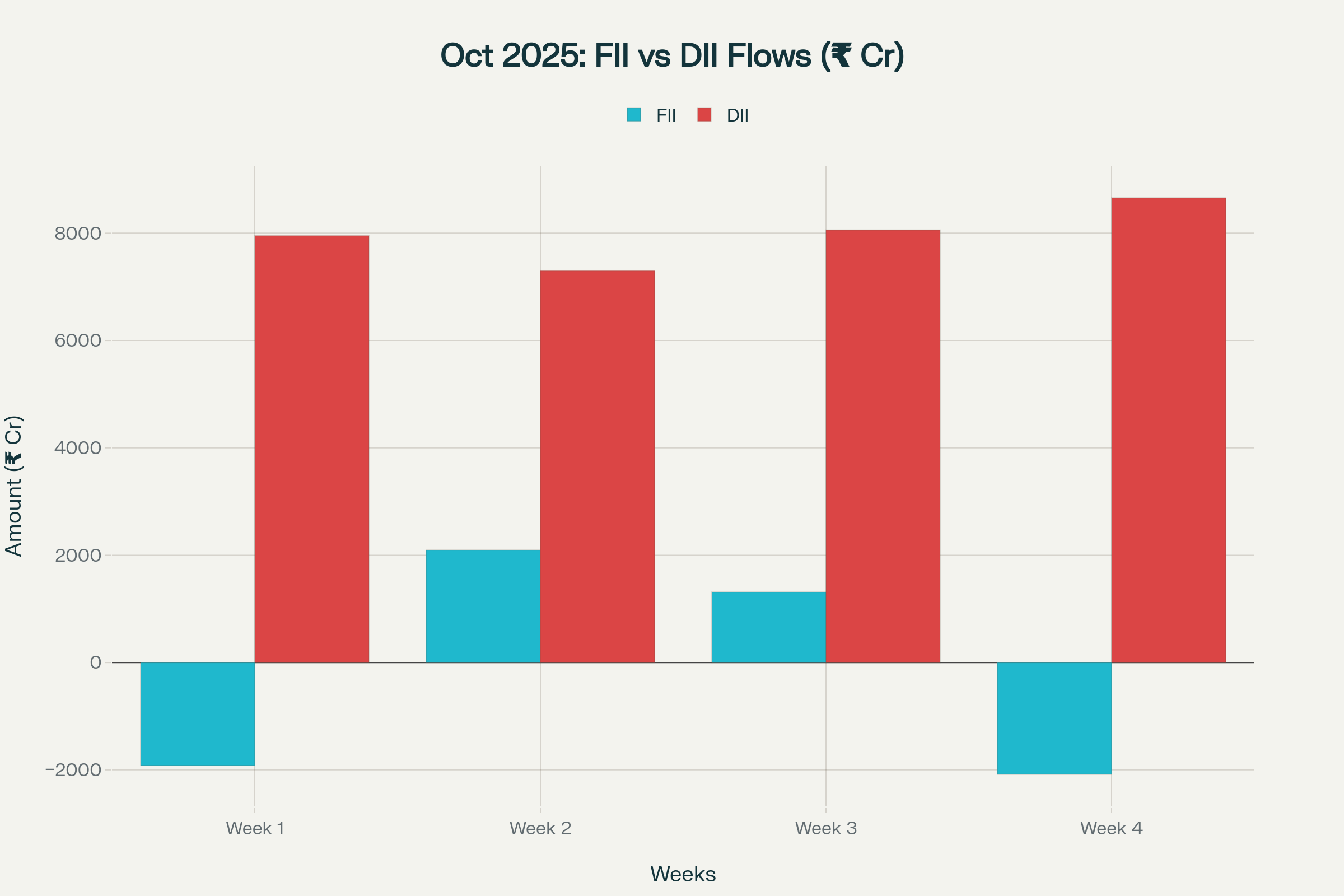

Monday witnessed modest FII selling of ₹55.58 crore, a marginal amount that suggests foreign investors are adopting a wait-and-watch approach ahead of the Fed decision rather than making aggressive directional bets. For October month-to-date, FIIs remain marginal net sellers at ₹536.58 crore, a dramatic improvement from the ₹1.96 lakh crore selling witnessed in FY2026 year-to-date through September.

More importantly, FII positioning in the derivatives segment continues to show improvement, with the long-short ratio maintaining at 28%, indicating that overseas fund managers are gradually turning bullish on Indian equities. This represents their most constructive stance since July 2025, signaling a potential end to the months-long selling spree.

DII Buying Remains Exceptional

Domestic Institutional Investors once again demonstrated their unwavering commitment with net purchases of ₹2,492.12 crore on Monday, marking one of the strongest single-day buying instances of the month. This brings the October month-to-date DII buying to an impressive ₹31,796.12 crore, providing the crucial foundation for the market’s 5.7% monthly rally.

DII buying of ₹31,796 crore in October offsets marginal FII selling of ₹537 crore

DII buying of ₹31,796 crore in October offsets marginal FII selling of ₹537 croreThe cumulative picture for October shows combined net institutional inflows of ₹31,259.54 crore despite marginal FII selling, highlighting the structural shift toward domestic-led markets. This DII dominance represents a fundamental change in Indian equity market dynamics and provides confidence that any pullback will find strong buying support.

Technical Analysis: 26,000 Breakout Imminent

Bullish Pattern Formation Strengthens

From a technical perspective, Monday’s price action was highly constructive, with the Nifty forming a long bullish candle that closed near the day’s high. The index has now created a series of higher highs and higher lows over the past four weeks, establishing a textbook uptrend structure that technical analysts view favorably for continued upside.

The Nifty 50 formed a bullish candle pattern with a higher high and higher low, indicating strong buying interest throughout the session. The index tested the psychological resistance of 26,000 multiple times during intraday trading. The option chain data reveals massive put writing at 25,900, indicating strong institutional support at this level”.

Key Technical Levels for October 28:

| Index | Monday Close | Expected Open | Immediate Support | Strong Support | Immediate Resistance | Strong Resistance | Breakout Target |

|---|---|---|---|---|---|---|---|

| Nifty 50 | 25,966 | 26,000 | 25,900 | 25,800 | 26,050 | 26,100 | 26,200 |

| Bank Nifty | 58,196 | 58,200 | 58,000 | 57,800 | 58,400 | 58,500 | 58,700 |

| Sensex | 84,779 | 84,850 | 84,500 | 84,200 | 85,000 | 85,200 | 85,500 |

The 26,000-26,100 zone represents the critical resistance band that bulls must conquer for the uptrend to continue toward all-time highs of 26,277.35. A sustained move above 26,100 levels will open up further upside towards 26,300 & 26,500 levels in the coming sessions. Failure to do so will lead to extension of consolidation in the range of 26,100-25,600″.

On the downside, the 25,900-25,700 zone has emerged as strong support, backed by heavy put writing and the 38.2% Fibonacci retracement of the October rally. We suggest that any dips toward this range should be viewed as buying opportunities given the intact bullish trend structure.

Bank Nifty Eyes 58,500 Breakout

Bank Nifty’s momentum appears even stronger than the broader market, with the index positioned to challenge the 58,500 level that represents a breakout point for further upside toward 59,000 and beyond. The banking index has been a consistent outperformer through October, gaining 0.63% despite the broader market’s consolidation phases.

Derivative Market Analysis: Expiry Day Dynamics

Options Data Signals Bullish Shift

The derivatives market data ahead of Tuesday’s monthly expiry reveals interesting developments that support the bullish case. The Nifty Put-Call Ratio (PCR) improved to 0.92 from 0.88, indicating increased confidence among options traders. More significantly, the Bank Nifty PCR jumped to 1.15 from 1.02, reflecting very bullish positioning in the banking sector.

Call Unwinding at 26,000 Suggests Breakout Potential

One of the most significant developments is the heavy unwinding of call options at the 26,000 strike, with 58,523 contracts being unwound on Monday. This call unwinding suggests that bears who had written calls expecting the index to remain below 26,000 are now covering their positions, reducing resistance at this psychological level and potentially paving the way for a breakout.

On the put side, maximum open interest has shifted upward from 25,500 PE to 25,900 PE, indicating that the support base has moved 400 points higher – a classic technical signal of a strengthening uptrend. Strong put writing continues at 25,900 levels, with the option chain data revealing this as a critical institutional support zone.

November Series Indicates Higher Targets

Looking ahead to the November series, the maximum call open interest at 26,500 CE and maximum put open interest at 25,500 PE define the expected trading range for the coming month. This 1,000-point range (25,500-26,500) suggests that the market anticipates continued upside momentum with solid support established well above October lows.

The India VIX declined marginally to 11.56, remaining at historically low levels despite the monthly expiry, which typically brings heightened volatility. This subdued volatility environment favors trending moves rather than choppy consolidation, supporting the case for continued directional momentum.

Global Market Landscape: Fed Decision Takes Center Stage

FOMC Meeting Begins: Rate Cut Virtually Certain

The Federal Reserve’s two-day FOMC meeting begins Tuesday, with the policy decision and Chair Jerome Powell’s press conference scheduled for Wednesday. Markets have priced in a 25 basis point rate cut with near 100% certainty, which would mark the continuation of the Fed’s easing cycle that began in September.

The softening US inflation data – with PCE inflation at 3.0% year-over-year versus expectations of 3.1% – has bolstered confidence in the Fed’s ability to cut rates without reigniting inflationary pressures. However, the ongoing US government shutdown, now stretching into its 26th day, means several important economic data releases (including Q3 GDP advance estimates) will be delayed, adding uncertainty.

Global Markets Provide Modest Support

Global equity markets demonstrated resilience Monday evening and Tuesday morning, with Asian markets opening with broad-based gains. Japan’s Nikkei 225 rose 0.12%, Hong Kong’s Hang Seng advanced 0.16%, and Shanghai Composite gained 0.18%, reflecting optimism surrounding the scheduled October 30 meeting between US President Trump and Chinese President Xi Jinping in South Korea.

| Market | Monday Close | Tuesday Indication | Change (%) | Impact |

|---|---|---|---|---|

| GIFT Nifty | 26,035 | 26,050 | +0.06 | Flat to Positive |

| S&P 500 | 6,775 | 6,782 | +0.10 | Neutral |

| Nasdaq | 23,143 | 23,168 | +0.11 | Neutral Positive |

| Hang Seng | 26,542 | 26,586 | +0.16 | Positive |

| Gold ($/oz) | 4,018 | 4,011.20 | -0.20 | Bullish |

The Indian rupee traded marginally firmer at 88.20 levels, supported by strong domestic market fundamentals and steady foreign exchange reserves.

Crude oil prices declined to $57.72 per barrel, continuing their downward trajectory on concerns about global demand and potential OPEC+ production increases. The falling crude provides significant relief to India’s import bill and supports the broader economy by reducing inflationary pressures.

Week Ahead: Critical Events Converge

Tuesday: Monthly Expiry and Major IT Earnings

Tuesday’s session will be dominated by three major catalysts:

-

Monthly Options Expiry: October contracts across Nifty, Bank Nifty, FinNifty, and Midcap indices expire, typically bringing heightened intraday volatility

-

FOMC Meeting Day 1: Fed meeting begins with intense focus on Wednesday’s decision

-

Major IT Earnings: Wipro, LTIMindtree, SAIL, and HCL Technologies report Q2 results

The IT sector earnings will be closely watched for commentary on demand environment, client spending patterns, and guidance for H2FY26. Any positive surprises could trigger further sector rotation into technology stocks.

Wednesday-Thursday: Fed Decision and Global Policy

Wednesday brings the most critical event of the week – the Fed’s rate decision at 11:30 PM IST followed by Chair Powell’s press conference. The market will focus not just on the expected 25 bps cut but on forward guidance regarding the pace of future cuts and assessment of the economic outlook.

Thursday features the European Central Bank’s rate decision (expected to hold at 2.00%) and the highly anticipated meeting between Presidents Trump and Xi Jinping in South Korea. Any progress on US-China trade relations could provide significant positive catalyst for global markets.

Friday: Multiple Data Points

Friday concludes the week with the Bank of Japan’s rate decision, Eurozone GDP data, and India’s fiscal deficit numbers for September. Additionally, October auto sales data from major manufacturers will start flowing, providing insights into festive season demand.

Market Strategy and Trading Recommendations

Bullish Strategy for Expiry Day

Given the technical setup and derivative market signals, analysts recommend a cautiously bullish approach for Tuesday’s monthly expiry:

-

For Breakout Traders: Wait for decisive close above 26,050 before initiating fresh long positions

-

For Dip Buyers: Use any decline toward 25,900-25,850 as accumulation opportunity

-

For Expiry Traders: Avoid aggressive positions; let first hour establish the trend

-

Stop Loss: Maintain strict stops below 25,850 for all long positions

Sectoral Rotation Strategy

Overweight Positions:

-

PSU Banks: Outperformance likely to continue given strong earnings and attractive valuations

-

Private Banks: Quality large-cap names with reasonable valuations and strong franchises

-

Oil & Gas: Falling crude prices benefit OMCs; upstream companies provide dividends

-

Metals: Chinese stimulus hopes and improved global demand outlook

-

IT Services (Selective): Trade deal optimism and defensive characteristics

Neutral/Selective:

-

FMCG: Volume recovery underway but valuations stretched after recent rally

-

Auto: Await October sales data for direction; two-wheelers preferred

-

Realty: Profit-booking likely after sharp gains; interest rate sensitivity remains

-

Capital Goods: Government capex support but near-term overbought

Underweight/Avoid:

-

Pharmaceuticals: Facing headwinds; profit-booking after recent underperformance

-

Mid-tier IT: Margin pressure and weak demand environment

-

Small & Midcaps: Vulnerable to volatility during Fed decision and expiry

Risk Factors and Monitoring Points

Key Risks to Watch:

-

Monthly Expiry Volatility: Large option positions create potential for sharp intraday swings

-

Fed Hawkish Surprise: Any indication of slower pace of cuts could trigger global selloff

-

Technical Failure: Inability to sustain above 26,000 could lead to correction to 25,700

-

Earnings Disappointments: High expectations from IT sector; misses could pressure stocks

-

US Government Shutdown: Prolonged impasse could impact economic data and sentiment

-

Global Geopolitical Risks: US-China meeting outcome; Middle East tensions

Positive Catalysts:

-

26,000 Breakout: Decisive close above resistance unlocks targets toward 26,277 ATH

-

Fed Rate Cut: Continuation of easing cycle globally supportive for equities

-

DII Support: Unprecedented domestic buying provides strong safety net

-

FII Positioning: Gradual shift from net short to net long suggests improved sentiment

-

Strong Earnings: Q2 results from banking and cyclical sectors building confidence

-

Trade Deal Progress: US-China and India-US negotiations could unlock significant upside

Conclusion: Historic Breakout Within Reach

As Indian equity markets enter Tuesday’s critical session combining monthly expiry with the commencement of the Fed’s FOMC meeting, bulls stand at the threshold of a potentially historic breakout above the 26,000 psychological barrier that has proven elusive for over a month. Monday’s strong rally that touched 26,006 intraday demonstrates that bulls have the firepower to challenge this resistance, though decisive breakout confirmation remains pending.

The technical setup appears increasingly constructive, with the Nifty forming a series of higher highs and higher lows, heavy call unwinding at 26,000 reducing resistance, and strong put writing at 25,900 establishing robust support. The derivatives market data suggests that a sustained move above 26,100 could trigger momentum-driven buying toward the 26,200-26,300 targets, potentially paving the way for an assault on the all-time high of 26,277.

The institutional flow picture provides confidence, with DII buying of ₹31,796 crore in October offsetting marginal FII selling and creating a solid foundation for continued market strength. The gradual improvement in FII positioning from net short to 28% net long in derivatives suggests that the worst of foreign selling may be behind us, potentially setting the stage for renewed inflows.

However, investors must navigate Tuesday’s session with appropriate caution given the monthly expiry dynamics that can create sharp intraday volatility. The key is to await confirmation of the 26,000 breakout through a decisive close above 26,050 rather than chasing the opening gap. Any dips toward 25,900-25,850 should be viewed as tactical buying opportunities given the intact bullish trend structure.

As we await Wednesday’s Fed decision and the flurry of earnings announcements this week, the Indian market’s ability to sustain above 26,000 will determine whether we’re witnessing the beginning of the next leg toward all-time highs or merely another failed breakout attempt requiring consolidation. The stage is set for a potentially historic week in Indian equities.

Disclaimer: This analysis is for informational purposes only and should not be construed as investment advice. Monthly options expiry and FOMC meetings can lead to heightened volatility. Investment decisions should be based on thorough fundamental and technical analysis. Investors should consult with qualified financial advisors before making investment decisions.

Analyst Name: Pradeep Suryavanshi

Bestmate Investment Services Pvt. Ltd.:

A-1-605, Ansal Corporate Park Sec-142, Noida 201305

CIN: U74999UP2016PTC143375

SEBI Registration Number: INH000015996

Website: www.bestmate.in I Email: info@bestmate.in

Download Report :- Nifty OL 28-10-2025

Disclaimer: Please read the Following very carefully:

“Investments in securities market are subject to market risks. Read all the related documents carefully before investing.”

- Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

- The fees are paid for research Report or Research recommendations and is not refundable or cancellable under any circumstances.

- We do not provide any guaranteed profit or fixed returns or any other services. We charge fixed fees and do not operate on any profit-sharing model.

- Images if any, shared with you are for illustration purposes only.

- We are not responsible for any financial loss or any other loss incurred by the client.

- Please be fully informed about the risk and costs involved in trading and investing. Please consult your investment advisor before trading. Trade only as per your risk appetite and risk profile.

- Trading/investing in stock market is risky due to its volatile nature. Upon accepting our service, you hereby accept that you fully understand the risks involved in trading/investing.

- We advise the viewers to apply own discretion while referring testimonials shared by the client. Past performances and results are no guarantee of future performance.

- All Report or recommendations shared are confidential and for the reference of paid members only. Any unapproved distribution of sensitive data will be considered as a breach of confidentiality and appropriate legal action shall be initiated.

- The Research Report or recommendations must not be used as a singular basis of any investment decision. The views do not consider the risk appetite or the particular circumstances of an individual investor; readers are requested to take professional advice before investing and trading. Our recommendations should not be construed as investment advice.

- In case of any query, please email on Info@bestmate.in be rest assured, our team will get back to you and resolve your query. Please state your registered phone number while mailing us.

- Reports based on technical and derivative analysis center on studying charts of a stock’s price movement, outstanding positions and trading volume, as opposed to focusing on a company’s fundamentals and, as such, may not match with a report on a company’s fundamentals.

Disclosure Document

The particulars given in this Disclosure Document have been prepared in accordance with SEBI(Research Analyst)Regulations,2014.The purpose of the Document is to provide essential information about the Research and recommendation Services in a manner to assist and enable the prospective client/clients in making an informed decision for engaging in Research and recommendation services before investing.For the purpose of this Disclosure Document, Research Analyst is Pradeep Suryavanshi Director, of Bestmate Investment Services Pvt Ltd (hereinafter referred as “Research Analyst”)

Business Activity: Research Analyst is registered with SEBI as Research Analyst with Registration No. INH000015996. The firm got its registration on and is engaged in research and recommendation Services. The focus of Research Analyst is to provide research and recommendations services to the clients. Analyst aligns its interests with those of the client and seeks to provide the best suited services.

Terms and conditions:

The Research report is issued to the registered clients. The Research Report is based on the facts, figures and information that are considered true, correct and reliable. The information is obtained from publicly available media or other sources believed to be reliable. The report is prepared solely for informational purpose and does not constitute an offer document or solicitation to buy or sell or subscribe for securities or other financial instruments for clients.

Disciplinary history:

- No penalties/directions have been issued by SEBI under the SEBI Act or Regulations made there under against the Research Analyst relating to Research Analyst services.

- There are no pending material litigations or legal proceedings, findings of inspections or investigations for which action has been taken or initiated by any regulatory authority against the Research Analyst or its employees.

Details of its associates:- No associates

Disclosures with respect to Research Reports and Research Recommendations Services

- The research analyst or research entity or his associate or his relative do not have financial interest in the subject company.

- The research analyst or its associates or relatives, do not have actual/beneficial ownership of one per cent or more securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance.

- The research analyst or his associate or his relative do not have any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

- The research analyst or its associates have not received any compensation from the subject company in the past twelve months.

- The research analyst or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months.

- The research analyst or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months.

- The subject company was not a client of Research Analyst or its employee or its associates during twelve months preceding the date of distribution of the research report and recommendation services provided.

- The research analyst or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months.

- The research analyst or its associates have not received any compensation or other benefits from the subject company or third party in connection with the research report.

- The research analyst has not been engaged in market making activity for the subject company.

- The research analyst has not served as an officer, director or employee of the subject company.

- The research analyst did not receive any compensation or other benefits from the companies mentioned in the documents or third party in connection with preparation of the research documents. Accordingly, research Analyst does not have any material conflict of interest at the time of publication of the research documents.