Indian equity markets are positioned for a cautious to slightly positive opening on Tuesday, November 18, as investors build on Monday’s impressive sixth consecutive session of gains that saw the Nifty 50 break decisively above the 26,000 psychological barrier and close at 26,013.45, the Sensex advance 388.17 points or 0.46% to 84,950.95, and the Bank Nifty surge 0.76% to 58,962.70 after touching an all-time record high of 59,001.55. With GIFT Nifty futures suggesting a flat to slightly negative start at approximately 26,006 levels (down 54 points from Monday’s close), the overall bias is expected to be neutral to slightly negative this morning, though the underlying trend remains bullish given the confluence of India-US trade deal optimism, NDA’s decisive Bihar election victory confirmation, and a dramatic FII reversal to net buying of ₹442.17 crores on Monday.

Market Performance Recap: Monday’s Breakthrough Above 26,000 Validates Recovery Rally

Monday’s trading session on November 17 witnessed a powerful continuation of the recovery rally that began earlier last week, with Indian benchmarks extending their winning streak to six consecutive sessions and achieving critical technical breakthroughs that had been questioned just days ago. The Nifty 50 gained 103.40 points or 0.40% to close at 26,013.45, decisively breaking and holding above the psychologically crucial 26,000 level for the first time since October 29, providing strong technical confirmation that the correction from October highs is concluding.

The BSE Sensex delivered even stronger performance, advancing 388.17 points or 0.46% to 84,950.95, as broad-based sector participation drove the index higher. The index has recovered approximately 1,461 points or 1.74% from its recent lows, validating the domestic institutional support theory.

The Nifty Bank index demonstrated exceptional strength, surging 0.76% to 58,962.70 while achieving a fresh all-time intraday high of 59,001.55, breaking above the previous record of 58,615.95 set on November 12. This all-time high in Bank Nifty is of particular significance as it validates the health of the broader market, with banking sector strength typically preceding broad-based rallies.

Broader indices outperformed with the Nifty Midcap 100 reaching a fresh record high of 61,211.05 (gaining 0.78%), and the Nifty Smallcap 100 advancing 0.73%, indicating that the recovery is now broad-based rather than concentrated in large-caps. This broadening of participation is a critically positive technical development.

The India VIX surged 5.67% to 12.43, an increase from Friday’s 11.94, reflecting the higher volatility associated with the large intraday moves and breakouts. While the VIX increase might normally suggest caution, it must be interpreted in the context of breakouts where short-covering rallies drive higher volatility.

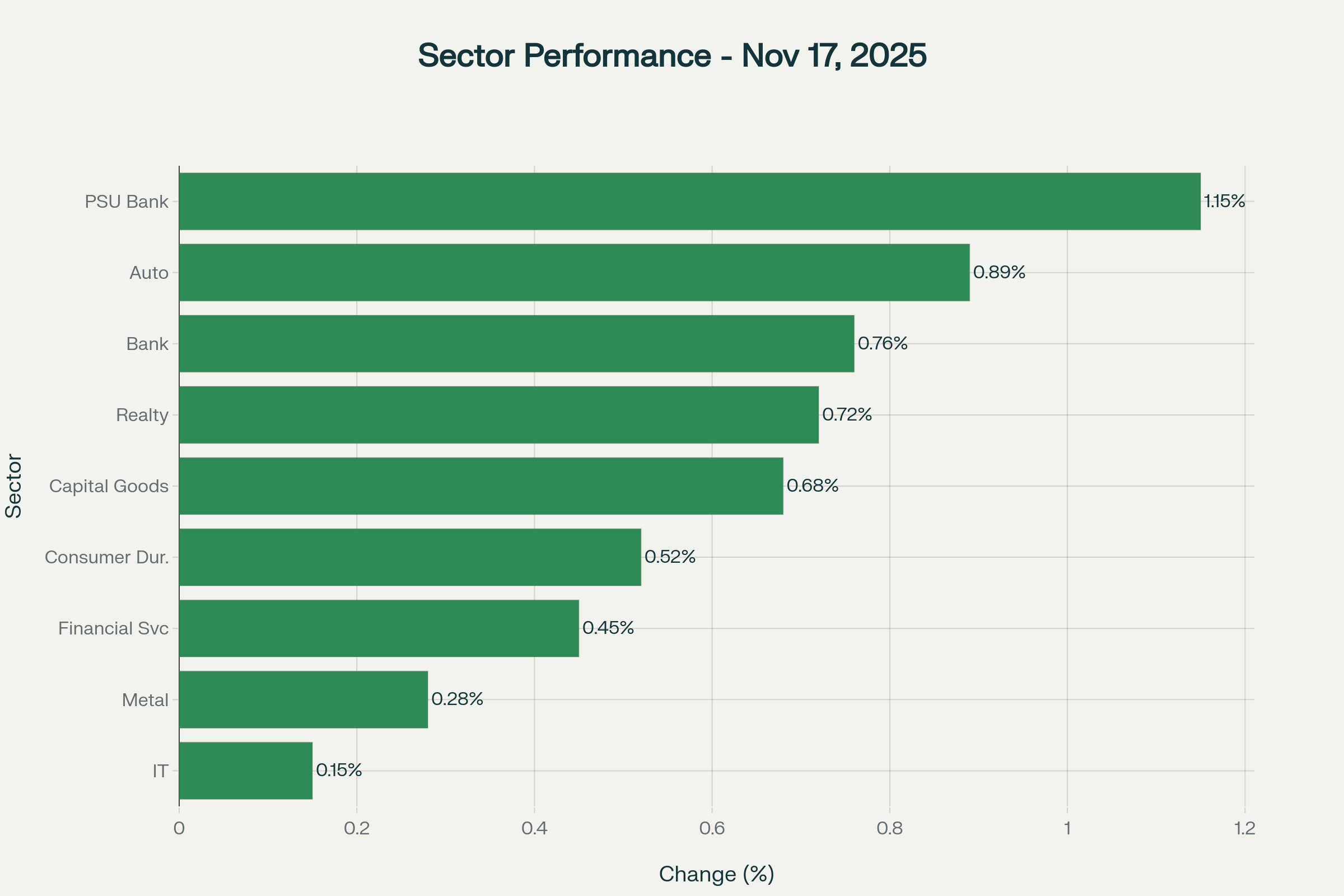

Market breadth remained positive, with all major sectoral indices closing in green. Notably, PSU Bank stocks led the charge with gains of over 1%, reflecting optimism about RBI rate cuts benefiting PSU bank profitability and the bank sector’s momentum. Auto, Bank, Realty, Capital Goods, and Consumer Durables all advanced between 0.5-1%, signaling broad-based strength.

Technical Analysis: Nifty Breakthrough Above 26,000 Validates Bull Case, 26,300 Now in Play

From a technical perspective, Monday’s close at 26,013.45 represents a decisive breakthrough above the 26,000 psychological level that had been acting as both a resistance zone and a psychological barrier for investors. the daily chart formation now shows a bullish candle with higher highs and higher lows, the hallmark of a strong uptrend that is likely to continue.

Crucially, the index is now trading well above all key moving averages, including the 20-day EMA, 50-day EMA, and 200-day SMA, indicating that the intermediate-term trend has shifted decisively to bullish. The technical consensus from Moneycontrol’s analysis notes that the short- and medium-term moving averages have also turned upward, further reinforcing the positive technical structure.

Technical indicators have turned decisively bullish:

-

RSI at 65.12 shows strong momentum without yet entering overbought territory.

-

Stochastic RSI maintains a bullish crossover.

-

MACD is on the verge of a positive crossover, with its histogram moving closer to the zero line.

On the upside, the immediate resistance at 26,100 (the October high and previous pivot point) must be breached to extend the rally toward 26,300 (near the record high of 26,277). if momentum sustains, the Nifty could potentially reach the 26,300 level, which represents the confluence of the October all-time high and the 138.2% Fibonacci extension of recent rallies.

On the support side, the 25,800-25,850 zone has now shifted to become immediate support, attracting buyers on any pullback. More substantial support exists at 25,700, coinciding with the 50-day EMA and representing a key accumulation zone.

The Bank Nifty all-time high at 59,001.55 is particularly noteworthy technically, as it represents a clean breakout from the recent consolidation zone, confirming renewed bullish momentum in the banking sector. The index remains a “buy-on-dip” candidate as long as it sustains above 58,000, where its 20-day exponential moving average is positioned. The immediate resistance is around 59,300-59,500, with potential to reach 59,850 if momentum extends.

Derivative Market Signals: Options Data Support 26,100-26,300 Rally

The derivatives segment reveals options traders are pricing in continued upside toward 26,100-26,300 with the recent breakout providing confirmation. According to Spider Software India’s options analysis, the highest call writing at 26,000 (1.5 crore contracts) suggests strong resistance near current levels, though call writing at higher strikes is thinner, suggesting that a breakout could accelerate.

The highest put writing at 25,900 (1.5 crore contracts) firmly establishes this level as the support zone where option writers expect buyers to step in on dips. This options configuration supports the technical view that the index is likely to consolidate in the 25,900-26,100 range before the next breakout toward 26,300.

For Bank Nifty, options data shows maximum call writing at 58,900 (12.5 lakh contracts) and put writing at 58,600 (19.1 lakh contracts), supporting the technical view that the index will consolidate near current levels before testing 59,300-59,500.

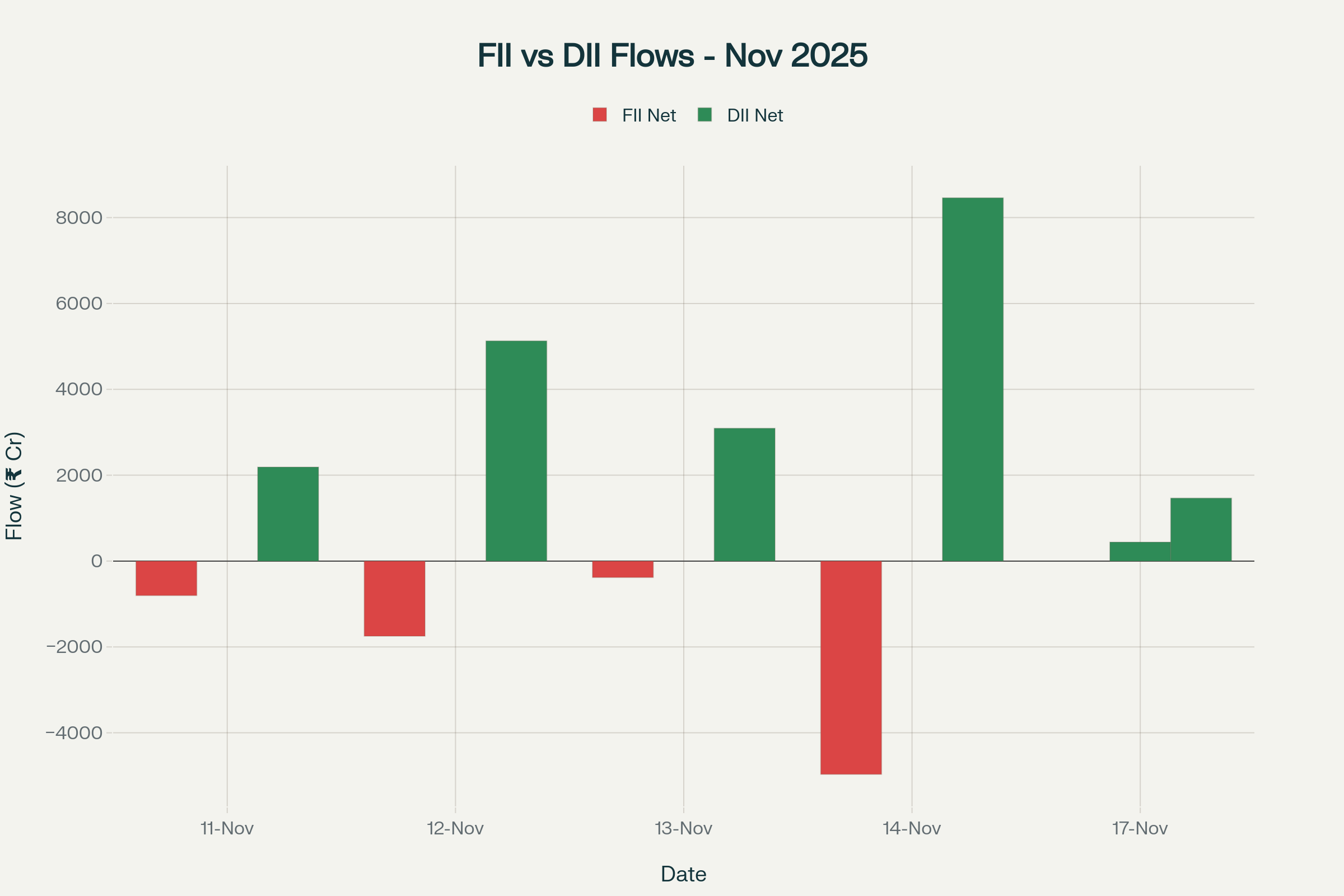

Institutional Flow Dynamics: FIIs Turn Buyers, DIIs Maintain Support

The most significant development on Monday was the dramatic reversal in FII sentiment, with FIIs becoming net buyers to the tune of ₹442.17 crores—the first net buying day of the week and a marked reversal from the prior session’s ₹4,968.22 crore selling. FIIs purchased shares worth ₹13,339.02 crores and sold ₹12,896.85 crores, indicating that foreign investors may be reversing their cautious stance in response to India-US trade deal optimism, NDA political stability confirmation, and attractive valuations after the recent correction.

This FII reversal is particularly important because it suggests that global macro headwinds that dominated last week may be moderating, or that foreign investors are viewing Indian equities as attractive opportunities for accumulation.

Domestic Institutional Investors continued their consistent support, with net purchases of ₹1,465.86 crores on Monday, bringing their cumulative November inflows to approximately ₹51,884.99 crores through November 17. DIIs have been the critical pillar supporting the market throughout November’s volatility.

For the month of November through November 17, FIIs are cumulative net sellers of ₹18,170.64 crores (a notable improvement from the ₹18,620.66 crore selling through November 14), while DIIs have been robust net buyers with cumulative inflows of ₹51,884.99 crores, representing a ₹70,055 crore differential. This massive divergence continues to underscore the critical role of domestic institutions in anchoring the market.

FII vs DII net flows showing FII turning net buyers on Nov 17 after persistent selling, while DIIs maintained consistent buying throughout

FII vs DII net flows showing FII turning net buyers on Nov 17 after persistent selling, while DIIs maintained consistent buying throughoutSectoral Performance: Broad-Based Gains with PSU Banks Leading Charge

Monday’s session witnessed exceptional broad-based sectoral strength, with all major sectors closing in positive territory for the first time in several sessions. This broad-based participation is a very positive technical development indicating that the recovery is becoming inclusive rather than concentrated.

The Nifty PSU Bank Index led sectoral gainers, advancing 1.15%, reflecting renewed optimism about RBI rate cuts and improved PSU bank profitability. The PSU bank leadership is particularly significant as it suggests domestic investors are positioning for lower rates and credit cycle improvement.

The Nifty Auto Index advanced 0.89%, driven by gains in Bajaj Auto (+2.15%), Eicher Motors (+1.52%), and Maruti Suzuki (+1.23%). Auto sector strength reflects expectations of improving rural demand and moderating interest rates supporting auto financing.

The Nifty Bank Index climbed 0.76%, driven by the strength in banking stocks mentioned earlier. The Nifty Realty Index gained 0.72%, benefiting from rate cut expectations that would support real estate financing and property valuations.

The Nifty Capital Goods Index advanced 0.68% and Consumer Durables gained 0.52%, reflecting broad-based positive sentiment across growth-oriented sectors.

Financial Services advanced 0.45%, while the Nifty Metal Index gained just 0.28% and IT index advanced only 0.15%, reflecting that gains are being driven by rate-sensitive sectors rather than by globally-exposed IT stocks.

Among individual stocks, Tata Consumer Products surged 1.85% and Max Healthcare advanced 1.48% among top gainers, while TMPV (Tata Motors Passenger Vehicles) fell 1.87% and Adani Enterprises declined 1.52% among top losers.

Sector-wise performance showing broad-based gains with PSU banks leading and all sectors ending in positive territory

Sector-wise performance showing broad-based gains with PSU banks leading and all sectors ending in positive territoryGlobal Market Cues: US Rate Cut Uncertainty Weighs, But India Decoupling Evident

The global market environment remains decidedly negative, with U.S. equities under pressure from Fed rate cut uncertainty and elevated tech valuations, though India’s decoupling from this weakness is becoming increasingly evident. U.S. markets closed sharply lower:

-

Dow Jones fell 1.20% to 46,607.48

-

S&P 500 declined 0.87% to 6,661.79

-

Nasdaq dropped 1.16% to 22,637.50

The weakness reflects investor caution ahead of delayed economic data releases including the November jobs report, which had been delayed due to the government shutdown. According to MUFG Research, global markets retained a “modest risk-off mode” ahead of key economic data like non-farm payrolls, with uncertainties around AI valuations also weighing on sentiment.

Asian markets participated in the global weakness:

-

Japan’s Nikkei fell 0.94% to 50,323.91

-

Hong Kong’s Hang Seng declined 1.02% to 26,384.28

-

Shanghai Composite edged down 0.12% to 3,972.03

However, India’s strong outperformance against global weakness is noteworthy, suggesting that domestic factors (NDA victory, trade deal hopes, rate cut expectations) are outweighing global headwinds.

The U.S. Dollar Index remained near 88.625, essentially flat. Against the Indian rupee, the USD/INR traded around 88.625, virtually unchanged from Friday’s levels. The rupee’s stability despite global weakness provides some support for Indian equities.

Crude oil prices stabilized around $63.93 per barrel for WTI and $64.22 for Brent, representing consolidation after the sharp multi-day weakness. For India, stable crude prices continue to provide relief on the import bill.

Gold remained consolidated around ₹78,350 per 10 grams, with the precious metal finding support from safe-haven demand amid global uncertainty. Silver traded near ₹91,750 per kg in a consolidation pattern.

Market Outlook for November 18: Consolidation Expected Near 26,000-26,100

Looking ahead to Tuesday’s trading session, market participants should prepare for a cautious opening with GIFT Nifty futures trading flat to slightly lower at 26,006 levels (down 54 points). The overall bias is expected to be neutral to slightly negative this morning, likely driven by profit-taking after the strong six-day rally and global market weakness overnight.

The Nifty 50 is likely to consolidate in the 25,950-26,100 range during the session, with traders potentially taking profits near 26,100 while watching for any attempts to break above this level toward 26,300. The critical support at 25,850-25,900 should provide a floor for any intraday weakness.

For the Bank Nifty, the index should target the 59,300-59,500 resistance zone, with support remaining at 58,600-58,000.

Several critical catalysts warrant monitoring during Tuesday’s session:

-

U.S. delayed economic data releases, particularly the November jobs report due Thursday that will have significant implications for Fed rate cut expectations

-

India-US trade negotiations progress and any announcements regarding tariff resolution

-

Corporate earnings announcements from companies including Tata Power, TVS Motor, Emcure Pharma, AstraZeneca Pharma, and JSW Energy

-

RBI monetary policy signals ahead of the December MPC meeting, particularly regarding rate cut timing

-

Crude oil price movements and OPEC+ commentary about production and market balance

Trading Strategy and Risk Management Framework

Given the strong technical breakout confirmed on Monday, broad-based sectoral strength, and positive institutional flow reversal by FIIs, a cautiously bullish approach appears warranted for Tuesday’s session, though traders should take profits on strength and maintain strict risk management.

For Nifty traders: The immediate strategy should be to defend 25,850-25,900 support with a minimum stop-loss at 25,750. Traders who did not participate in the rally should wait for pullbacks toward 25,950-26,000 before initiating fresh long positions, with targets of 26,100-26,300 over a 3-5 session timeframe.

Profit-taking near 26,100 appears prudent after the powerful rally, with traders potentially reducing exposure and taking partial profits to lock in gains.

Swing traders can use any dips toward 25,900-25,950 as buying opportunities, with stops below 25,750 and targets at 26,300-26,400.

Options strategies should focus on call spreads (buying 26,100 call, selling 26,300 call) to participate in controlled breakout moves. Put selling at 25,900 strike continues to offer attractive risk-reward given the strong support.

Sector allocation should maintain exposure to PSU banks, auto, realty, and capital goods that demonstrated strength on Monday, while being cautious about profit-taking in IT stocks that lagged.

Conclusion

As Indian markets open on November 18, 2025, investors navigate a particularly constructive backdrop where domestic catalysts (NDA victory confirmation, FII buying reversal, trade deal optimism, rate cut expectations) are decisively outweighing global headwinds (US Fed uncertainty, tech valuation concerns). The Nifty’s sixth consecutive day of gains culminating in a breakout above 26,000 combined with the Bank Nifty’s all-time high at 59,001 provides strong technical confirmation that the recovery from October’s highs is concluding.

The dramatic FII reversal to net buying of ₹442.17 crores on Monday represents a potential inflection point in institutional flows, suggesting that global investors may be finding Indian equities attractive after the correction. Combined with DIIs’ sustained buying of ₹51,884.99 crores for November to date, the institutional support for higher markets appears robust.

GIFT Nifty’s flat to slightly negative indication suggests that profit-taking may dominate early Tuesday, but the underlying technical structure and broad-based sectoral strength support the view that any pullbacks will be buying opportunities.

For traders and investors, the consolidation phase near 26,000-26,100 appearing to establish over the next few days would be healthy, allowing the market to build a stable platform for the next leg toward 26,300 and potentially the October all-time high of 26,277. Positions should be managed tactically with profits taken on strength and stops maintained below key support levels.

The medium-term outlook remains constructively bullish, supported by India’s strong economic fundamentals, resilient corporate earnings, RBI’s accommodative policy bias, NDA political stability, and improving institutional flow dynamics from both domestic and foreign investors.

Analyst Name: Pradeep Suryavanshi

Bestmate Investment Services Pvt. Ltd.:

A-1-605, Ansal Corporate Park Sec-142, Noida 201305

CIN: U74999UP2016PTC143375

SEBI Registration Number: INH000015996

Website: www.bestmate.in I Email: info@bestmate.in

Download :- Nifty OL 18-11-2025

Disclaimer: Please read the Following very carefully:

“Investments in securities market are subject to market risks. Read all the related documents carefully before investing.”

- Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

- The fees are paid for research Report or Research recommendations and is not refundable or cancellable under any circumstances.

- We do not provide any guaranteed profit or fixed returns or any other services. We charge fixed fees and do not operate on any profit-sharing model.

- Images if any, shared with you are for illustration purposes only.

- We are not responsible for any financial loss or any other loss incurred by the client.

- Please be fully informed about the risk and costs involved in trading and investing. Please consult your investment advisor before trading. Trade only as per your risk appetite and risk profile.

- Trading/investing in stock market is risky due to its volatile nature. Upon accepting our service, you hereby accept that you fully understand the risks involved in trading/investing.

- We advise the viewers to apply own discretion while referring testimonials shared by the client. Past performances and results are no guarantee of future performance.

- All Report or recommendations shared are confidential and for the reference of paid members only. Any unapproved distribution of sensitive data will be considered as a breach of confidentiality and appropriate legal action shall be initiated.

- The Research Report or recommendations must not be used as a singular basis of any investment decision. The views do not consider the risk appetite or the particular circumstances of an individual investor; readers are requested to take professional advice before investing and trading. Our recommendations should not be construed as investment advice.

- In case of any query, please email on Info@bestmate.in be rest assured, our team will get back to you and resolve your query. Please state your registered phone number while mailing us.

- Reports based on technical and derivative analysis center on studying charts of a stock’s price movement, outstanding positions and trading volume, as opposed to focusing on a company’s fundamentals and, as such, may not match with a report on a company’s fundamentals.

Disclosure Document

The particulars given in this Disclosure Document have been prepared in accordance with SEBI(Research Analyst)Regulations,2014.The purpose of the Document is to provide essential information about the Research and recommendation Services in a manner to assist and enable the prospective client/clients in making an informed decision for engaging in Research and recommendation services before investing.For the purpose of this Disclosure Document, Research Analyst is Pradeep Suryavanshi Director, of Bestmate Investment Services Pvt Ltd (hereinafter referred as “Research Analyst”)

Business Activity: Research Analyst is registered with SEBI as Research Analyst with Registration No. INH000015996. The firm got its registration on and is engaged in research and recommendation Services. The focus of Research Analyst is to provide research and recommendations services to the clients. Analyst aligns its interests with those of the client and seeks to provide the best suited services.

Terms and conditions:

The Research report is issued to the registered clients. The Research Report is based on the facts, figures and information that are considered true, correct and reliable. The information is obtained from publicly available media or other sources believed to be reliable. The report is prepared solely for informational purpose and does not constitute an offer document or solicitation to buy or sell or subscribe for securities or other financial instruments for clients.

Disciplinary history:

- No penalties/directions have been issued by SEBI under the SEBI Act or Regulations made there under against the Research Analyst relating to Research Analyst services.

- There are no pending material litigations or legal proceedings, findings of inspections or investigations for which action has been taken or initiated by any regulatory authority against the Research Analyst or its employees.

Details of its associates:- No associates

Disclosures with respect to Research Reports and Research Recommendations Services

- The research analyst or research entity or his associate or his relative do not have financial interest in the subject company.

- The research analyst or its associates or relatives, do not have actual/beneficial ownership of one per cent or more securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance.

- The research analyst or his associate or his relative do not have any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

- The research analyst or its associates have not received any compensation from the subject company in the past twelve months.

- The research analyst or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months.

- The research analyst or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months.

- The subject company was not a client of Research Analyst or its employee or its associates during twelve months preceding the date of distribution of the research report and recommendation services provided.

- The research analyst or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months.

- The research analyst or its associates have not received any compensation or other benefits from the subject company or third party in connection with the research report.

- The research analyst has not been engaged in market making activity for the subject company.

- The research analyst has not served as an officer, director or employee of the subject company.

- The research analyst did not receive any compensation or other benefits from the companies mentioned in the documents or third party in connection with preparation of the research documents. Accordingly, research Analyst does not have any material conflict of interest at the time of publication of the research documents.

Sources :-

- https://www.ndtvprofit.com/markets/trade-setup-for-nov-18-nifty-faces-immediate-resistance-at-26100

- https://www.moneycontrol.com/news/business/markets/stock-market-live-sensex-nifty-50-share-price-gift-nifty-latest-updates-18-11-2025-liveblog-13681720.html/amp

- https://www.spidersoftwareindia.com/blog/stock-market-prediction-for-nifty-bank-nifty-18th-november-2025/

- https://asiatimes.com/2025/11/next-financial-meltdown-could-be-much-worse-with-us-on-sidelines/

- https://www.thehindubusinessline.com/markets/stock-market-live-18-november-2025/article70290894.ecehttps://www.thehindubusinessline.com/markets/stock-market-live-18-november-2025/article70290894.ece

- https://www.nseindia.com/static/all-reports/historical-equities-fii-fpi-dii-trading-activity

- https://www.nseindia.com/reports/fii-dii

- https://tradingeconomics.com/india/currency

- https://timesofindia.indiatimes.com/business/international-business/markets-watch-asia-stocks-slip-as-rate-cut-hopes-fade-crude-prices-retreat-after-russian-exports-resume/articleshow/125375357.cms

- https://www.tradingview.com/news/reuters.com,2025:newsml_L4N3WT1E9:0-update-1-asia-morning-call-global-markets/

- https://www.mufgresearch.com/fx/asia-fx-talk-jpy-weighed-down-by-uncertainties-18-november-2025/

- https://www.moneycontrol.com/stocks/marketstats/fii_dii_activity/index.php

- https://www.moneycontrol.com/news/business/markets/trade-setup-for-november-18-top-15-things-to-know-before-the-opening-bells-13681590.html

- https://www.business-standard.com/markets/news/stocks-to-watch-today-nov-18-physicswallah-bse-hcl-tech-infosys-paytm-125111800077_1.html