Indian equity markets are poised for a cautious start on Friday, October 31, 2025, following Thursday’s sharp decline that saw the Nifty 50 slip below the psychologically important 26,000 mark. The benchmark indices witnessed significant profit booking after the U.S. Federal Reserve’s dovish yet cautious stance on future rate cuts triggered widespread selling pressure across global markets. As investors digest the Fed’s signal that a December rate reduction is “far from a foregone conclusion,” domestic markets are expected to trade in a consolidation phase with critical technical levels determining the near-term trajectory.

Market Performance Overview: Thursday’s Decline Sets the Tone

The Indian equity benchmarks concluded Thursday’s session under considerable pressure, marking the first decline in four consecutive sessions. The Nifty 50 closed at 25,877.85, registering a loss of 176.05 points or 0.68%, while the BSE Sensex tumbled 592.67 points or 0.70% to settle at 84,404.46. The decline coincided with the monthly expiry of derivatives contracts, which amplified volatility and led to heightened put writing activity across strike prices.

The broader market indices exhibited relative resilience compared to their large-cap counterparts. The Nifty Midcap 100 declined marginally by 0.1%, while the Nifty Smallcap 100 also shed 0.1%, indicating that selling pressure was primarily concentrated in heavyweight stocks. Market breadth turned decidedly negative, with approximately 1,682 shares declining against 1,128 advancing stocks on the National Stock Exchange, reflecting widespread profit booking across sectors.

The India VIX, the market’s fear gauge, edged up by 0.79% to close at 12.07, signaling a modest increase in near-term volatility expectations. This uptick in volatility, though contained, suggests that market participants remain cautious about the immediate direction, particularly given the uncertainty surrounding global monetary policy and ongoing geopolitical developments.

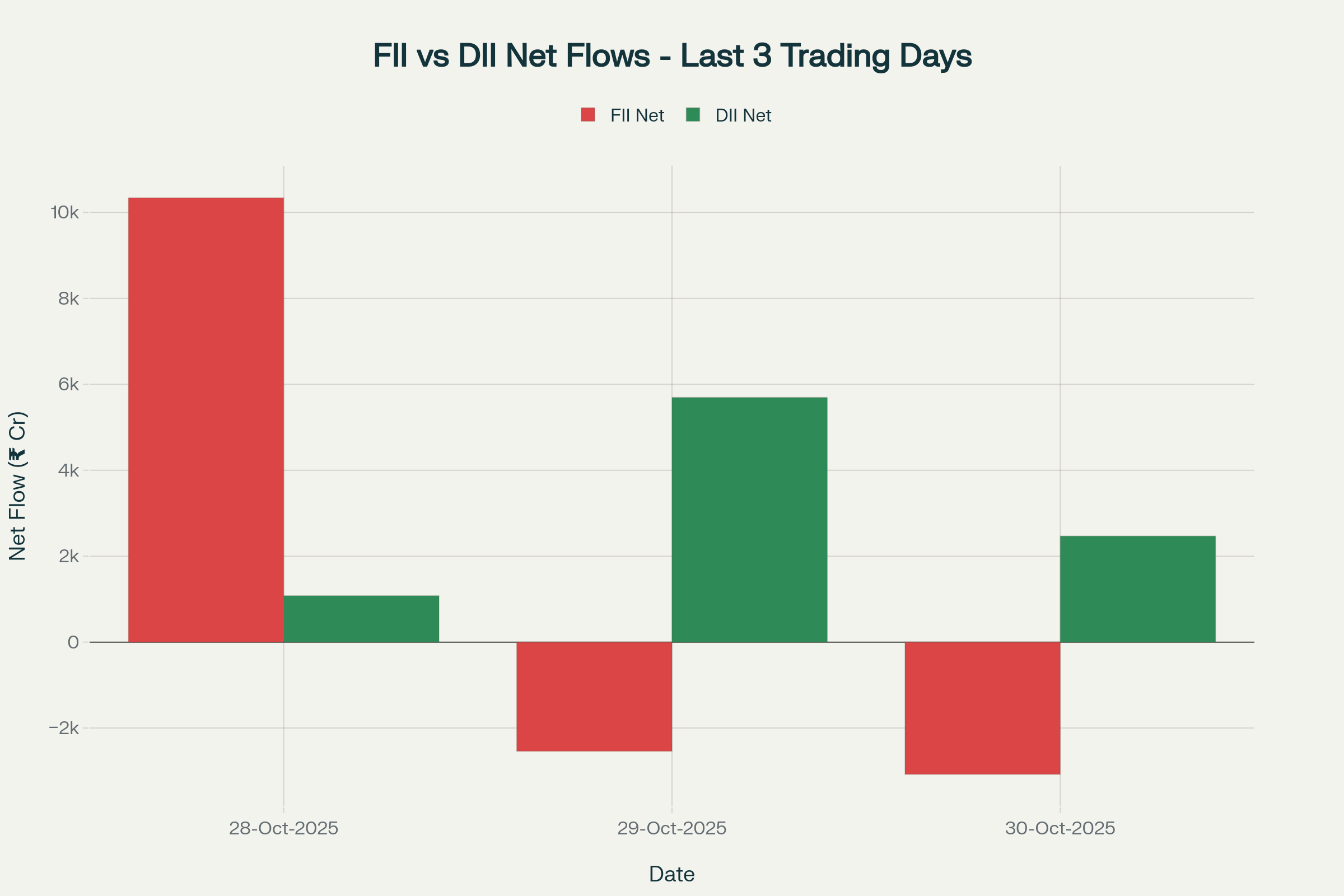

FII vs DII net flows comparison showing domestic institutional support offsetting foreign selling pressure in recent sessions

FII vs DII net flows comparison showing domestic institutional support offsetting foreign selling pressure in recent sessionsTechnical Analysis: Critical Levels to Watch for October 31

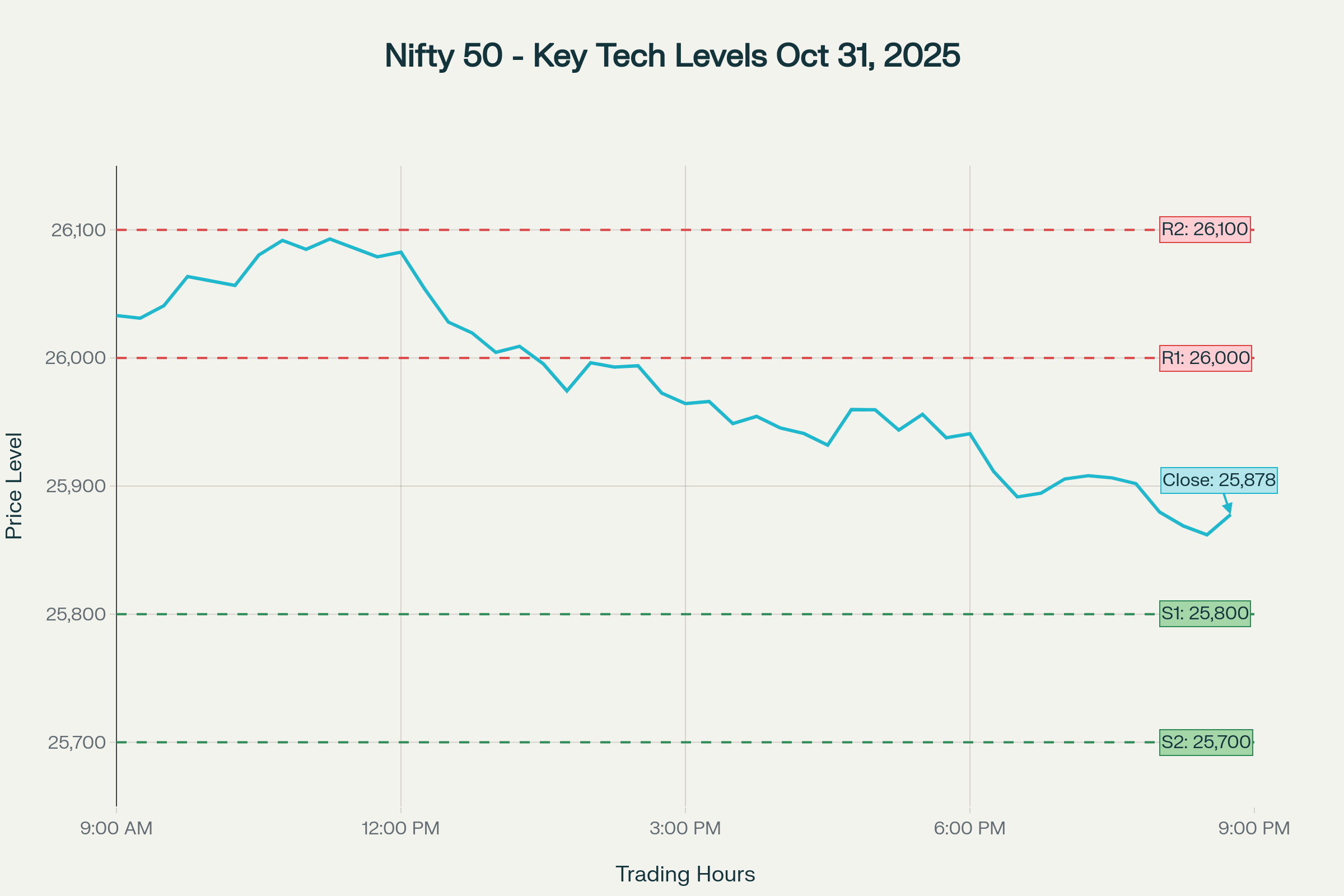

From a technical perspective, the Nifty 50 is currently positioned at a crucial juncture, with the index trading between well-defined support and resistance zones. Market technicians have identified 25,800 as the immediate support level, which must hold to prevent further downside momentum. A decisive breakdown below this level could trigger a cascade toward the next significant support at 25,700, and subsequently to 25,500, which represents a critical demand zone.

On the upside, the 26,000 psychological mark has emerged as a formidable resistance barrier, having rejected upward moves twice during Thursday’s session. A sustained breakout above 26,000, followed by a move beyond 26,040 and 26,100, would signal the resumption of the bullish trend and potentially open doors for targets toward 26,300. Technical analysts note that the index formed a bearish candle on the daily chart, falling below the 5-day exponential moving average (EMA), which indicates short-term weakness.

The Bank Nifty mirrored the broader market’s weakness, closing at 58,031.10 with a decline of 354.15 points or 0.61%. For Friday’s session, the banking index faces critical resistance at 58,330, which has consistently rejected upward advances. The immediate support is positioned at 57,890, with deeper support levels at 57,300-57,500 and a stronger demand zone around 56,800-56,500. A breakout above 58,330 could trigger short-covering rallies toward 58,400, 58,470, and 58,550 levels, making call options attractive for intraday traders.

Nifty 50 technical chart highlighting critical support and resistance zones for intraday and short-term trading strategies

Nifty 50 technical chart highlighting critical support and resistance zones for intraday and short-term trading strategiesDerivative Market Analysis: Options Data Signals Caution

The derivatives segment provides valuable insights into market sentiment and potential directional moves for the upcoming session. The Nifty Put-Call Ratio (PCR) declined sharply to 0.75 on October 30, compared to 1.14 in the previous session, indicating a shift toward bearish sentiment. This significant drop in PCR suggests that traders are increasingly purchasing put options or call writers are becoming more aggressive, both scenarios pointing to near-term caution.

The maximum pain level for Nifty options stands at 25,900, suggesting that option writers would prefer the index to gravitate toward this level by expiry. Large put open interest (OI) is concentrated at the 25,500-25,600 strike prices, forming a strong base of support, while significant call OI clusters at 26,100-26,200 pose resistance barriers. This options configuration reinforces the view that the index is likely to trade in a 25,700-26,100 range in the near term.

For Bank Nifty, the derivatives data shows substantial put OI at the 58,000 strike, acting as a key support area, while call build-up between 58,600 and 58,700 presents formidable resistance. The Bank Nifty PCR hovers near 1, reinforcing a neutral to slightly bearish bias for the banking index. Trading behavior suggests that put holders are reducing exposure while call interest is accumulating around resistance zones, indicating a wide expiry range but with persistent downside pressure.

Institutional Flow Dynamics: DIIs Counter FII Outflows

Institutional trading activity reveals a critical divergence that has been supporting Indian markets despite persistent foreign selling. On October 30, Foreign Institutional Investors (FIIs) were net sellers to the tune of ₹3,077.59 crores in the cash market, marking the second consecutive session of selling after the brief buying episode on October 28. FIIs sold equities worth ₹12,427.66 crores while purchasing only ₹9,350.07 crores, reflecting continued risk-off sentiment among overseas investors.

In stark contrast, Domestic Institutional Investors (DIIs) emerged as strong buyers, providing crucial support by net purchasing ₹2,469.34 crores worth of equities on October 30. DIIs bought shares worth ₹14,826.52 crores and sold ₹12,357.18 crores, demonstrating sustained confidence in Indian equities at lower levels. This buying interest from domestic institutions has been instrumental in cushioning the market from steeper declines and preventing a breakdown of critical support levels.

For the month of October 2025 till date, FIIs have been marginal net buyers with total purchases of ₹4,422.45 crores, while DIIs have been robust buyers with cumulative net inflows of ₹45,725.58 crores. This stark divergence underscores the growing importance of domestic institutional participation in maintaining market stability, particularly during periods of elevated global uncertainty and foreign investor risk aversion.

Sectoral Performance: Divergent Trends Across Segments

Thursday’s session witnessed notable sectoral rotation, with clear winners and losers emerging across different industry groups. The pharma sector emerged as the worst performer, with the Nifty Pharma index declining 0.59% as heavyweight stocks like Dr. Reddy’s Laboratories plunged 3.79% and Cipla fell 2.54%. The sharp correction in pharmaceutical stocks was attributed to profit booking after recent gains and concerns about pricing pressures in key export markets.

The financial services sector also witnessed significant selling pressure, with the Nifty Financial Services index dropping 0.77%. Within this space, HDFC Life Insurance declined 2.01%, while Bharti Airtel fell 1.50%. Banking stocks showed mixed performance, with PSU banks slightly outperforming their private sector counterparts, though the overall banking index remained under pressure.

On the positive side, select pockets of strength emerged in the metals and mining sector, where Coal India led the gainers with a robust 1.58% gain to close at ₹388.05. The metal sector’s resilience was supported by stabilizing commodity prices and optimism surrounding US-China trade negotiations. Infrastructure and capital goods stocks also showed relative strength, with Larsen & Toubro advancing 0.79% to ₹3,989.40 and Bharat Electronics gaining 0.74%.

The consumer goods sector exhibited mixed performance, with defensive FMCG names like Nestlé India posting modest gains of 0.55%, while broader consumption-oriented stocks faced selling pressure. The IT sector declined 0.51%, weighed down by concerns about discretionary spending in developed markets and the stronger dollar’s impact on export competitiveness.

Global Market Cues: Fed Caution Weighs on Risk Assets

The global market environment on Thursday turned decidedly cautious following the Federal Reserve’s policy announcement, which, while delivering an expected 25 basis point rate cut to a range of 3.75%-4.00%, sent mixed signals about the future path of monetary policy. Fed Chair Jerome Powell’s comments that a December rate cut was “not a foregone conclusion” caught markets off guard, triggering a risk-off response across asset classes.

U.S. equity markets ended mixed on Wednesday night, with the Dow Jones Industrial Average declining 0.23% to close at 47,522.12, while the S&P 500 fell 0.99% to 6,822.34. The Nasdaq Composite underperformed significantly, dropping 1.57% to 23,581.14, weighed down by profit taking in high-flying technology stocks despite strong earnings from major tech giants. The market reaction reflected investor concerns about the Fed’s cautious stance on further easing, particularly given the “somewhat elevated” inflation readings and uncertainty about the economic outlook.

Asian markets presented a mixed picture on Friday morning. The Nikkei 225 in Japan surged 1.82% to 52,259.80, buoyed by a weaker yen and strong corporate earnings. However, the Hang Seng in Hong Kong declined 0.24% to 26,282.69, while the Shanghai Composite fell 0.73% to 3,986.90, as investors digested mixed signals from ongoing US-China trade discussions. European markets showed marginal movements, with the FTSE 100 virtually flat at 9,760.06 and the DAX down 0.02% at 24,118.89.

The U.S. Dollar Index strengthened to around 99.46, hovering near a three-month high as Powell’s hawkish undertones supported the greenback. Against the Indian rupee, the dollar traded at approximately ₹88.35-88.65, putting pressure on import-dependent sectors and adding to inflation concerns. The stronger dollar environment generally weighs on emerging market equities as it makes dollar-denominated investments more attractive relative to EM assets.

Crude Oil and Commodity Markets: Sustained Pressure on Energy Prices

Crude oil prices remained under pressure on Friday, heading toward a third consecutive monthly decline as oversupply concerns and a stronger dollar weighed on energy markets. WTI crude oil futures slipped to around $60.16 per barrel, down 0.58%, while Brent crude declined 0.51% to $64.27 per barrel. The persistent weakness in oil prices reflects abundant global supply, with OPEC+ considering a modest output increase for December despite Western sanctions disrupting Russian oil exports.

The subdued oil prices present a mixed blessing for the Indian economy. Lower crude costs help reduce the import bill and ease inflationary pressures, benefiting sectors like aviation, logistics, and chemicals. However, the weakness also reflects concerns about global demand growth, which could signal a broader economic slowdown that may impact India’s export-oriented sectors. The three-month decline in oil prices represents the longest losing streak since mid-2023, highlighting structural shifts in the global energy market.

Gold prices remained range-bound near elevated levels, trading around ₹80,000 per 10 grams in the domestic market, as investors weighed the Fed’s cautious stance against ongoing geopolitical tensions. The precious metal has found support from safe-haven demand, though the stronger dollar and reduced expectations for aggressive Fed easing have capped significant upside. Natural gas prices showed strength, rising 0.91% to $3.85 per MMBtu, supported by seasonal demand expectations and inventory concerns.

Market Outlook for October 31: Range-Bound Consolidation Expected

Looking ahead to Friday’s trading session, market participants should brace for a cautious start with the GIFT Nifty trading around 26,025-26,040, indicating a flat to mildly positive opening for domestic indices. However, the overall bias for the session remains sideways to cautiously positive, with the market likely to remain trapped in a defined range as traders await fresh catalysts.

The Nifty 50 is expected to trade in a consolidation phase between 25,700 and 26,100, with any decisive breakout or breakdown on either side determining the next directional move. Traders should view dips toward the 25,790-25,820 range as potential buying opportunities for positional trades, given the strong support base in this zone and the month-end rebalancing flows that typically provide support. However, sustained trading below 25,700 could trigger further profit booking toward 25,500, necessitating strict stop-loss discipline.

For the Bank Nifty, the 57,890-58,330 range defines the immediate trading corridor, with monthly expiry dynamics likely to increase volatility during the latter half of the session. The banking index’s ability to defend the 57,890 support level will be crucial in maintaining overall market stability, as banking stocks carry significant weightage in benchmark indices.

Several factors warrant close monitoring during Friday’s session. First, any developments from the ongoing US-China trade negotiations in South Korea could provide directional cues, with positive outcomes potentially triggering risk-on sentiment. Second, corporate earnings announcements, particularly from heavyweights like BHEL, L&T, SAIL, and Fino Payments Bank, will influence sector-specific movements and broader market sentiment.

Third, traders should remain vigilant about global cues, particularly any fresh commentary from Federal Reserve officials that could clarify the central bank’s policy trajectory. Fourth, institutional flow patterns will continue to play a crucial role, with sustained DII buying providing a critical support buffer against potential FII selling.

Trading Strategy and Risk Management

Given the prevailing market conditions, a prudent trading approach for October 31 would emphasize capital preservation and tactical positioning rather than aggressive directional bets. Traders should consider the following strategic guidelines:

For Nifty traders, maintaining tight stop-losses below 25,750 for long positions and above 26,050 for short positions would help manage risk in the current volatile environment. Positional traders with a bullish bias could consider accumulating quality large-cap stocks on dips toward support zones, while swing traders might prefer to remain on the sidelines until a clear breakout or breakdown materializes.

Options strategies appear particularly attractive in the current scenario, with option spreads and hedged positions around the 25,800-26,000 range offering favorable risk-reward profiles. Put option sellers should exercise caution given the elevated volatility and potential for gap-down moves, while call writers might find opportunities near resistance levels.

Sector rotation strategies could prove beneficial, with selective buying in defensive sectors like FMCG and pharma on dips, while maintaining exposure to cyclical sectors like infrastructure and metals that stand to benefit from stabilizing global trade tensions. However, avoiding overweight positions in interest-rate-sensitive sectors like banking and real estate would be prudent until greater clarity emerges on the Fed’s policy path.

From a derivatives perspective, traders should closely monitor changes in open interest and implied volatility across different strike prices to gauge shifting sentiment. Any significant unwinding of put positions or aggressive call writing near current levels could signal impending weakness, warranting defensive adjustments to existing positions.

Broader Economic Context and Medium-Term Outlook

While near-term uncertainty dominates market sentiment, the medium-term outlook for Indian equities remains constructive, supported by several structural factors. The Indian economy continues to demonstrate resilience, with growth projections remaining robust despite global headwinds. The IMF’s October 2025 World Economic Outlook projects global growth to moderate from 3.3% in 2024 to 3.2% in 2025, with emerging markets including India expected to maintain growth rates above 4%.

Corporate earnings for Q2 FY2025-26 have generally met or exceeded expectations across most sectors, providing fundamental support to valuations. The ongoing government focus on infrastructure development, manufacturing growth under production-linked incentive schemes, and the expanding digital economy continue to offer long-term investment opportunities.

However, several risks merit attention. Elevated valuations across mid-cap and small-cap segments, despite recent corrections, suggest limited margin of safety. Geopolitical tensions, including US-China trade dynamics and Middle East conflicts, could trigger sudden risk-off episodes. Inflationary pressures, both globally and domestically, remain a concern, potentially constraining central bank policy flexibility.

The rupee’s depreciation against the dollar, trading near 88.35-88.65 levels, poses challenges for import-dependent sectors and could add to domestic inflation if sustained. While the Reserve Bank of India has maintained adequate forex reserves to manage currency volatility, persistent dollar strength could test the central bank’s tolerance limits.

Conclusion

As Indian markets navigate the final trading day of October 2025, investors face a complex landscape characterized by technical consolidation, cautious global sentiment, and divergent institutional flows. The Federal Reserve’s measured approach to rate cuts, combined with ongoing geopolitical uncertainties, argues for a defensive positioning and tactical flexibility rather than aggressive directional bets.

The immediate focus remains on the 25,700-26,100 range for Nifty and 57,890-58,330 for Bank Nifty, with breakouts or breakdowns from these levels determining the near-term trajectory. Sustained support from domestic institutional investors provides a crucial cushion, though continued foreign selling remains a headwind.

For traders and investors, the current environment demands disciplined risk management, selective sector allocation, and patience in awaiting high-probability setups. While volatility may persist in the near term, India’s strong economic fundamentals and attractive long-term growth prospects continue to support a constructive medium-term outlook for equity markets. Friday’s session will likely set the tone for November, with monthly expiry dynamics and global cues playing pivotal roles in determining market direction as the year approaches its final quarter.

Analyst Name: Pradeep Suryavanshi

Bestmate Investment Services Pvt. Ltd.:

A-1-605, Ansal Corporate Park Sec-142, Noida 201305

CIN: U74999UP2016PTC143375

SEBI Registration Number: INH000015996

Website: www.bestmate.in I Email: info@bestmate.in

Download Report :- Nifty OL 31-10-2025

Disclaimer: Please read the Following very carefully:

“Investments in securities market are subject to market risks. Read all the related documents carefully before investing.”

- Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

- The fees are paid for research Report or Research recommendations and is not refundable or cancellable under any circumstances.

- We do not provide any guaranteed profit or fixed returns or any other services. We charge fixed fees and do not operate on any profit-sharing model.

- Images if any, shared with you are for illustration purposes only.

- We are not responsible for any financial loss or any other loss incurred by the client.

- Please be fully informed about the risk and costs involved in trading and investing. Please consult your investment advisor before trading. Trade only as per your risk appetite and risk profile.

- Trading/investing in stock market is risky due to its volatile nature. Upon accepting our service, you hereby accept that you fully understand the risks involved in trading/investing.

- We advise the viewers to apply own discretion while referring testimonials shared by the client. Past performances and results are no guarantee of future performance.

- All Report or recommendations shared are confidential and for the reference of paid members only. Any unapproved distribution of sensitive data will be considered as a breach of confidentiality and appropriate legal action shall be initiated.

- The Research Report or recommendations must not be used as a singular basis of any investment decision. The views do not consider the risk appetite or the particular circumstances of an individual investor; readers are requested to take professional advice before investing and trading. Our recommendations should not be construed as investment advice.

- In case of any query, please email on Info@bestmate.in be rest assured, our team will get back to you and resolve your query. Please state your registered phone number while mailing us.

- Reports based on technical and derivative analysis center on studying charts of a stock’s price movement, outstanding positions and trading volume, as opposed to focusing on a company’s fundamentals and, as such, may not match with a report on a company’s fundamentals.

Disclosure Document

The particulars given in this Disclosure Document have been prepared in accordance with SEBI(Research Analyst)Regulations,2014.The purpose of the Document is to provide essential information about the Research and recommendation Services in a manner to assist and enable the prospective client/clients in making an informed decision for engaging in Research and recommendation services before investing.For the purpose of this Disclosure Document, Research Analyst is Pradeep Suryavanshi Director, of Bestmate Investment Services Pvt Ltd (hereinafter referred as “Research Analyst”)

Business Activity: Research Analyst is registered with SEBI as Research Analyst with Registration No. INH000015996. The firm got its registration on and is engaged in research and recommendation Services. The focus of Research Analyst is to provide research and recommendations services to the clients. Analyst aligns its interests with those of the client and seeks to provide the best suited services.

Terms and conditions:

The Research report is issued to the registered clients. The Research Report is based on the facts, figures and information that are considered true, correct and reliable. The information is obtained from publicly available media or other sources believed to be reliable. The report is prepared solely for informational purpose and does not constitute an offer document or solicitation to buy or sell or subscribe for securities or other financial instruments for clients.

Disciplinary history:

- No penalties/directions have been issued by SEBI under the SEBI Act or Regulations made there under against the Research Analyst relating to Research Analyst services.

- There are no pending material litigations or legal proceedings, findings of inspections or investigations for which action has been taken or initiated by any regulatory authority against the Research Analyst or its employees.

Details of its associates:- No associates

Disclosures with respect to Research Reports and Research Recommendations Services

- The research analyst or research entity or his associate or his relative do not have financial interest in the subject company.

- The research analyst or its associates or relatives, do not have actual/beneficial ownership of one per cent or more securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance.

- The research analyst or his associate or his relative do not have any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

- The research analyst or its associates have not received any compensation from the subject company in the past twelve months.

- The research analyst or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months.

- The research analyst or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months.

- The subject company was not a client of Research Analyst or its employee or its associates during twelve months preceding the date of distribution of the research report and recommendation services provided.

- The research analyst or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months.

- The research analyst or its associates have not received any compensation or other benefits from the subject company or third party in connection with the research report.

- The research analyst has not been engaged in market making activity for the subject company.

- The research analyst has not served as an officer, director or employee of the subject company.

The research analyst did not receive any compensation or other benefits from the companies mentioned in the documents or third party in connection with preparation of the research documents. Accordingly, research Analyst does not have any material conflict of interest at the time of publication of the research documents.