Friday Trading Day: Markets Eye 25,800-26,000 Range Amid Earnings Season and Mixed Global Cues

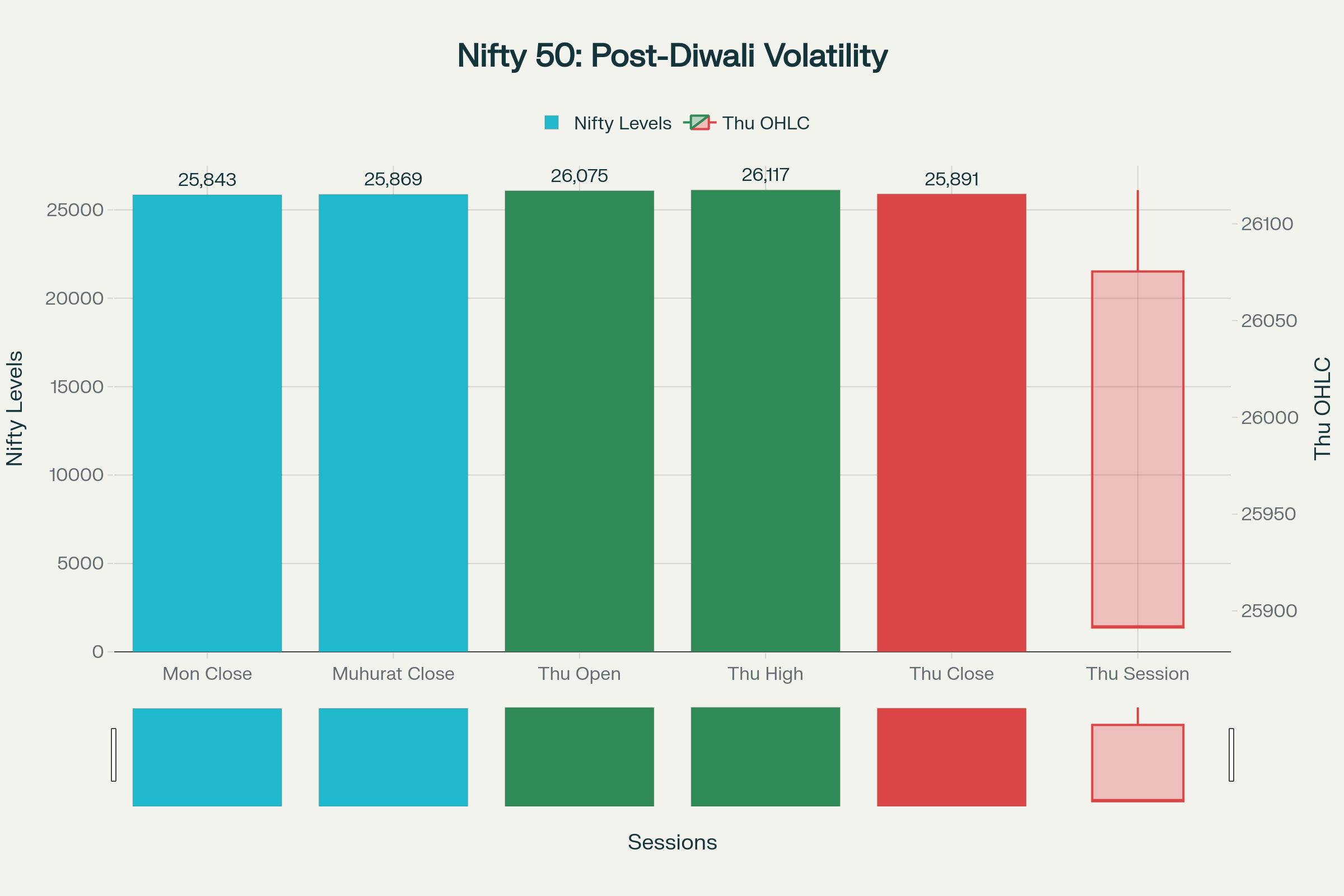

The Indian equity markets are poised for a flat to marginally negative opening on Friday, October 24, as GIFT Nifty indicates a minor 0.34% decline to 25,942 levels, reflecting profit-booking sentiment after Thursday’s volatile session that saw benchmark indices squander strong morning gains. After achieving a fresh 52-week high of 26,117 in early trade, the Nifty 50 witnessed intense selling pressure from heavyweight stocks, closing marginally higher by just 22.80 points (0.09%) at 25,891.40, underscoring the market’s struggle to sustain momentum above the psychologically crucial 26,000 mark.

Thursday’s session was characterized by sharp intraday swings, with the Sensex erasing over 740 points from its day’s high to close at 84,556.40 with a modest 130-point gain, while broader indices underperformed with BSE Midcap declining 0.06% and Smallcap falling 0.42%. The return of Foreign Institutional Investor selling to the tune of ₹1,165.94 crore, combined with rising volatility indicated by India VIX jumping 2.81% to 11.70, signals growing caution among market participants despite continued Domestic Institutional Investor support.

Thursday’s Session Review: Profit-Booking Erases Morning Euphoria

Gap-Up Opening Meets Resistance

Thursday began on an exuberant note with Nifty opening at 26,075 and touching an intraday peak of 26,117.45, crossing the coveted 26,000 psychological barrier for the first time since late September 2024. The Sensex surged to 85,296.72, positioning just 682 points away from its all-time high of 85,978.25 achieved in September 2024.

Nifty 50 erases 226-point intraday rally as profit-booking intensifies at higher levels

Nifty 50 erases 226-point intraday rally as profit-booking intensifies at higher levelsHowever, the euphoria proved short-lived as investors rushed to book profits in heavyweight stocks that had witnessed significant appreciation during the festive rally. The market witnessed consistent selling pressure from higher levels, with the Nifty ultimately declining 226 points from its intraday peak to close at 25,891.40, representing a complete reversal of morning gains.

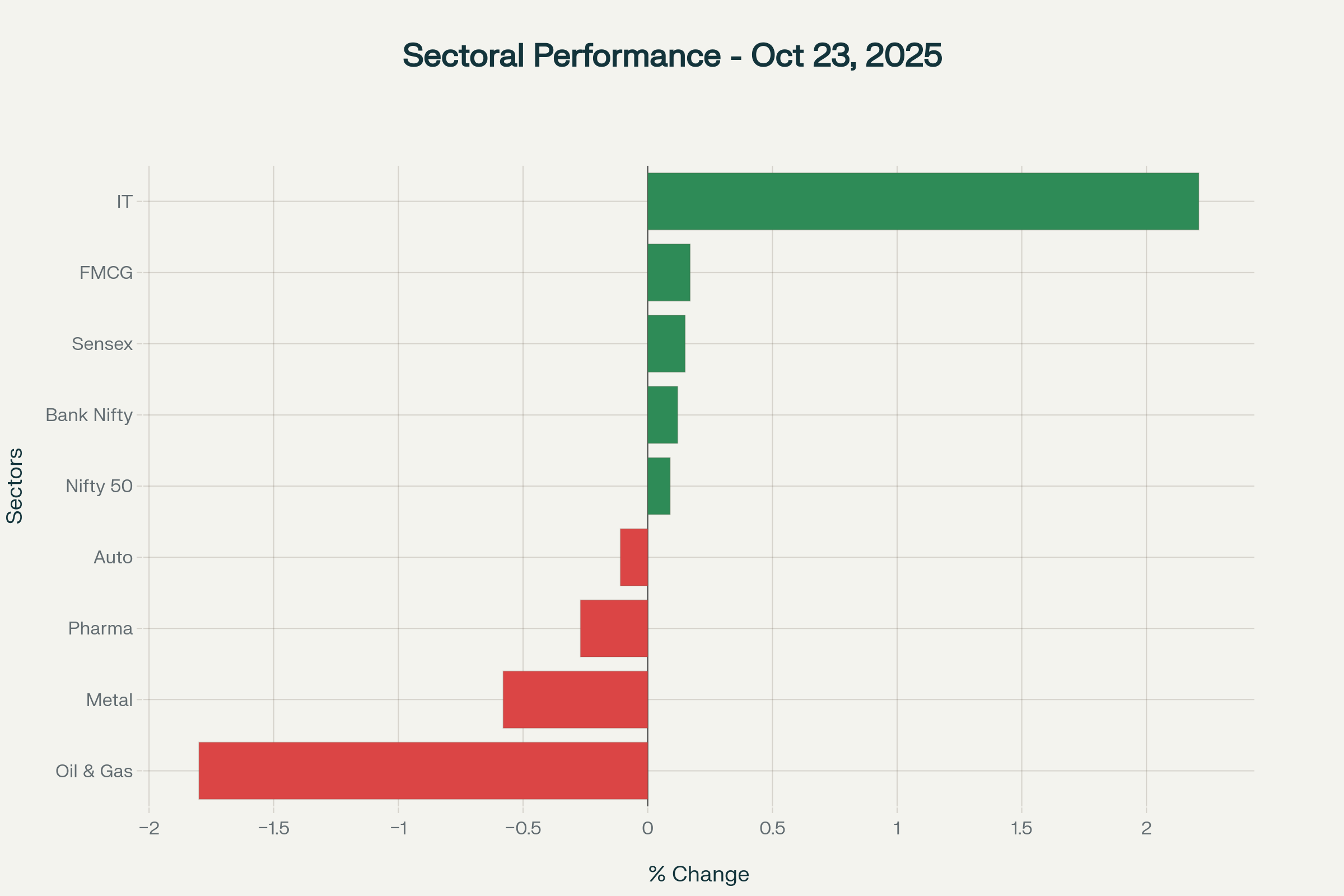

Sectoral Divergence: IT Shines, Energy Falters

Thursday’s session exhibited stark sectoral divergence with the IT index emerging as the clear outperformer, surging 2.21% driven by optimism surrounding a potential India-US trade agreement and H-1B visa clarity. IT majors led the gainers’ list with Infosys skyrocketing 3.65%, HCL Technologies advancing 2.85%, and TCS rising 2.17%, reflecting renewed investor confidence in the sector’s prospects.

IT sector rallies 2.21% on India-US trade deal optimism while energy stocks decline

IT sector rallies 2.21% on India-US trade deal optimism while energy stocks declineOn the flip side, the Oil & Gas sector bore the brunt of selling pressure, declining 1.80% on the back of falling international crude oil prices and profit-booking in previously resilient energy stocks. Pharmaceuticals fell 0.27%, while metals declined 0.58% on concerns about global demand amid renewed trade tensions.

Stock-Specific Action

Individual stock performance reflected the sectoral trends, with IT heavyweights dominating the gainers’ list. Beyond the IT pack, Shriram Finance (+1.98%), Axis Bank (+1.85%), and Kotak Mahindra Bank (+1.18%) provided support to the indices.

Major losers included IndiGo (-3.45%), Bharti Airtel (-1.65%), Reliance Industries (-1.21%), ICICI Bank (-1.28%), and Tata Consumer Products (-1.33%). The selling in these heavyweights, which command significant index weightage, contributed substantially to the market’s inability to sustain higher levels.

Institutional Flow Dynamics: FII Reversal Signals Caution

Foreign Investors Resume Selling

Thursday marked a significant shift in institutional flow patterns, with Foreign Institutional Investors turning net sellers to the tune of ₹1,165.94 crore after three consecutive sessions of buying. This represents the second-largest single-day FII outflow for October, second only to the ₹1,508.53 crore selling witnessed on October 14.

The renewed FII selling appears driven by multiple factors including profit-booking after the sharp rally from October lows, stretched valuations in certain pockets, rising geopolitical tensions, and concerns about the sustainability of corporate earnings growth.

DII Support Remains Robust

Despite FII selling, Domestic Institutional Investors continued their unwavering support with net purchases of ₹3,893.73 crore on Thursday, marking one of the strongest single-day buying instances for October. This brings the month-to-date DII buying to a staggering ₹29,701.82 crore, providing a solid foundation for market stability.

Technical Analysis: Consolidation Expected After Sharp Rally

Overbought Conditions Trigger Profit-Booking

From a technical perspective, the Nifty 50’s struggle to sustain above 26,000 levels and the subsequent sharp decline from intraday highs confirms that the index has entered an overbought zone after rallying nearly 1,500 points over the past four weeks. The stochastic oscillator on both daily and weekly charts has moved into overbought territory, suggesting the potential for short-term consolidation or corrective pause.

After a sharp 1,500-point rally over the past four weeks, the stochastic oscillator on both daily and weekly charts has entered the overbought zone. This suggests the potential for a short-term consolidation or corrective pause at higher levels”.

Key Technical Levels for October 24:

| Index | Thursday Close | Expected Open | Immediate Support | Strong Support | Immediate Resistance | Strong Resistance |

|---|---|---|---|---|---|---|

| Nifty 50 | 25,891.40 | 25,880 | 25,800 | 25,700 | 25,950 | 26,050 |

| Bank Nifty | 58,078.05 | 58,050 | 57,900 | 57,600 | 58,300 | 58,500 |

| Sensex | 84,556.40 | 84,500 | 84,200 | 83,950 | 84,900 | 85,200 |

We expect the Nifty to consolidate in the 25,600-26,100 range in the near term, working off the overbought conditions. On the downside, the 25,500-25,700 zone is seen as a strong support region, aligning with the 38.2% Fibonacci retracement of the ongoing rally from 24,587 to 25,891 and the recent breakout region, thus providing a solid technical support base.

The Nifty completely erased its morning gains during the day; nevertheless, the short-term trend remains strong. On the daily chart, a large red candle has formed, indicating the possibility of a pullback towards the 25,700 level in the next few days. However, the short-term trend remains intact, with the potential to revisit higher levels around 26,200 in the next 10–15 days”.

Bank Nifty’s Resilient Structure

Bank Nifty demonstrated relative strength, closing at 58,078.05 with a 0.12% gain despite the broader market weakness. The index is expected to consolidate with positive bias, with immediate support at 57,500-57,600 levels (last week’s breakout area) and a stronger demand zone near 56,800-56,500. On the upside, resistance is placed around 59,000 levels, coinciding with the 138.2% retracement of the previous decline.

Derivative Market Analysis: Bears Gain Upper Hand

Options Data Signals Caution

Thursday’s derivative market activity revealed a significant shift in sentiment, with the Nifty Put-Call Ratio (PCR) dropping sharply to 0.95 from 1.28 in the previous session, indicating increased bearish positioning among options traders. This decline in PCR suggests that traders are buying more calls relative to puts or writing more puts, reflecting cautious pessimism about near-term prospects.

The Bank Nifty PCR also declined to 1.08 from 1.35, though it remains above the 1.0 threshold, suggesting relatively better sentiment for banking stocks compared to the broader market.

Open Interest Analysis Reveals Resistance

Maximum call open interest remains firmly anchored at the 26,000 CE strike with heavy call writing observed at this level, clearly demarcating the immediate psychological resistance that bulls struggled to overcome on Thursday. The significant call unwinding at 26,000 levels indicates bears are actively defending this zone.

On the put side, maximum open interest has shifted from 25,500 PE to 25,700 PE, indicating that the support base has moved marginally higher. However, strong put writing continues at 25,800 levels, suggesting this as the critical near-term support zone that bulls must defend.

| Metric | Thursday Close | Previous Day | Change | Interpretation |

|---|---|---|---|---|

| India VIX | 11.70 | 11.38 | +0.32 | Higher Volatility |

| Nifty PCR | 0.95 | 1.28 | -0.33 | ⚠️ Bearish Bias |

| Bank Nifty PCR | 1.08 | 1.35 | -0.27 | ⚠️ Neutral |

| Max Call OI | 26000 CE | 26000 CE | Unchanged | 🎯 Strong Resistance |

| Max Put OI | 25700 PE | 25500 PE | Shifted Up 200 | 💪 Support Higher |

FII F&O Position Reversal

A concerning development in the derivatives segment is the shift in FII positioning from net long to net short, suggesting that foreign institutional investors are increasingly bearish on near-term market prospects. This positioning change, combined with cash segment selling, indicates growing caution among international investors.

Global Market Landscape: Mixed Signals Persist

US Markets Show Resilience

Wall Street concluded Thursday with modest gains despite earlier volatility, with the S&P 500 rising 0.19% to 6,758.20, the Nasdaq advancing 0.29% to 23,095.60, and the Dow Jones gaining 0.16% to 46,782.15. The positive close came despite ongoing concerns about the government shutdown and delayed economic data releases.

Asian Markets Provide Support

Asian markets demonstrated resilience in early Friday trading, with Japan’s Nikkei 225 rising 0.23%, Hong Kong’s Hang Seng advancing 0.50%, and Shanghai Composite gaining 0.21%. The regional strength provides some offset to GIFT Nifty’s marginally negative indication.

| Market | Thursday Close | Friday Indication | Change (%) | Impact |

|---|---|---|---|---|

| GIFT Nifty | 26,031.00 | 25,942.00 | -0.34 | Flat to Negative |

| S&P 500 | 6,745.30 | 6,758.20 | +0.19 | Neutral |

| Nasdaq | 23,028.45 | 23,095.60 | +0.29 | Neutral Positive |

| Hang Seng | 26,218.75 | 26,350.85 | +0.50 | Positive |

| Gold ($/oz) | 4,195.50 | 4,208.30 | +0.31 | Bullish |

Commodity and Currency Dynamics

Gold prices extended their bull run to $4,208.30 per ounce, continuing to benefit from safe-haven demand amid geopolitical uncertainties and expectations of Federal Reserve rate cuts. The Indian rupee is expected to trade with a slight positive bias around 88.18 levels, supported by strong domestic market fundamentals and steady foreign exchange reserves.

Crude oil prices declined marginally to $57.98 per barrel, continuing their downward trajectory on concerns about global demand and potential OPEC+ production increases. The falling crude prices provide relief to India’s import bill and support the domestic economy.

Earnings Season: Major Results on Friday

State Bank of India Takes Center Stage

Friday’s session will witness the most anticipated quarterly result of the week – State Bank of India’s Q2FY26 numbers. As India’s largest lender commanding significant index weightage, SBI’s performance provides crucial insights into the overall banking sector health, credit growth trajectory, and asset quality trends.

Analysts expect SBI to report steady credit growth in the 14-15% range with stable net interest margins around 3.0-3.1%. Asset quality is anticipated to remain resilient with gross NPA expected at 2.1-2.2% levels. The management commentary on deposit mobilization, loan growth pipeline, and guidance for H2FY26 will be closely watched.

Asian Paints Faces Volume Growth Test

Asian Paints, the decorative paints major, is expected to report results that reflect the challenging demand environment in the paints segment. While festive season sales provide some support, the company continues to face margin pressure from increased competition (especially from new entrant Birla Opus) and elevated raw material costs.

The market will focus on volume growth trends, pricing actions taken to counter competitive intensity, and management’s outlook on demand recovery in the second half of the fiscal year. Consensus estimates suggest modest revenue growth with margin compression compared to previous quarters.

Dr Reddy’s Laboratories: US Generics in Focus

Dr Reddy’s Laboratories’ quarterly results will provide insights into the US generics business, which has been a key growth driver. The company’s performance in launching new products, market share gains in existing molecules, and progress on its biosimilars pipeline will be crucial factors determining stock movement.

Other notable results expected on Friday include Bajaj Auto (festive season demand assessment), Dabur India (rural recovery signals), Indus Towers (tower leasing trends), and ABB India (capital goods order inflow).

Market Strategy and Trading Recommendations

Range-Bound Trading Expected

Given the current technical setup and derivative market signals, experts recommend a cautious approach with expectations of range-bound trading between 25,700-26,000 levels in the near term. The market is likely to work off its overbought conditions through time correction or minor price correction before attempting another leg up.

Shrikant Chouhan, Head Equity Research at Kotak Securities, advises: “Technically, after a gap-up open, the market consistently witnessed profit booking at higher levels. From the day’s highest level, the market shed over 230/750 points. Additionally, on daily charts, a bearish candle has formed, indicating temporary weakness. However, the short-term market outlook remains positive”.

Sector-Specific Approach

Overweight Positions:

-

IT Services: Strong momentum with India-US trade deal optimism; sector showing leadership

-

Banking (Selective): Large private banks and PSU banks with strong Q2 results

-

FMCG (Defensive): Volume recovery and rural demand improvement provide support

-

Pharmaceuticals: Export-oriented pharma with US FDA approvals

Neutral/Selective:

-

Capital Goods: Government capex support but valuations extended

-

Auto: Await festive season sales data for direction

-

Consumer Durables: Festive demand boost but premium valuations

Underweight/Avoid:

-

Oil & Gas: Falling crude prices impact OMCs; sector facing headwinds

-

Metals: Global demand concerns and China trade tensions

-

Realty: Interest rate sensitivity and profit-booking after recent gains

Risk Management Critical

Key risk factors to monitor:

-

Sustained FII Selling: Thursday’s outflow needs monitoring; continuation could pressure markets

-

Earnings Disappointments: High expectations from banking sector; any miss could trigger correction

-

Global Developments: US-China trade tensions, Fed policy trajectory, geopolitical risks

-

Technical Breakdown: Decisive close below 25,700 could trigger deeper correction to 25,500

-

Volatility Spike: Rising India VIX suggests increased uncertainty

Trading Guidelines for October 24

For Intraday Traders:

-

Avoid aggressive directional bets given mixed signals

-

Focus on stock-specific opportunities rather than index trades

-

Book profits quickly; don’t overstay positions

-

Maintain strict stop-losses given rising volatility

-

Watch 25,850-25,950 range; trade breakouts with confirmation

For Positional Traders:

-

Use any decline toward 25,700-25,800 as accumulation opportunity

-

Maintain trailing stop-loss at 25,650 for long positions

-

Book partial profits on rallies toward 25,950-26,000

-

Reduce leverage given overbought conditions

-

Sector rotation strategy: Rotate out of energy into IT/banking

Specific Trading Levels:

-

Nifty Buy Above: 25,920 with target 25,980-26,030; stop-loss 25,870

-

Nifty Sell Below: 25,850 with target 25,800-25,750; stop-loss 25,900

-

Bank Nifty Buy Above: 58,150 with target 58,300-58,450; stop-loss 58,050

-

Bank Nifty Sell Below: 57,950 with target 57,800-57,650; stop-loss 58,050

Week Ahead: Key Events and Data

Domestic Calendar

-

Friday (Oct 24): SBI, Asian Paints, Dr Reddy’s results; manufacturing PMI preliminary

-

Saturday-Sunday: Weekend; markets closed

-

Monday (Oct 27): Weekly options expiry; Maruti, Tata Steel earnings

-

Tuesday (Oct 28): Federal Reserve policy meeting begins; Wipro, LTIMindtree results

-

Wednesday (Oct 29): RBI MPC minutes release; inflation data

Global Events to Monitor

-

US GDP Q3 Advance Estimate (Friday) – crucial for Fed policy outlook

-

US Core PCE Price Index – Fed’s preferred inflation gauge

-

Federal Reserve FOMC meeting (October 28-29) – rate decision and Powell presser

-

European Central Bank policy commentary on inflation trajectory

-

China PMI data for October – manufacturing and services sector health

Conclusion: Consolidation Healthy After Sharp Rally

As Indian equity markets navigate the final week of October 2025, Thursday’s profit-booking session serves as a healthy reminder that markets cannot move in a straight line indefinitely. The 1,500-point rally from October lows has brought indices to overbought levels, necessitating a period of consolidation or minor correction to create a sustainable base for the next leg of the move.

The return of FII selling, while concerning, is offset by continued robust DII support that has been the hallmark of October 2025. The cumulative institutional support of ₹28,599 crore provides a strong foundation, though investors must remain vigilant about the sustainability of this DII buying in the face of persistent FII outflows.

From a technical perspective, the 25,700-25,800 support zone assumes critical importance. As long as the Nifty maintains this base, the broader uptrend remains intact with potential to challenge all-time highs around 26,277. However, a decisive break below this support could trigger a deeper correction toward 25,500-25,350 levels.

The IT sector’s emergence as a new market leader provides fresh impetus, broadening market participation beyond the banking sector that dominated the festive rally. As earnings season progresses, stock and sector-specific action is likely to intensify, rewarding companies that deliver on expectations while punishing disappointments.

Friday’s major earnings, particularly from SBI, will set the tone for the final trading day of the week. Investors should adopt a balanced approach – maintaining exposure to quality stocks while respecting the market’s need for consolidation after a sharp rally. The key is to use any weakness as a buying opportunity in fundamentally strong stocks rather than chasing momentum at elevated levels.

Disclaimer: This analysis is for informational purposes only and should not be construed as investment advice. Past performance is not indicative of future results. Investment decisions should be based on thorough fundamental and technical analysis. Investors should consult with qualified financial advisors before making investment decisions.

Note: Markets are open for regular trading on Friday, October 24, 2025. Weekly options expiry is scheduled for Monday, October 27, 2025.

Analyst Name: Pradeep Suryavanshi

Bestmate Investment Services Pvt. Ltd.:

A-1-605, Ansal Corporate Park Sec-142, Noida 201305

CIN: U74999UP2016PTC143375

SEBI Registration Number: INH000015996

Website: www.bestmate.in I Email: info@bestmate.in

Disclaimer: Please read the Following very carefully:

“Investments in securities market are subject to market risks. Read all the related documents carefully before investing.”

- Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

- The fees are paid for research Report or Research recommendations and is not refundable or cancellable under any circumstances.

- We do not provide any guaranteed profit or fixed returns or any other services. We charge fixed fees and do not operate on any profit-sharing model.

- Images if any, shared with you are for illustration purposes only.

- We are not responsible for any financial loss or any other loss incurred by the client.

- Please be fully informed about the risk and costs involved in trading and investing. Please consult your investment advisor before trading. Trade only as per your risk appetite and risk profile.

- Trading/investing in stock market is risky due to its volatile nature. Upon accepting our service, you hereby accept that you fully understand the risks involved in trading/investing.

- We advise the viewers to apply own discretion while referring testimonials shared by the client. Past performances and results are no guarantee of future performance.

- All Report or recommendations shared are confidential and for the reference of paid members only. Any unapproved distribution of sensitive data will be considered as a breach of confidentiality and appropriate legal action shall be initiated.

- The Research Report or recommendations must not be used as a singular basis of any investment decision. The views do not consider the risk appetite or the particular circumstances of an individual investor; readers are requested to take professional advice before investing and trading. Our recommendations should not be construed as investment advice.

- In case of any query, please email on Info@bestmate.in be rest assured, our team will get back to you and resolve your query. Please state your registered phone number while mailing us.

- Reports based on technical and derivative analysis center on studying charts of a stock’s price movement, outstanding positions and trading volume, as opposed to focusing on a company’s fundamentals and, as such, may not match with a report on a company’s fundamentals.

Disclosure Document

The particulars given in this Disclosure Document have been prepared in accordance with SEBI(Research Analyst)Regulations,2014.The purpose of the Document is to provide essential information about the Research and recommendation Services in a manner to assist and enable the prospective client/clients in making an informed decision for engaging in Research and recommendation services before investing.For the purpose of this Disclosure Document, Research Analyst is Pradeep Suryavanshi Director, of Bestmate Investment Services Pvt Ltd (hereinafter referred as “Research Analyst”)

Business Activity: Research Analyst is registered with SEBI as Research Analyst with Registration No. INH000015996. The firm got its registration on and is engaged in research and recommendation Services. The focus of Research Analyst is to provide research and recommendations services to the clients. Analyst aligns its interests with those of the client and seeks to provide the best suited services.

Terms and conditions:

The Research report is issued to the registered clients. The Research Report is based on the facts, figures and information that are considered true, correct and reliable. The information is obtained from publicly available media or other sources believed to be reliable. The report is prepared solely for informational purpose and does not constitute an offer document or solicitation to buy or sell or subscribe for securities or other financial instruments for clients.

Disciplinary history:

- No penalties/directions have been issued by SEBI under the SEBI Act or Regulations made there under against the Research Analyst relating to Research Analyst services.

- There are no pending material litigations or legal proceedings, findings of inspections or investigations for which action has been taken or initiated by any regulatory authority against the Research Analyst or its employees.

Details of its associates:- No associates

Disclosures with respect to Research Reports and Research Recommendations Services

- The research analyst or research entity or his associate or his relative do not have financial interest in the subject company.

- The research analyst or its associates or relatives, do not have actual/beneficial ownership of one per cent or more securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance.

- The research analyst or his associate or his relative do not have any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

- The research analyst or its associates have not received any compensation from the subject company in the past twelve months.

- The research analyst or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months.

- The research analyst or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months.

- The subject company was not a client of Research Analyst or its employee or its associates during twelve months preceding the date of distribution of the research report and recommendation services provided.

- The research analyst or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months.

- The research analyst or its associates have not received any compensation or other benefits from the subject company or third party in connection with the research report.

- The research analyst has not been engaged in market making activity for the subject company.

- The research analyst has not served as an officer, director or employee of the subject company.

- The research analyst did not receive any compensation or other benefits from the companies mentioned in the documents or third party in connection with preparation of the research documents. Accordingly, research Analyst does not have any material conflict of interest at the time of publication of the research documents.

Sources :-

- https://www.ndtvprofit.com/markets/trade-setup-nse-nifty-50-bank-support-resistance-levels-outlook-october-24-2025

- https://www.moneycontrol.com/news/business/markets/stock-market-live-sensex-nifty-50-share-price-gift-nifty-latest-updates-23-10-2025-liveblog-13627799.html

- https://www.moneycontrol.com/news/business/markets/trading-plan-can-nifty-50-sustain-above-25-900-bank-nifty-hold-58-000-amid-rangebound-trading-13629629.html

- https://www.nseindia.com/reports/fii-dii

- https://economictimes.indiatimes.com/markets/stocks/live-blog/bse-sensex-today-live-nifty-stock-market-updates-23-october-2025/liveblog/124750713.cms

- https://www.moneycontrol.com/stocks/marketstats/fii_dii_activity/index.php

- https://economictimes.indiatimes.com/

- https://www.moneycontrol.com/news/business/markets/trade-setup-for-october-24-top-15-things-to-know-before-the-opening-bells-13629538.html

- https://economictimes.indiatimes.com/markets/stocks/news/stocks-in-news-itc-hotels-dr-reddys-sbi-life-hero-motocorp-vedanta/articleshow/124768458.cms

- https://www.moneycontrol.com/news/business/markets/diwali-muhurat-trading-2025-live-updates-samvat-2082-21-10-2025-stock-market-sensex-nifty-50-bse-nse-oct-21-liveblog-13625774.html

- https://www.moneycontrol.com/news/business/markets/stock-market-live-sensex-nifty-50-share-price-gift-nifty-latest-updates-20-10-2025-liveblog-13624116.html

- https://economictimes.indiatimes.com/markets

- https://www.nseindia.com/

- https://in.investing.com/indices/bank-nifty-historical-data

- https://www.moneycontrol.com/indian-indices/India-VIX-36.html