Download AI generated Summary Audio –

Investment Thesis (Summary): EID Parry is a deep-value holding company with a dominant stake in Coromandel International (India’s leading agro-chemicals & fertilizer player) and a portfolio of sugar, ethanol, co-generation, and nutraceutical businesses. The stock trades at a steep holding-company discount – the market is valuing EID Parry at barely half the worth of its ~56% Coromandel stake, implying investors get the entire sugar and ethanol operations “for free.” Over the next 3 years, we expect earnings growth from ethanol expansion and sugar-cycle recovery, and foresee value-unlocking catalysts (e.g. stake monetization or demergers) that could narrow the holding discount, driving our ₹2,500/share target. Below we present a detailed financial model, sum-of-parts valuation, and segment-wise analysis supporting this view.

1. Financial Performance & 3-Year Projections

Historical Financials:

EID Parry’s consolidated financials have been dominated by Coromandel’s performance. In FY2023, a surge in fertilizer prices drove consolidated revenue to ₹35,244 Cr (a multi-year peak), before normalizing to ₹29,413 Cr in FY2024. FY2025 saw revenue recover to ₹31,609 Cr. However, net profits have been relatively steady around ₹900 Cr in recent years (PAT attributable to EID Parry shareholders was ₹900 Cr in FY24 and ₹878 Cr in FY25). This translated to EPS of ~₹50–53 over FY2023–25 and an ROE in the ~10–11% range. Key ratios for the stock currently include a P/E ~27x, P/B ~2.6x, and ROCE ~17%, reflecting moderate returns on equity compared to pure-play FMCG peers but typical for a cyclically-exposed business.

Peer Comparison:

Among sugar-sector peers, EID Parry is the largest by market cap (~₹20,500 Cr) owing to its Coromandel stake, whereas top sugar producers like Balrampur Chini and Triveni Engineering have market caps of ~₹12,300 Cr and ₹8,000 Cr respectively. On a trailing P/E basis EID Parry (~22–27x) is in line with efficient sugar players – Balrampur Chini trades at ~28x, Triveni at ~33x – though sugar valuations vary widely with the cycle (e.g. Dalmia Bharat Sugar at ~8x due to a recent profit spike). Notably, global sugar companies trade at only ~8–10x earnings in steady state, reflecting commodity-cycle risk. In contrast, fertilizer/agri-input peers command higher multiples: Coromandel International itself trades at ~33x TTM P/E and Godrej Agrovet at ~37x. EID Parry’s ROE (~10%) is currently lower than pure sugar peers like Balrampur (17%) due to recent losses in sugar operations, but its ROCE (~17%) is healthy – aided by the stable returns of Coromandel. Overall, EID Parry’s valuation appears attractive relative to the intrinsic sum-of-parts (detailed below), albeit with a holding company discount that has historically been ~50% (higher than typical Indian holdco discounts of ~30–40%).

3-Year Projections:

We model a CAGR of ~8–10% in consolidated revenue over FY2026-28, driven by moderate growth in Coromandel’s fertilizer & chemical sales (mid-single-digit volume growth, stable pricing) and an upswing in EID’s standalone sugar and ethanol revenues (on higher crushing volumes and new distillery capacity). We expect EPS to grow at ~15% CAGR, as the sugar segment swings from loss-making to profitable, and ethanol margins improve with scale. The table below summarizes our projections:

| Fiscal Year | Revenue (₹ Cr) | Net Profit (₹ Cr) | EPS (₹) | ROE | P/E (at CMP ₹1,150) |

| FY2024 (Actual) | 29,413 | ~900 (after minority) | 50.7 | ~10% | 22.7x |

| FY2025 (Actual) | 31,609 | 878 | 49.4 | ~10% | 23.3x |

| FY2026 (E) | 33,500 | 1,050 | 59.0 | ~11% | 19.5x |

| FY2027 (E) | 36,500 | 1,300 | 73.0 | ~13% | 15.8x |

| FY2028 (E) | 39,000 | 1,500 | 84.0 | ~14% | 13.7x |

**Key assumptions: We assume sugar production rebounds (discussed in Segmental Outlook) with no severe cane shortages, and ethanol volumes rise ~15% annually (supported by India’s push to 20% blending by 2025-26). Coromandel’s profits are assumed to grow ~10% annually (a slowdown from recent 24% CAGR as global fertilizer prices normalize). We model steady state consolidated EBITDA margins ~9–10% and improving standalone ROE as losses abate. Net Debt is expected to decline with strong cash flows – EID Parry used recent Coromandel dividends and stake sale proceeds to pay down debt, and further deleveraging is likely (the current debt-to-equity is modest, <0.5x). These projections yield an FY28 EPS ~₹84; at our target price ₹2,500, this equates to ~30x P/E on 3-year forward earnings – reasonable given the potential for unlocked value and the stable earnings contribution of Coromandel.

2. Sum-of-the-Parts Valuation (Coromandel Stake & Holding Co. Discount)

EID Parry’s valuation is best understood via Sum-of-the-Parts (SOTP), separating the value of its 56.2% stake in Coromandel International and the value of its standalone sugar/ethanol/nutraceutical businesses:

Coromandel International (56.2% stake):

EID Parry holds 165.46 million shares of Coromandel, which at the current market price of ~₹2,320 yields a stake value of ~₹38,400 Crore. This is equivalent to ~₹2,160 per EID Parry share (EID has ~17.78 Cr shares outstanding). Notably, this single asset exceeds EID Parry’s entire market capitalization by a wide margin. For perspective, Coromandel’s market cap is ~₹68,000 Cr at present, and EID’s stake (~56%) is worth roughly ₹31,000–38,000 Cr (the value fluctuated around ₹31k Cr when EID’s market cap was only ₹15k Cr in early 2025). Thus, the Coromandel stake comprises over 90% of EID Parry’s intrinsic value in our analysis.

Standalone Businesses (Sugar, Ethanol, Co-gen, Nutraceuticals, CPG):

While small relative to Coromandel, the core operating segments do have value. Based on historical earnings and peer multiples, we estimate the sugar, ethanol, co-generation, nutraceutical and consumer products divisions combined are worth ~₹3,000–3,500 Crore (details in Segmental Analysis below). This includes: sugar business at ₹300–400 Cr (low multiples due to cyclicality), ethanol/distillery at ₹750–900 Cr (higher multiple ~12x reflecting growth potential), nutraceuticals ~₹200–300 Cr (niche, higher-margin potential), co-generation ~₹100–200 Cr (small, valued on asset/cash flow basis), and the emerging Consumer Products Group (CPG) ~₹300–500 Cr (early-stage but promising). Aggregating these yields ~₹3,000 Cr of value for EID’s own operations – about ₹170–200 per share of EID Parry.

SOTP and Target Price: Adding the parts, the total intrinsic value is approximately ₹2,330 per share (₹2,160 from Coromandel + ₹1,150), the stock reflects roughly a 50% discount to SOTP, implying investors are effectively paying only for ~50% of the Coromandel stake and getting the rest of the businesses at zero value. Our ₹2,500 target assumes that over 3 years this discount narrows to ~20–30% (through corporate actions or market re-rating) and that the SOTP itself grows with earnings (especially as Coromandel and ethanol operations expand). For instance, if Coromandel’s market value rises ~30% (supported by profit growth) and EID’s standalone segments show improved profits, EID’s intrinsic SOTP could approach ₹3,200–3,500 per share by FY2028. Even applying a 25% holdco discount on ₹3,200 yields ~₹2,400 – in line with our target. In a true unlocking scenario (e.g. a demerger or stake sale), the discount could vanish, an

d EID’s value could approach the full SOTP, implying >₹3,000/share (an upside case).

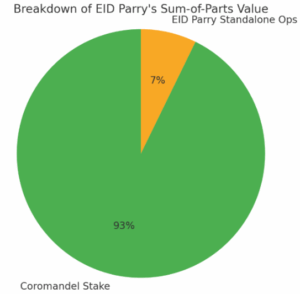

Breakdown of EID Parry’s Sum-of-the-Parts value: The Coromandel stake (~₹38,400 Cr) represents ~93% of the total intrinsic value, while the sugar, ethanol, co-gen, nutraceutical and CPG businesses (~₹3,000 Cr) form the remaining ~7%. The market is heavily discounting this holding structure, valuing EID Parry at barely ~50% of the SOTP value.

Holding Company Discount & Arbitrage: The “arbitrage” opportunity is clear – buying EID Parry shares effectively secures ₹1 of Coromandel for only ₹0.50 (plus a free option on sugar/ethanol upside). However, realizing this value requires the discount to narrow.

Such discounts persist due to: (a) structural reasons (investors prefer direct ownership of Coromandel; EID has no control over Coromandel’s cash beyon11-07-2025d dividends), and (b) corporate governance approach (the Murugappa management’s conservative stance has historically avoided aggressive moves like spin-offs or large buybacks that could unlock value). In the next sections we examine what could trigger a re-rating.

3. Segmental Business Analysis and Outlook

EID Parry’s standalone operations span four key segments: Sugar, Distillery (Ethanol), Co-generation (Power), and Nutraceuticals, along with a growing Consumer Products Group (CPG). Below we analyze each segment’s performance, outlook, and contribution to revenue & margins.

Sugar Segment: Sugar manufacturing is EID Parry’s legacy core business – the company operates 6 sugar mills in South India with ~40,800 TCD cane crushing capacity. In FY2024, the sugar segment generated ~₹1,865 Cr revenue (about 60% of standalone sales), but faced margin pressures. Government policies (cane price FRP, export quotas) and weather led to volatility: FY2025 saw a 13% drop in sugar revenue to ₹1,571 Cr as cane crushing fell (38 Lakh MT vs 50 LMT in FY24) and sugar production declined. This resulted in a segment loss of ₹86 Cr in FY25, a sharp swing from a ₹68 Cr profit in FY24. The reasons were higher cane costs and lower recovery rates, while domestic sugar prices failed to rise proportionately.

Outlook: We expect a rebound in sugar production over the next 1–2 seasons as cane availability improves (supported by farmer incentives and better rainfall in South India). The company has been investing in cane development and high-yield varieties. If crushing volume reverts closer to capacity (say 50+ LMT/year) and recovery rates normalize, sugar output will rise, enabling EID Parry to regain lost volume. Domestic sugar prices are also on an upswing amid global deficits – currently around ₹37–38/kg ex-mill and likely firm. We model sugar revenues growing to ~₹1,800 Cr by FY2027. However, regulatory risks persist (the government can cap exports or fix cane prices), keeping EBITDA margins low (5–7%) in sugar. We value the sugar segment conservatively at ~₹350 Cr (~9x normalized earnings) given its volatile profitability.

Co-generation (Power) Segment: EID Parry’s sugar mills are integrated with co-gen plants that burn bagasse (cane residue) to produce power. The company has ~140 MW of co-gen capacity. This supplies the mills’ own energy needs and feeds surplus power to the grid under long-term PPAs. In FY2024, co-gen contributed ~₹114 Cr revenue, but notably recorded a PBIT loss of ₹75 Cr. High coal prices (used as supplemental fuel) and seasonal plant utilization impacted profitability.

Outlook: Co-gen is essentially a by-product business – its fortunes are tied to the cane crush (more bagasse = more power). With higher sugar volumes expected, co-gen output should also rise. The segment provides a steady income stream and offsets factory energy costs, but earnings are modest. We anticipate co-gen returning to near break-even or slight profit as coal prices stabilize and as new Power Purchase Agreements lock in tariffs. Given its small size, we ascribe ~₹150 Cr value to co-gen (on a DCF of future cash flows).

Distillery (Ethanol) Segment: The distillery/ethanol business is EID Parry’s growth engine, leveraging molasses from sugar to produce ethanol (blending alcohol) and other industrial spirits. EID Parry operates 5 distilleries with 582 KLPD capacity, producing ~60 million liters of ethanol in FY24. In FY2024, distillery revenue was ₹799 Cr (~28% of standalone sales). Thanks to recent expansions, FY2025 distillery revenue jumped 38% to ₹1,102 Cr. This segment now contributes the highest EBITDA among standalone businesses. Operating margins are mid-single-digit (ethanol prices are fixed by the government, and input (molasses) costs rose last year, squeezing margins to ~6–7%). Even so, ethanol helped cushion consolidated profits in FY25 – distillery sales rose ~20% YoY in Q4FY25, offsetting the sugar decline.

Outlook: The ethanol segment has a robust growth trajectory ahead. The Indian government’s E20 blending mandate by 2025-26 is a major demand driver, requiring ethanol output to double nationally. EID Parry is running its distilleries at over 90% capacity utilization and is exploring expansions, including grain-based ethanol production to utilize capacity year-round. Industry ethanol pricing was recently hiked (C-heavy molasses ethanol price +₹1.39/L for ESY 2024-25), which should slightly improve margins. We forecast EID’s ethanol volumes to grow ~15% CAGR (via debottlenecking and potential new capacity), with segment revenue reaching ~₹1,500+ Cr by FY2028. This would make ethanol nearly as large as the sugar segment. Margins could expand to ~8–10% if operating at scale and as feedstock mix diversifies (grain-based ethanol yields better year-round utilization). Valuation: Ethanol businesses globally command higher multiples (~12x EV/EBITDA or P/E) given stable demand. We value EID’s distillery segment at ₹800–900 Cr (implying roughly 10–12x FY25 EBITDA, which we find reasonable given policy tailwinds).

Nutraceuticals Segment: EID Parry’s nutraceuticals division produces spirulina, chlorella, probiotics and other algae-based health supplements – a niche business leveraging the company’s fermentation expertise. This segment is relatively small: FY2024 nutraceutical revenue was ~₹31 Cr, rising to ₹37 Cr in FY2025. Historically, nutraceuticals had higher margins, but FY24 saw a PBIT loss of ₹10 Cr due to scaling challenges and one-time issues (e.g. export certification issues in Europe that hit sales). In FY25 the loss narrowed to ₹1 Cr as overheads were optimized.

Outlook: While not a major revenue driver, nutraceuticals offer a high-margin potential if scale improves. Management has noted improved offtake post USFDA approvals for spirulina and new products (like Chlorella) gaining traction. We expect this segment to break even or turn a slight profit going forward, with revenue growth ~15–20% annually from a low base (demand for natural supplements is rising). Given long-term opportunities, we assign a premium multiple and value the nutra business at ₹250 Cr (reflecting strategic value of its technology and a potential EBITDA margin of 20%+ if scaled).

Consumer Products Group (CPG): EID Parry has been transitioning from bulk commodity sales to branded consumer products – an important strategic move. The CPG division includes retail packaged sugar (Parry’s brand), jaggery, specialty sweeteners (low-GI sugar, etc.), and now even “superfood” staples (like millets and grains). In FY2025, the CPG segment delivered ₹884 Cr revenue, a robust 65% growth over ₹535 Cr in FY24. This was aided by new product launches and wider distribution. Branded sugar (the core of CPG) grew 11% in FY25, while the big jump came from expanding into branded staples and value-added products. The company rapidly expanded retail reach to over 1,10,000 outlets in FY24 and 2,15,000+ by FY25. However, being in nascent stage, CPG likely operates at low single-digit margins due to brand-building and distribution costs (the segment’s profitability isn’t separately reported yet).

Outlook: The CPG initiative is crucial for EID Parry to unlock higher multiples (FMCG businesses command P/E > 40–50x). Management’s strategy focuses on premiumization (brown sugars, organic jaggery), new product development, and deepening distribution in South, West, and e-commerce channels. We foresee CPG revenues continuing to grow at 25–30% annually, crossing ₹1,200 Cr in a few years, with gradual margin improvement as scale benefits kick in. By FY2028, CPG could contribute ~20% of standalone revenues with mid-to-high single digit EBIT margin. For valuation, we factor ₹400 Cr for the CPG business (this is high-growth optionality that could rerate the stock if successful).

In summary, standalone segment outlook is improving: sugar and co-gen should recover from an abnormal down year, ethanol is on a strong growth path, and CPG/nutra are scaling up. We expect standalone operations (which were roughly at break-even in FY25 excluding one-offs) to generate meaningful profits (~₹150–200 Cr PAT) by FY2028, bolstering the consolidated earnings beyond just Coromandel’s contribution.

4. Coromandel International: Contribution and Outlook

Business Profile: Coromandel International Ltd. (EID Parry’s subsidiary) is one of India’s largest agri-input companies. It is the No.2 phosphatic fertilizer producer nationally and also has a significant crop protection (pesticides) business. Key product segments include complex fertilizers like DAP/NPK, specialty nutrients, organic compost, as well as a growing portfolio in agrochemicals. Coromandel operates 17 manufacturing plants and a pan-India rural distribution network. It has consistently delivered high returns and growth, making it the crown jewel of Murugappa Group’s agri operations.

Financial Performance: Coromandel has shown a 5-year revenue CAGR of ~24% (helped by commodity price inflation in fertilizers). In FY2024-25, Coromandel’s revenue was ₹24,090 Cr (9% YoY growth) and net profit ₹2,070 Cr (26% YoY growth). Profit margins expanded to ~8.6% as raw material costs softened and the crop protection segment performed well. By Q4 FY25, Coromandel reported quarterly PAT of ₹580 Cr (up from just ₹160 Cr in Q4 FY24 due to one-off base effect). It generates strong operating cash flows (nearly ₹2,500 Cr+ EBITDA annually) and has been rewarding shareholders with generous dividends (₹15 per share total in FY25, ~0.65% yield).

Strategic Outlook: The fertilizer industry in India has high volume but is regulated via subsidies. Coromandel is focusing on non-subsidy segments for growth – e.g. specialty fertilizers, water-soluble nutrients, and expanding its crop protection chemical business (which has better margins and export potential). It has made acquisitions in pesticides and is investing in backward integration (like sulfuric acid plants) to secure raw materials. With stable government policies, Coromandel is expected to maintain steady growth: we project ~8–10% CAGR in revenue over the next 3 years, driven by modest volume increases in fertilizer (demand is largely stable, subject to monsoons) and higher growth in crop protection (low-teens growth, as this segment scales up). Margins may improve slightly if raw material prices (phosphate, ammonia) remain benign and product mix shifts to higher-value offerings. Coromandel is also debt-free and exploring new avenues (recently forayed into the semiconductor chemical business, though at early stages).

Valuation and Impact on EID Parry: Coromandel currently trades at ~₹2,300/share (₹67,000+ Cr market cap), valuing it at ~32x P/E (TTM) and ~3.5x book – a reflection of its high ROE (~18-20%) and solid dividend payouts. At these valuations, EID Parry’s 56% stake is worth ~₹38,000 Cr as noted. Any increase in Coromandel’s stock price or performance directly raises EID Parry’s intrinsic value. For example, a 10% rise in Coromandel’s market cap adds nearly ₹380 per share to EID’s SOTP value. Our target price of ₹2,500 factors in a continued robust outlook for Coromandel: we assume Coromandel’s stock could appreciate ~30% over 3 years (through earnings growth and maintaining ~30x P/E), which would proportionally increase EID’s stake value. Risks: If Coromandel’s performance falters (due to adverse subsidy policy or raw material shocks), it would significantly impact EID’s valuation. That said, Coromandel’s track record and dominant market position provide confidence in steady contribution to EID Parry’s consolidated profits (Coromandel comprised ~83% of our SOTP value in a recent brokerage sum-of-parts analysis).

5. Promoter Shareholding & Corporate Governance

Shareholding Structure: EID Parry is part of the venerable Murugappa Group. The promoters (primarily the Murugappa family’s holding entities like Ambadi Investments) currently own ~41.6% of EID Parry. Notably, promoter holding has decreased from ~44.5% to 41.6% over the last 3 years – this was largely due to small stake sales to institutions, possibly to increase public float. Correspondingly, Domestic institutional investors (DIIs) have raised their stake to ~13.8% (from <5% a few years ago), and foreign institutions hold ~12.2%. The increasing institutional ownership signals greater investor interest as the company delivers consistent returns. Public shareholders (retail and others) account for ~32% of the stock. There are no significant non-promoter strategic shareholders disclosed – Coromandel itself is listed separately (EID Parry doesn’t own 100%, the rest ~43% of Coromandel is held by public institutions and investors).

Corporate Governance: EID Parry’s board and management adhere to high governance standards, reflecting the Murugappa Group’s reputation for prudence and integrity. The Board is chaired by Mr. M.M. Venkatachalam (from the Murugappa family) and includes a healthy mix of independent directors and group veterans. The Murugappa Group is known for professional management – day-to-day operations are run by a professional CEO (Mr. Muthiah Murugappan as of FY25) rather than family members, and Coromandel also has its own separate management team. Corporate governance practices (audit controls, disclosures, shareholder communication) are strong – evidenced by accolades like being featured in “Best Managed Boards” rankings.

However, one facet of governance draws investor attention: the group’s conservative capital allocation and reluctance to undertake transformative moves (like demerging Coromandel or large buybacks). While this conservatism ensures stability (low debt, steady dividends), it has contributed to the persistent holding discount as markets speculate that management is “not in a hurry” to unlock value. For instance, despite calls from some investors, EID Parry has not indicated any plan to spin off the Coromandel stake or merge businesses (Coromandel itself is financially independent and listed). The Murugappa family appears content to let EID Parry remain a holding structure for now, focusing on long-term growth rather than short-term stock price pop. This cautious approach has pros and cons: minority shareholders are assured of no rash decisions, but patience is required for value unlocking. On balance, EID Parry’s governance is regarded as ethical and transparent, with the only concern being the potential conflict of interest inherent in any holding company (cash flows from the subsidiary might not fully accrue to holdco investors – though EID Parry does receive healthy dividends from Coromandel, e.g. ₹199 Cr in FY25).

Importantly, there have been no major governance controversies – aside from a well-known Murugappa family dispute (not related to EID Parry’s operations) which was amicably settled. The company’s disclosures (annual reports, investor presentations) are detailed and aligned with SEBI regulations. The promoter group has zero pledges on their shares (promoter pledging is 0%), indicating financial stability.

Promoter Initiatives: In recent years, management has taken steps that indirectly benefit shareholders: e.g., selling small stakes in Coromandel to deleverage EID Parry’s balance sheet. In June 2020, EID Parry sold ~2% of Coromandel (5.85 million shares) at ₹629/share, raising ~₹369 Cr to reduce debt. They again sold ~3.4% in late 2020 (reducing stake from ~60.5% to 56.4%). These moves, while reducing EID’s holding, shored up its financial position and signaled capital discipline. Going forward, any further stake sales or use of Coromandel dividends could be channeled into share buybacks or higher dividends for EID Parry shareholders – actions that would be viewed very positively in governance terms.

6. Holding Discount History, Catalysts & Valuation Unlocking

Historical Discount and Arbitrage: EID Parry’s stock has long traded at a significant discount to its intrinsic value. As of early 2025, the implied holdco discount was ~60% (market cap ₹15k Cr vs stake value ₹31k Cr). This 60% gap is at the extreme end even for Indian markets. Historically, the discount has fluctuated with two main factors: (a) the profitability of EID’s own sugar operations, and (b) market expectations of any corporate action. For instance, during strong sugar cycles (e.g. 2016-17 when sugar prices and profits spiked), EID Parry’s stock outperformed Coromandel, thereby narrowing the discount to ~30% according to analyst reports at the time. Conversely, when the sugar business is loss-making (as in FY25) and no news of restructuring, the discount widens (50–60%).

Some relative-value investors have exploited this by pair trades – buying EID Parry and shorting Coromandel as a mean-reversion bet on the discount. However, absent a catalyst, this arbitrage can take a long time to close. There have not been any dramatic “closure” events in the past (e.g. no merger has occurred yet). The minor stake sales in 2020 narrowed the gap slightly for a while, but the discount persisted around 50%. In essence, the market has been assigning near-zero value to EID’s standalone businesses in trough years. This also means upside optionality – any improvement in those businesses or hint of demerger could rapidly re-rate the stock. Indeed, over the last year (2024–25), EID Parry’s share price rose ~40% (from ~₹800 to ₹1,150) as sugar/ethanol prospects improved and investors anticipated ethanol blending benefits. This outperformance vs Coromandel indicates some partial narrowing of the holdco discount recently.

Catalysts for Unlocking Value: Looking ahead, several potential triggers could unlock value and narrow the discount:

Spin-off / Demerger of Coromandel: A separation of Coromandel from EID Parry (e.g. distributing Coromandel shares to EID shareholders or merging EID into Coromandel) would directly eliminate the holdco structure. While the Murugappa Group has not indicated this, it remains the most powerful catalyst. If EID Parry even announces a plan to spin off part of the stake or merge entities, the stock would likely surge to reflect closer to look-through value.

Partial Stake Sale or Strategic Investor: The promoters could monetize another chunk of Coromandel stake (say bring it down from 56% to ~51% or 50%) and use the proceeds for shareholder-friendly actions. A large special dividend or share buyback at EID Parry funded by such a sale would reward shareholders and signal intent to reduce the discount. Alternatively, bringing in a strategic investor at the EID level (not currently rumored) could re-rate it.

Higher Payouts from Coromandel: Coromandel is a cash-generative company; if it increases dividends or issues a one-time special dividend to EID Parry, that cash can be passed through. In FY2022, Coromandel issued a hefty dividend (EID Parry’s share was ₹305 Cr), which boosted EID’s own dividend. Consistent high payouts effectively realize some of the subsidiary’s value for EID, potentially improving market perception.

Ethanol & Sugar Earnings Upswing: A less direct but important catalyst is a marked improvement in standalone earnings. If EID Parry’s sugar/ethanol segment delivers strong profit growth (for example, ethanol expansions yielding, say, ₹100+ Cr annual PAT in a couple of years, and sugar returning to profitability), the market would be forced to assign positive value to these businesses (reducing the “zero for standalone” mindset). This happened in the past when sugar cycles turned – EID’s earnings jumped, the stock rallied and narrowed the gap. The upcoming ethanol-driven earnings could act similarly.

Debt Reduction and Buybacks: While EID Parry’s net debt is already moderate, further de-leveraging enhances equity value. The company has indicated it will continue using Coromandel dividends and internal accruals to pay down debt. A share buyback is another possibility if cash builds up – a buyback (even a small one) signals confidence and can provide a floor to the stock price. Murugappa Group companies have done buybacks in the past (Tube Investments, for example); if EID Parry announces one, it could shrink the holdco discount by boosting EPS and promoter ownership.

Market Sentiment and Group Moves: Sometimes, holding discounts narrow due to market re-rating of the sector or conglomerate restructuring. Any move by the Murugappa Group to simplify its structure (they have multiple listed entities) could put focus on EID Parry. Additionally, improvement in trading liquidity (currently ~₹30–40 Cr/day vs ₹250 Cr/day for Coromandel) as more institutions come on board can help the stock’s valuation catch up.

Rerating Potential: At a 40% holding discount (the lower end seen in India for well-managed holdcos), EID Parry’s market cap would be ~₹30,000 Cr based on current SOTP – implying a share price of ~₹1,700 (already ~50% upside from CMP). At a 30% discount, it would be ~₹2,050/share. Our target ₹2,500 assumes not only discount narrowing but also growth in SOTP, as discussed. Importantly, even maintaining a 50% discount, if Coromandel’s value rises and standalone business is valued higher, EID’s stock will rise. Thus, there are multiple paths to upside – fundamental growth and structural re-rating.

Risks to Thesis: The key risks include: (1) Sugar cycle downturn – if monsoons fail or government caps sugar prices, EID’s sugar/ethanol profits could disappoint, keeping the standalone value depressed. (2) No action on unlocking – the discount could persist or even widen if the group takes no steps and if Coromandel’s price stalls. In a scenario of fertilizer downturn and continued holding structure, the stock may remain range-bound. (3) Regulatory changes – adverse changes like reduction in fertilizer subsidies affecting Coromandel, or ethanol policy reversal, would hurt valuations. However, current government policies are supportive (ethanol blending, stable subsidy regime) and these risks seem moderate.

Historical Precedents: It’s worth noting that some Indian conglomerates have successfully unlocked holdco discounts (e.g. Tata Chemicals restructuring, Vedanta’s attempted buyout of Cairn India, etc.). For Murugappa Group, a comparable case was Tube Investments which benefited from unlocking the value of CG Power stake. Investors are increasingly vocal about such value disparities. The Indian Express notably highlighted EID Parry as a “hidden stake” story with 250% underlying value upside potential. Such coverage can itself be a catalyst by attracting value investors.

Conclusion: EID Parry offers a compelling blend of value and growth – a strong underlying asset (Coromandel) providing stability and cash flows, and a suite of cyclical businesses with improving fundamentals. At ~60% discount, the margin of safety is high; investors are effectively paying for a portion of Coromandel and getting a call option on sugar/ethanol upside. Over the next 3 years, we expect this discount to narrow towards ~30% as catalysts materialize, driving significant stock appreciation. Our target of ₹2,500 (≍ 20x FY28E EPS, or an implied ₹44,000 Cr market cap which is ~70% of projected SOTP) reflects confidence that EID Parry’s true worth will be increasingly recognized by the market. This re-rating, combined with moderate earnings growth, underpins a bullish outlook. While patience is required in any holding company investment, the risk-reward appears favorable, and EID Parry stands as a classic “value unlock” candidate in the Indian market.

*****Sources: Company Annual Reports and Investor Presentations; BSE filings (Q4 FY25 results); Screener.in financial data; Indian Express deep-dive on EID Parry (Feb 2025); Moneycontrol/Reuters news on stake sale and results; Trendlyne shareholding data; Tickertape and broker reports for peer comparison; Coromandel International filings/press releases; Government ethanol policy updates; and Murugappa Group disclosures. All financial projections are the author’s estimates based on these sources and industry outlook.

Sources Links:-

- https://indianexpress.com/article/smart-stocks/eid-parry-stock-market-sensex-nifty-9820166/#:~:text=Story%20continues%20below%20this%20ad

- http://icicidirect.com/research/equity/rapid-results/eid-parry-india-ltd#:~:text=Sugar%3A%20The%20revenues%20of%20the,to%20the%20increase%20in%20costs

- https://www.screener.in/company/EIDPARRY/consolidated/#:~:text=Mar%202022%20%20Mar%202023,15%2C105%2015%2C242%2016%2C467%2021%2C146%2032%2C088

- https://eidparry.com/wp-content/assets/2025/06/EID-Parry-Investor-PPT-FY-25.pdf#:~:text=8%20Update%20on%20Ethanol%20Blending,39%20%2F%20Ltr

- https://www.reuters.com/world/india/indias-eid-parry-reports-quarterly-profit-rise-aided-by-distillery-segment-2025-05-27/#:~:text=Revenue%20from%20operations%20increased%2013.5,14%20billion%20rupees

- https://www.moneycontrol.com/news/business/eid-parry-sells-stake-in-coromandel-international-share-price-slips-3-5348051.html#:~:text=Share%20prices%20of%20Coromandel%20International,sold%20its%20stake%20in%20Coromandel

- https://simplywall.st/stocks/in/materials/nse-coromandel/coromandel-international-shares/news/coromandel-international-full-year-2025-earnings-eps-beats-e-1

Analyst Name: Pradeep Suryavanshi

Bestmate Investment Services Pvt. Ltd.:

A-1-605, Ansal Corporate Park Sec-142, Noida 201305

CIN: U74999UP2016PTC143375

SEBI Registration Number: IN000015996

Website: www.bestmate.in

Email: pradeep@bestmate.in

Disclaimer: Please read the Following very carefully:

Investments in securities market are subject to market risks. Read all the related documents carefully before investing.

Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

The fees are paid for research Report or Research recommendations and is not refundable or cancellable under any circumstances.

We do not provide any guaranteed profit or fixed returns or any other services. We charge fixed fees and do not operate on any profit-sharing model.

Images if any, shared with you are for illustration purposes only.

We are not responsible for any financial loss or any other loss incurred by the client.

Please be fully informed about the risk and costs involved in trading and investing. Please consult your investment advisor before trading. Trade only as per your risk appetite and risk profile.

Trading/investing in stock market is risky due to its volatile nature. Upon accepting our service, you hereby accept that you fully understand the risks involved in trading/investing.

We advise the viewers to apply own discretion while referring testimonials shared by the client. Past performances and results are no guarantee of future performance.

All Report or recommendations shared are confidential and for the reference of paid members only. Any unapproved distribution of sensitive data will be considered as a breach of confidentiality and appropriate legal action shall be initiated.

The Research Report or recommendations must not be used as a singular basis of any investment decision. The views do not consider the risk appetite or the particular circumstances of an individual investor; readers are requested to take professional advice before investing and trading. Our recommendations should not be construed as investment advice.

In case of any query, please email on Info@bestmate.in be rest assured, our team will get back to you and resolve your query. Please state your registered phone number while mailing us.

Reports based on technical and derivative analysis center on studying charts of a stock’s price movement, outstanding positions and trading volume, as opposed to focusing on a company’s fundamentals and, as such, may not match with a report on a company’s fundamentals.

Disclosure DocumentThe particulars given in this Disclosure Document have been prepared in accordance with SEBI(Research Analyst)Regulations,2014.The purpose of the Document is to provide essential information about the Research and recommendation Services in a manner to assist and enable the prospective client/clients in making an informed decision for engaging in Research and recommendation services before investing.

For the purpose of this Disclosure Document, Research Analyst is Pradeep Suryavanshi Director, of Bestmate Investment Services Pvt Ltd (hereinafter referred as “Research Analyst”)

Business Activity: Research Analyst is registered with SEBI as Research Analyst with Registration No. INH000015996. The firm got its registration on and is engaged in research and recommendation Services. The focus of Research Analyst is to provide research and recommendations services to the clients. Analyst aligns its interests with those of the client and seeks to provide the best suited services.

Terms and conditions:

The Research report is issued to the registered clients. The Research Report is based on the facts, figures and information that are considered true, correct and reliable. The information is obtained from publicly available media or other sources believed to be reliable. The report is prepared solely for informational purpose and does not constitute an offer document or solicitation to buy or sell or subscribe for securities or other financial instruments for clients.

Disciplinary history:

No penalties/directions have been issued by SEBI under the SEBI Act or Regulations made there under against the Research Analyst relating to Research Analyst services.

There are no pending material litigations or legal proceedings, findings of inspections or investigations for which action has been taken or initiated by any regulatory authority against the Research Analyst or its employees.

Details of its associates No associates

Disclosures with respect to Research Reports and Research Recommendations Services

The research analyst or research entity or his associate or his relative do not have financial interest in the subject company.

The research analyst or its associates or relatives, do not have actual/beneficial ownership of one per cent or more securities of the subject company, at the end of the month immediately preceding the date of publication of the research report or date of the public appearance.

The research analyst or his associate or his relative do not have any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

The research analyst or its associates have not received any compensation from the subject company in the past twelve months.

The research analyst or its associates have not managed or co-managed public offering of securities for the subject company in the past twelve months.

The research analyst or its associates have not received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months.

The subject company was not a client of Research Analyst or its employee or its associates during twelve months preceding the date of distribution of the research report and recommendation services provided.

The research analyst or its associates have not received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months.

The research analyst or its associates have not received any compensation or other benefits from the subject company or third party in connection with the research report.

The research analyst has not been engaged in market making activity for the subject company.

The research analyst has not served as an officer, director or employee of the subject company.

The research analyst did not receive any compensation or other benefits from the companies mentioned in the documents or third party in connection with preparation of the research documents. Accordingly, research Analyst does not have any material conflict of interest at the time of publication of the research documents.

Download Full Report :-EID Parry